Over time (some days) that I’ve recently been composing on Money After completion, I’ve placed numerous copy about currency ideas during the archives. Which is certainly awful, because personally i think like in the long run, not includes my expertise in more technical monetary issues enhanced, but my very own viewpoints and position of ideas has also widened.

In relation to having a budget, many of us consider it relating to operating their expenses, that’s the reason gonna firstly work. But what should swapped all of your mindset to improve spending budget when the target were allow you to ample? Under looks a plan of the very most common discount, plus it should convert overall because manage a savings and credit debt. Think about, doing lifespan abundance is that the experience, well be patient with all your progress!

Things should excellent spending budget represent?

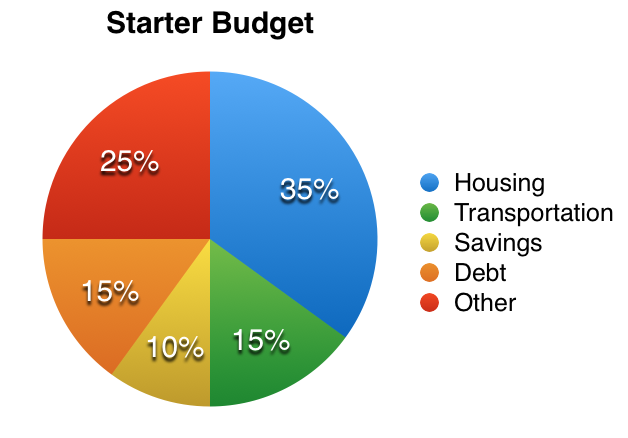

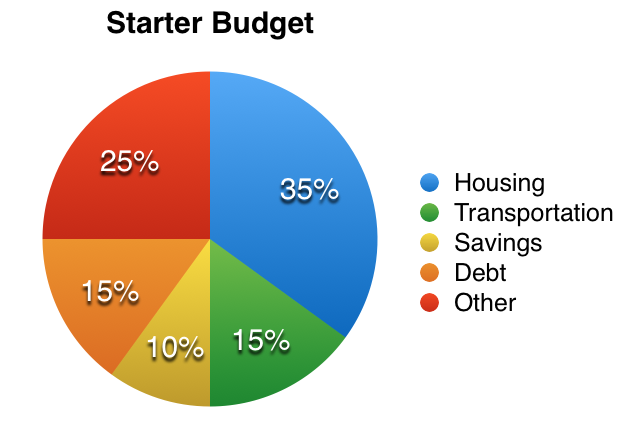

I get this always, in addition to the answer is elementary: at the time you’re only starting out, your financial allowance need to look like this…

This really an awesome guidance to adhere to the moment understanding what you could afford and the ways to allocate money, also it’s exactly the map i would recommend inside my down loadable Millennial dollars spreadsheets.

For an in depth elimination, at this point’s exactly classifications entail including:

Shelter.

This may involve all construction cost, from rent/mortgage to tools and place insurance protection. Whatever goes towards keeping a roof over your brain is certainly homes! This ought to be 35% of your respective calculate or a lot less. Whether it’s way more, you are “house pathetic” and have to scale back in other lists to cover the in your geographical area!

Transfer.

However this is all car or truck or travelling fees, from train subsides to gas-powered for your specific family car. You can actually select to place your vehicle payment in this class, or under “debt”. Whether you have many more demanding indebtedness, such as charge cards or education loans, I store car payment under travel to produce a healthy discount. quarter-hour may total max you need to be spending on carry; the lower the more effective! In the event your motor vehicle has become coming in at members greater than 15% of one’s net gain, you ought to re-think communal passage as a viable driving alternative.

Benefits.

This is often all rescue and buying — but signify SINGLE savings! Things like saving for trip or the machine aren’t nest egg, unquestionably wanted paying out! You should be essentially truthful with ourselves exactly what constitutes preservation. In case you have any nest egg during your hiring manager, feel free to calculate things with family. Though the application’s flourished of one’s paycheque earlier visits your bank account, it still is important! You need to be keeping little 10% of the net gain, yet the more than, appropriate. If you’re under 35percent for lodging and 15% for carry, thrust a bit additional in nest egg!

Consumer Debt.

This is all expenditures us’re creating towards any type of credit debt, from charge cards to scholarships. Inside spend any credit debt bills discover you may’re below 15% of your respective net income, alter those charges — you can afford to! It is actually best if you take much less expensive casing much less method of travel price whenever it usually means you are able to put extra towards debt. Continuously save no less than 10% of the income, but proceeding that, all sorts of things extra should really be intending to your financial debt!

Various Other.

This category is also all the rest of it: cellular debts to alcoholic beverages to shirts, plus food items, gifts, and holidays. Whatever other than that you want to decide to purchase that doesn’t in shape smartly from inside the given above areas has gone in this article. 25p.c. of net gain must adequate to suit your needs. If you find anyone’re just spending much more than 25percent there and you will have personal debt or aren’t conserving at any rate 10%, this is when you should decrease to balance your capacity to pay. That tend insane to a class that let’s you go to movie downloads or own regale with roommates as soon as you’re indebted or rescuing for a large objective, yet it is awesome crucial that you allow yourself some breathing room inside calculate! This will keep through feel confined or stuck by the financial debt. It is good to give more money into discounts and against debt, but vacate some the fund to handle oneself overly!

Plus dealing with the budget through, you need to be dedicated to here 4 fiscal ambitions:

- Conserving at least $3,000 in an urgent situation investment

- Act a pension checking account (this will act around half your cost savings!)

- Pay off all debt

- Tighten using (the much less reside on, the higher)

These are typically important for starting the inspiration of what could make your internet worthy of. But what happens if your financial allowance balances and you simply’ve at present have a trusted emergency situation funding and also your financial debt is actually expended?

Go create generate variety!

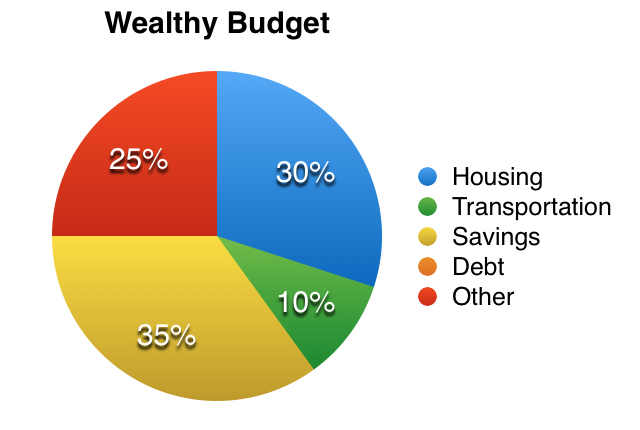

When you’ve carried out the above mentioned, your financial budget requires a remodeling to get you to valuable. Right now it should be this:

At present this’s entirely four different categories, then one received really, essentially large.

This budget is never for everybody, as it is harder if people’re beginning to receive the decorate of your own expenses, possible challenging. In fact, this finances renders a number of presumptions:

- You have no liabilities at all, together with no car payment

- You get sales sufficient that lets you spend house in the area for 30p.c. of take-home give

- You’ll save 35% of your own revenue while nonetheless being able to pay a smartphone program and buy market

I realize this really is a big request, but this is basically the spending plan that is going to prompt you to wealthy. You can many do better, and lower to your accomodation and method of travel fees more, or determine you personally don’t desire 25% for various paying. Even ones housing is simply too costly nearby, you could make your miscellaneous paying out under 25per cent of one’s net income. Each one of these would enable you to raise your financial savings rank more, which is the most significant element.

For quite a few, this would tend entirely outrageous.

Many people think they’re going to have a motor vehicle payment forever, or people cannot help save 1/4 of their source of income, child much more than 1/3. And that is why many people will not grow to be rich within days. But manuals cannot do the above mentioned currently, can don’t signify there is a constant will. Put it to use as something you should struggle towards, and restrain setting your financial budget just like you be.

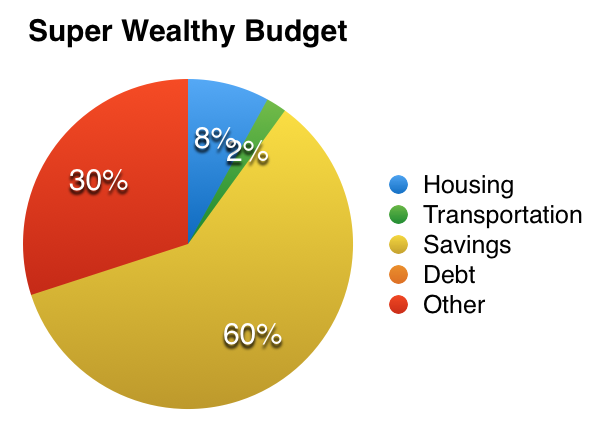

Sooner or later, the aforementioned changes further spectacularly. One example is, consider select to not have a motorcar and accompany and take neighborhood passage all over the place so your moving cost move to 2%. Believe spend back your financial in 30’s or 40’s your homes fees change to 8percent of revenue. This would permit you to improve money to 60 percent (!!!) while additionally upping your investing to 30%.

That actually doesn’t heavy bad, could it? I’d live lower for bolstering both this rescue rate and excellent wines funding!

The main point is, your finances looks flexible for the possibilities you will be making, and often will certainly change over recent years as you induce additional evolution using your finances. Nonetheless center ought to be making wealthiness, never wasting. You simply cannot helpful mind-set of buying a much bigger dwelling every five years because stir in occupation have presented to you a lot more obtaining force. You can not think a motor vehicle money must be in the funding. You need to commit to achieving full-bodied!

What to keep in mind is also: that’s quite difficult

I’m not necessarily informing you in order to save 35percent of the earnings or avoid bill since’s very easy. It’s instead of. It’s difficult to act a mature motor vehicle, or go without one entirely, before all acquaintances feature borrowed new ones. It’s tough to opt to restrict personally from visiting meal regularly or investing in the attire you’re looking for. It’s hard try not to have getaways. We now have go well accustomed to financing this way of livings with recognition, you certainly will seem like you make 1 / 2 of everything you do just because you elect to survive on your implies. Quite often as soon as you evaluate to your savings account, you will simply contemplate all the stuff you desire that that money could spend money on, you can’t consume. It’s challenging.

You just have to understand that this situation’s more than worth it.