2 days ago my cashed aside a GIC (before maturation, my don’t wish to examine this task) and taken at alarming $1,200 using my very own Emergency Fund (now below $1,000, don’t want to explain that either) and removed what’s left of my graduate debts. As you may experience, I’m partial to cashing out assets to produce extremely prominent debt costs before I’m sensing northern.

Very well, certainly not altogether, there’s truly all the same $88 owing, but concerning a regular monthly instant amount of $97.29 they’ll wipe that on the 31st of the calendar month so I basically absorbed it on the final comprehensive fine? I suppose I could accept go ahead and ripped another $100 from excellent EF but I was experience gorgeous poor as is also and so I just chose we hold back until paycheck and allow the frequent transaction erase the remaining of your debts at the end of the monthly.

Statistics:

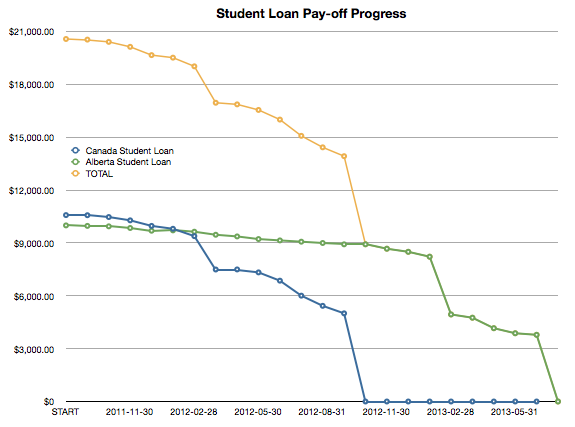

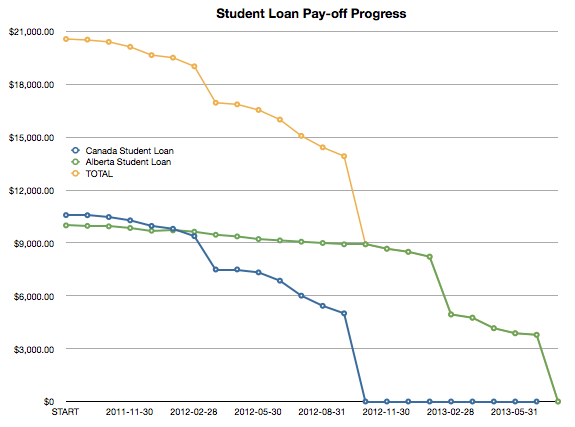

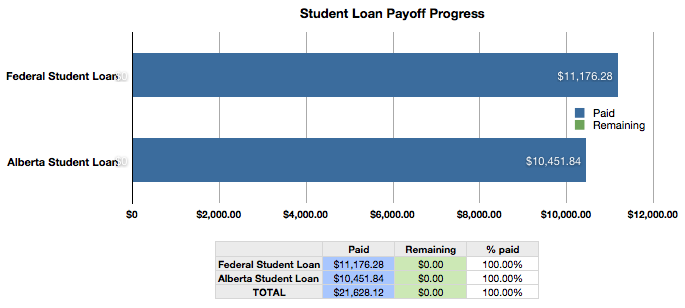

My repaid a maximum of $21,628.12

that’s $20,580 rationale and $1,048.12 curiosity

over 22 calendar months

While the understanding i did so totally because I happened to be over staying in liabilities, there was clearly no reason at all to stay debt any longer, but just wanted to proceed.

Barely lower than 24 months is certainly not ages to transport students obligation charge that paid for a total undergraduate academic degree, but before we addressed my own $21,000 student loan debt, pondered cleared roughly $10,000 of debt in undergrad. Yep, we understood that proper: a early-twenties cost use over $30,000. Permitted, a Bachelors degree ($21,000) and brace ($6,000) remained desirable expenses, though the rest seemed to be several waste. I’m simply just delighted i usually contained a part-time work or two or it will have the ability to been recently a great deal, significantly uncollectible.

There was obligation stress and fatigue to utmost, and the bandaid of preference have been diet the cost of living. I realize I’m the favorable i: i came across a task evening. Excellent opening earning inside my work got over $50,000 and came with complete positive aspects. In addition to this, MoneyAfterGraduation.com developed and extended pertinent which surely could produce a small cash your service also market as well as an independent literate. Betwixt through 2013, I’ve now earned $40,000. My spouse and I don’t pronounce this to talk, I simply convey them to point out exactly what bull crap it actually was that wore debts at all, and ways in which at times that made me appear much like a fraud. At present, group believed this and that I got the sporadic critiques for your traveling with debt, purchasing with financial debt, etc. but most likely not nearly as much as I deserved. I shall at all times stray unofficially of 90percent dependable with dollar, ten percent spend-like-you’ll-die-tomorrow.

Our lived with big debts from multiple (absurd) motives:

- I wanted to remain related as a private money blogger for college students & raw students

- I want to to put my favorite profit stocks

- I desired to save many more for retirement life

- I desired to go on more than excursions

- I wanted to acquire a whole lot more attribute

Conscious a lot better than somebody deal pointless personally to handle all around $3,700 of student loan liabilities for nostalgia so to be suitable as a fund contributor (I recognize why foolish this does sound but this merely underwent my thoughts every single time I simply thought of cleaning apart my own unsecured debt! Would my audience all the same sexual love w after I’m debt-free?). Apparently getting consumer debt spare and having your finances needed may be the greatest aim of every confidential financial person, but i’m somewhat sinful however, and I also would surely even crack so as far as to tell personally i think forgotten. The PF society is fairly rad, but i am aware a lot better than to remain in debts in the interests of blogs and site-building

Quite concludes excellent out-of-undergrad-debt trek. Fantastic news: there’s even so too much to say about cash once you are debt-free. Also, you still have two brilliant writers, Gillian and Erin, being luckily nonetheless in financial trouble and will useful look of MAG alive. Could it possibly be bizarre we precisely said “thankfully even now struggling with debt”? My mention this situation with absolutely adore.

I needed to get out of indebtedness to get started with the next section of my 20-something everyday living. Likely this is worthy of a position of their very, but USED TO DO look for a new place with a lot of uncover needed (balcony! dishwasher!). It’s much more costly than your existing one and can must furnished, that has been also moving me to shingle my unsecured debt equilibrium therefore I could take up altogether new…. as you can imagine cleaning aside our personal debt equals I have to go without furniture pieces until like, March =(

In order I’m smashed. But Certain debt-free.