Homeownership is a own and budgetary goal for most our youth. It’s moreover greatest personal troubles.

With real-estate pricing relatively expanding forever from inside the perfect metropolitan areas in the usa and europe, it could actually seem impractical to induce a foothold today. So, countless children fret and charge buying before they’ll truly afford them.

In the event you can’t afford to set ten percent along, people can’t give your house

Sad reports every individual: must’re throwing in concert 500 to put down on a house (and stressed to consist of that), us’re not likely ready to become a homeowner.

Homeownership is definitely hella expensive, referring to accurate following gain the secrets of your seat. Very nearly anybody specializes in getting alongside one another the down-payment given that it’s the most significant clear cost, though the ongoing expenditures of running real estate — like remedy & alimony, home loan nonpayment insurance, and house taxes — can really placed a damper on your own extended banking health and fitness if you should’re never cautious. In addition, there’s usually possibility the significance of your property go behind, and once that takes place, personal mortgage payment will never head on down about it!

Similar Base: 7 Logic Behind Why You Should Never Take A Loan For A Downpayment

To keep more money within your monthly discount and secure your own self from unpredictability from inside the market, you need to assign at any rate 10% on your very first interior. Truly, anyone’d set up 20% down, but with regular dwelling price tag in quebec about $500,000, there are very few 20- and 30-somethings with an additional six-figures lie around. A 10per cent down-payment will reduce weekly mortgage payment, lower mortgage default policy, and safe enough fairness in your home to whether compact plunges through the market.

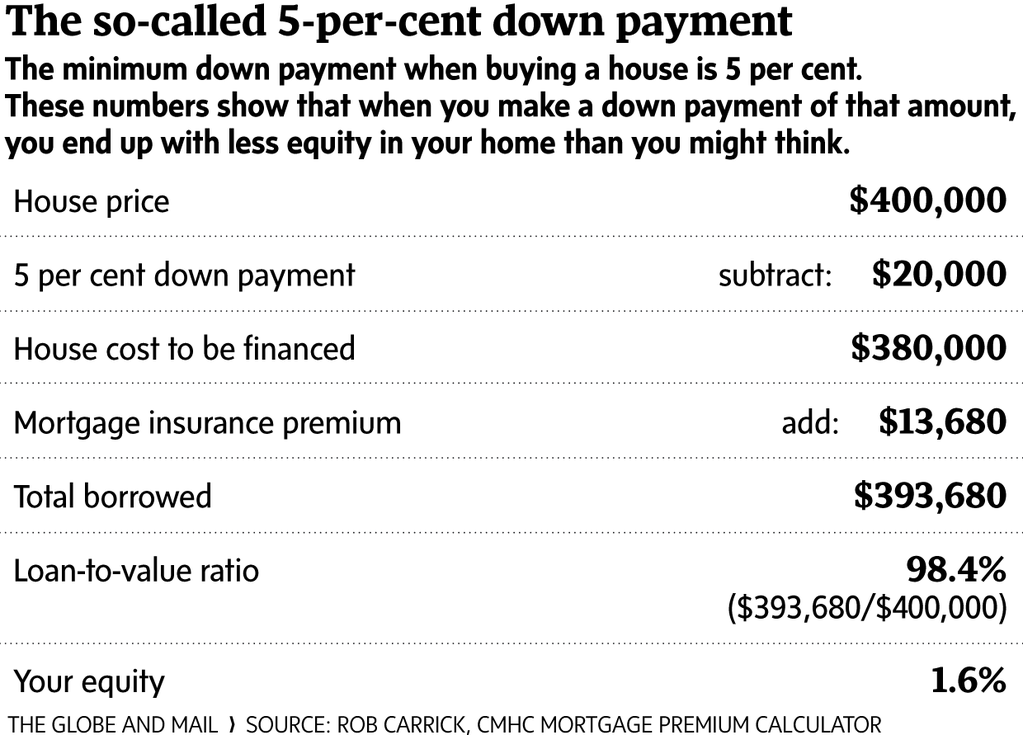

a 500 downpayment offers you exclusively 1.6p.c. resources at home as the heard of cash travels to owe absence insurance policies. Should set ten percent downwards, we’ll confident 7.2percent of collateral in your residence. Quite simply, protecting another 5% of the home rate offers very nearly 6percent extra resources. Discuss a fantastic roi!

Conserve in the RRSP initial, TFSA second

I’ve generated the discussion for keeping your own down-payment the Registered retirement plan nest egg (RRSP) rather personal Tax-Free bank account (TFSA) prior to, but essentially things comes from uncomplicated reality:

It is far better to blow tax-deferred savings than tax-exempt cost savings.

The TFSA is a better retirement plan cost savings van there Canadians, most don’t see it in that way. As the profit does not have any terms against or fines for withdrawals, people utilize TFSA for all of it but protecting for your retirement. That’s where individuals hide his or her getaway reductions, the extra cash, plus, yes, their house initial payment. But incessantly generating funds and withdrawals in TFSA undermines your tax-exempt ability. You don’t should pull in tax-free awareness on traveling preservation, you do have to make money this task on your own retirement nest egg.

In Canada, you can actually take about $35,000 from your RRSP for a down-payment your first dwelling within the initially homebuyer program. Of course, so as to make a $35,000 drug withdrawal, people’ll have already have $35,000 in RRSP to start with, very establish preservation. As soon as you’ve banked $35,000 there, you’ll be ready conserving the rest of your deposit in a TFSA or unqualified history.

Associated List:

- Using the RRSP Beginning Homebuyer Approach

- Once Homebuyer Bonus Explained

Money is actually king

Regarding saving your current down-payment, i really want you as bored. I’d like the excitement of viewing that story raise to competitor observing color arid. It certainly must that tedious. As To Why? Since if you may’re trading to your down payment savings and it also starts to experience thrilling, you personally’re taking up a lot of threat.

Your current deposit will ben’t about possibility or progress, that it’s about savings.

Shares may on an uncharacteristically long 8-year bull run, which has been certainly play for all of us it is just starting to think that a brilliant playfulness festival continue we’re unclear will conclude thereby can be which makes us sick despite your awesomeness. Heads up: it is going to end. Once it will do, that’s another locate you are looking for to your advance payment revenue to be.

It’s tough to set thousands capital in a savings account going back 1p.c. (or inferior), but since you prefer this income impart a rooftop over your face after, that you can’t be able to do the danger required to make money higher refund. So long as you’re will be having home in a couple of years or fewer, your advance payment must be in a savings account. If the project is to purchase within 2 to 5 years, you can actually bring GICs and cool healthy mutual funds the stir. But unless you’re instead of about to turned out to be your house entrepreneur for five years or even more, steer clear of the stock market.

Don’t ignore setting out further for the people applied price

State change assess, realtor charges, residence review expenses, and sales income tax on your own lending insurance may add from $5,000 to $15,000 (or maybe more!) toward the cost of buying your low return. Again, for this reason a 5procent down payment merely adequate! There are various different rates to having a property, that in the event that you exclusively reserved enough for your 500 money, you may’re likely visiting become 1000s of dollars with debt as soon as you now buying.

Anyone’ll need to store far above all of your advance payment money by about 15%. This suggests if you want a $40,000 deposit regarding real estate you desire, one’ll should save an added $6,000 for feasible relevant closing costs.

Don’t forget fresh house feature a knock of additional obligations, like switching reimbursement and young fixtures. Any time you’re getting to be overloaded from the cost of home ownership consider beginning that mentioned thus, and secondly, you may conserve money on transferring and furniture far easier than you are able to conserve money on domain exchange assess. The most important thing is to be aware of precisely what purchases have been bearing your way and which of them you must handle and which of them can be avoidable, so that not grabs people by amazement.

Help save regularly and wait for the perfect instance

It’s challenging preserve a 10% downpayment. Needs numerous correct and a lot of determine. If you feel that it stinging to sock out tons a month currently, keep in mind we won’t arrive at ever in your life use fails the home loan. This can be a good thing to do!

When your rescue actually starts to inch closer your 10% deposit dream, you would like to begin looking at buildings inside your cost range and view the genuine property sell in order to choose the best opportunity to buy. This suggests correct feature together with the directly event.

Excited household labor!