A pretty good credit is part of adept economic well being! You could chop your credit score to make it the figure accomplishable to ensure you can get the greatest percentage of interest and the majority of mobility on funding in order to satisfy debt goals.

Something a credit history?

Might say your credit history is definitely a measure of your own “credit-worthiness”, however’s honestly a mathematical evaluation of how well members manage debt, then a lender can provide alot more liabilities. Credit scores in Canada start around 300 to 900. You can examine your credit history and collect all of your wide credit file completely free from Borrowell.

a credit entirely counts any time you’re aiming to tackle personal debt. Nonetheless, because so many multitude need to take about personal debt for great satisfactory grounds, like acquiring a property or eliminating an industry money, you intend to look after your credit score. Not only can an improved credit score help you to be eligible for financial, however you’ll will also get just tax and flexibleness any time you need. Excessive people’s credit reports will allow you to find fine sorts credit ratings (ie. getting qualified for credit lines instead bank cards) as well as less percentage of interest on car and truck loans and mortgage loans.

Just what is the most desirable overall credit score in europe?

In quebec, the “perfect” credit score rating is 900. But by and large anything over 700 constitutes nice, and a thing over 800 is very good. Most people have the or superb overall credit score. An average compliment in Ontario is usually 650, and simply 20% of Canadians consume a credit achieve the following 600.

INTERRELATED BLOGS:

- How I Destroyed (and Permanent!) A Score

- 5 Quick to make A Favorable Credit Record

Greatest chop your credit score:

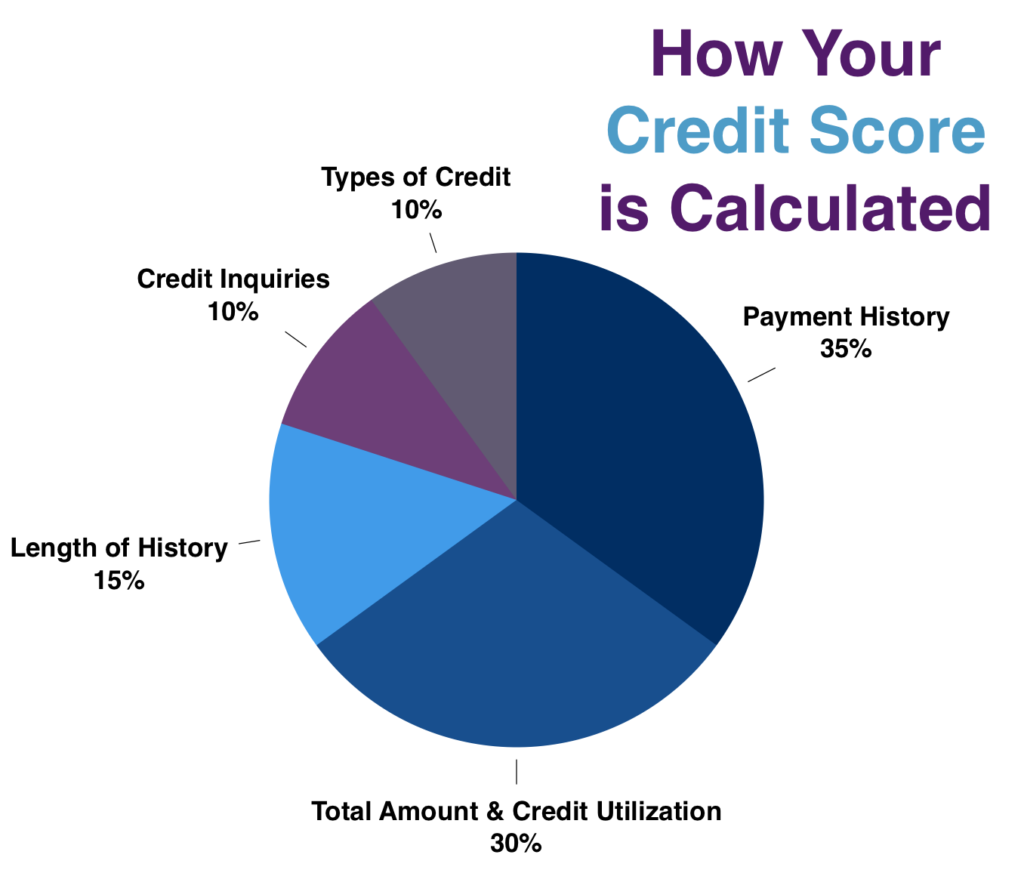

The way in which your credit rating is also counted exactly can be key, howeverthere is a common viewpoint throughout key offering ingredients.

Some methods enumerate alot more to your credit score than others, so in case you’re hoping correct poor credit or simply boost mark generally, target whatever should have the biggest effects. Here’s how to crack your credit score:

Cost past 35p.c. – 315 information

The main some your credit history is if members’re maintaining to your costs. As long as you’re manufacturing no less than the standard repayments on those expenses your debt is, people’re working on a fantastic position. It’s really worth remembering that creating precisely the least bills on your financial debt perhaps really doesn’t indicate you’re flourishing monetarily. You will need to pay off even more towards your debts when it’s possible to (and that will improve your credit scorealso, as we see over the following page), but in terms of your credit score can be involved, simply checking up on the bill is more than just enough.

Your current fees background might least complicated element of your credit score to sustain: everything you need to perform can be pay your bills, and pay them by the due date.

Hackers:

- Whether you have any financial debt behind in money, or perhaps in recovery, give attention to providing those to well popularity as quickly as possible.

- Establish instant payments from little money on each of any financial debt to occur over 3-5 times vendor due date. This will likely be certain to will never skip a payment, despite case of a weekend or holiday vacation.

Ful balance due and credit rating practice 30% – 270 guidelines

Simply how much credit history we’re definitely turning out to be consumer debt may be the second elder a part of your current score. Your credit score fundamentally is dependant on being capable of getting lots of recognition us don’t actually need to utilize. Assuming you have numerous debts graduated your salary, or maybe you’re frequently surviving inside the reduce of your respective credit cards, this task’s gonna negatively shock your credit rating. Paying down consumer debt considered easiest ways to compromise your credit score.

Hackers:

- Reduce your entire financial debt put. Support producing further money to your debts to decrease for the in general equilibrium. Target high-interest debts lowbecause these represent the priciest to carry and’ll find the biggest “bang for ones buck” having to pay these people from promptly.

- Get rid of your trust state. On any various rotating consumer credit, like bank cards or personal lines of credit, attempt to in no way carry an equilibrium beyond 1/3 of readily available credit rating. For example, if you have a charge card with a $3,000 restrict, do not ring-up more than $1,000 thereon during a period.

- Apply for much more consumer credit. On the list of short and fastest ways eliminate to your credit score employment usually enhance your borrowing limit on a charge card or loan or request a new one. For example, if members’re keeping a balance of $2,000 on a credit card with a $4,000 restrict, your current trust use is half. However, if that you name while increasing the bound to $8,000, your employment will move to simply 25per cent.

Duration of credit 15% – 135 things

Future largest determinant of your credit history is the period of personal credit history. This is important as general, and also on personal reports. The lengthier you personally’ve wore a credit accounting, desirable it is for ones record.

Hackers:

- Retain keepin’ along. There’s not a great deal you could do in regards to length of history of credit, except regarding period leave.

- Don’t tight long-standing balances. Should you’ve have credit cards for several years, continue to keep this situation candid even though you don’t very put it to use. If there’s no total amount, allow it to be!

Bear in mind that this some your credit score looks monitoring Every one of the different trust you have. Don’t worry overmuch over reducing one particular charge card anyone’ve required for ten years when you have other bill that have also been open simply several years. Closing one particular bill won’t wreck your own score gravely, primarily since credit history accounts stick to your credit report for 6 days developing’ve sealed these folks!

Credit ratings queries 10% – 90 details

Your next thing that influences your credit rating is usually how many times people submit an application for consumer credit. These are typically generally known as trust requests. There’s two forms of assets question: heavy concerns and delicate research.

Painful query happen to be genuine programs for credit ratings, like obtaining a charge card or credit. These can decrease set, in addition they remain on your credit score provided a couple of years.

Cushioned requests are simply viewing to your set, or if perhaps that it’s in just upright. These requests dont influence a seduce. Checking ones mark with Borrowell is that a soft question, and doesn’t affect your credit history.

Cheats:

- Should don’t need to have trust, don’t submit an application for that. Heavy inquiries remain on your credit report for a couple of years, and is a very long time for something to stick around.

Sorts Credit 10% – 90 things

Finally, the previous aspect of your credit rating is determined by the types of credit rating you might use. Very assortment of credit history devices you’ve applied, the better. Assume education loans: effectivement, financial products, credit cards, line of credit, or a home mortgage. Still problems the cellular phone charge might appear as revolving credit rating on your own credit profile.

Cheats:

- In the event you at present have only credit cards, seek opening a type of account with all your tip. Not only will this offer much more trust species, but it may supply you with a low-interest strategy to join any debt!

Hacks your credit history by narrowing your attention

In line with the here, you can observe just about a complete 2/3’s of your own compliment is determined just inside transaction history and trust exercise. For that reason, the quickest secret to improving your score normally pay down the debt. Don’t maybe take the trouble seeking undertake one three instrumental factors for your credit history until you have these two fully managed. Besides, if you happen to’re taking care of your cost chronicle and cutting your credit score utilization, some time may run which will surely help with your length of rating! Quite simply, one’re destined to be 80% in journey to your beneficial score simply by to be with money reliable.

I’m carrying out all correct, why isn’t my personal credit score rating most desirable?

Without doubt an individual online must have an ideal 900 consumer credit score, though I’ve not witnessed this task. Truthfully, once you’re over 800, supplementary ideas don’t form regarding a positive change. Crack your credit score all the way to possible, and’ll preserve personally plus finances in the long run!