When it comes to committing to the stock exchange, these day there are many more choices than ever before. You do not possess to match these products are your key funds, nor do you have to select a bank inside. You may occasion portfolio into the own personal applause, but exactly how much you intend to do yourself is moreover your choice. This is how the majority of people experience hung-up on whether or not to purchase self-directed paying vs. robo-advisor.

Self-directed investing is most reasonably priced solution, but dependent on all of your investing-savvy could mean many more risk. A robo-advisor can cost a tad bit more, it usually takes the burden of controlling buys yourself off to your arms. Determined by ones investment funds process, you are able to select one or both to control finances.

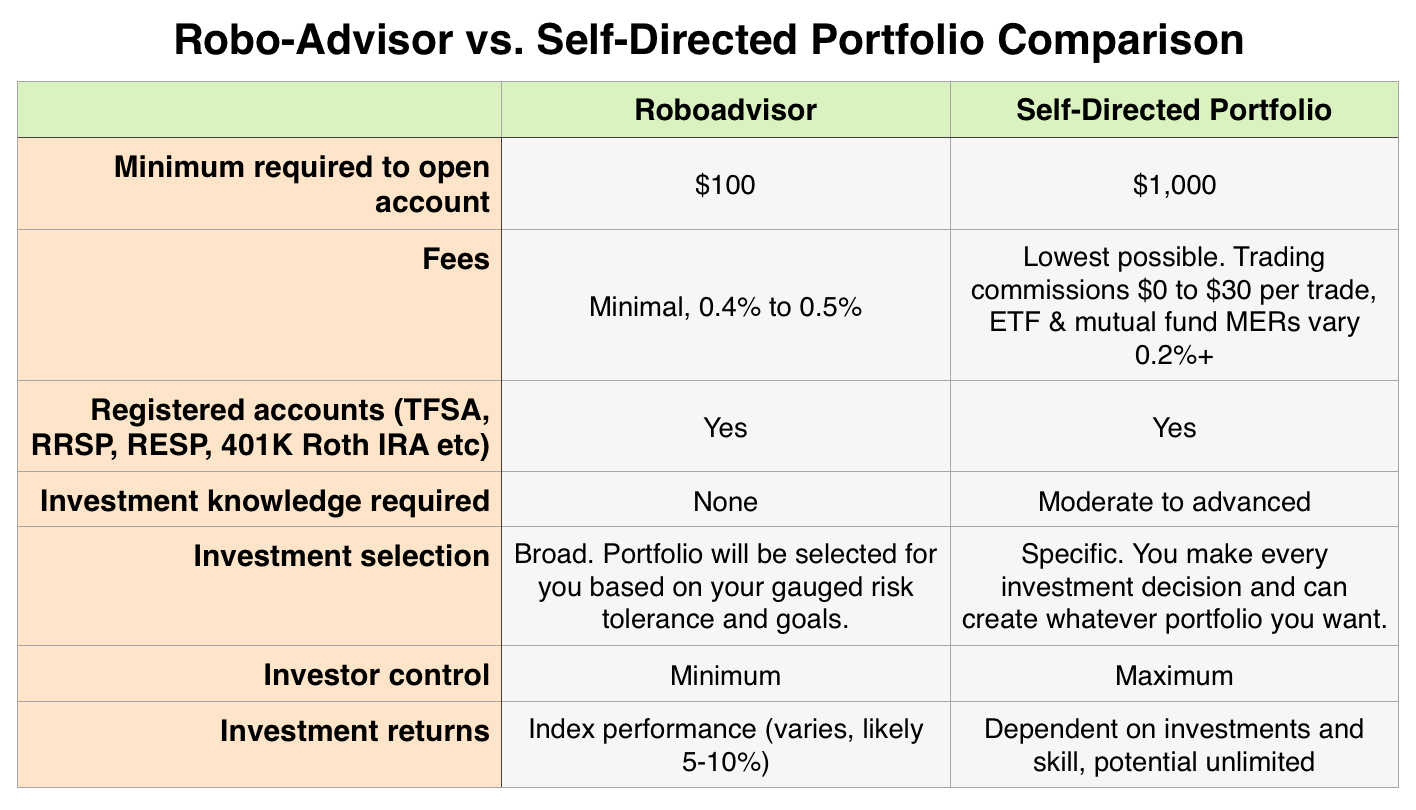

Here’s how a self-directed investing vs. robo-advisor plan liken!

What exactly is a robo-advisor?

It might unreliable, but a robo-advisor is certainly not basically a machine. Behind every robo-advisor in europe you’ll find real folks. The term “robo” is merely right there to underline an purchase is happening automatically for its capitalist (that’s you).

This is significant to comprehend because signifies that robo-advisor information were make an effort to been able dollars. Citizenry most often distinguished themselves as a kind of “passive” committing, but this is exactly faulty. They’re more tightly regarding another actively managed income, like mutual funds, except appreciably inexpensive. However, invest implies that the profile allotment can and serve change over clip. This means the collection a person to begin with established with the robo-advisor may not be alike function you’ve in some times or a long time. This really isn’t a terrible thing! The market is switching, in addition to the budget management has become creating differences into the profile guaranteeing a person stick expended as mentioned in personal chance tolerance and banking desired goals.

The low charges regarding robo-advisors are some of the motives normally these bang-up technology. In which a good money will cost you just as much 3per cent to 500 in management cost, a robo-advisor like Wealthsimple will let you shell out for as low as 0.4per cent to 0.5p.c.. But it is still costly than putting independently. Build it yourself or self-directed buying and selling with ETFs can reduce our charges even further. ETF premiums is really as modest as 0.1%, nevertheless, you must do all of the dealing personally.

A free account with a robo-advisor are a tax-advantaged report like an RRSP, TFSA, or RESP (quebec) or a 401K or RothIRA (American market).

When you pick a robo-advisor

A robo-advisor tends to be a fantastic improvement to credit schedule, no matter your own making an investment practical knowledge.

If you’re a fresh buyer that mayn’t fully grasp the majority in regards to the currency markets, a robo-advisor is the perfect place to begin. By signing up with a robo-advisor, you will encounter the ability to determine and benefit knowledge in the market. You will not only get the hang of putting footing like “ETF” or “dividends”, one’ll will also get the opportunity to observe your balance range being the class arises and downwards.

Robo-advisors are fantastic for individuals that want to shell out, however they are not necessarily thinking about mastering the particulars of fabricating or dealing with and venture angebot. If you should don’t own period of time or even the want to research funds, a robo-advisor is made for we!

Should you’re a professional buyer, you could also always choose to employ a robo-advisor. There is no law that says it is vital that you shell out every dollar singular journey. Indeed, this even make extra appreciation to share your own financial resources between a robo-advisor and a DIY accounts. This could possibly provide you with the defense of using another individual organize a portfolio accessible, while continue to creating your personal savings to try out the market industry with.

The way you prefer to separate your benefits between a self-directed spending vs. robo-advisor depends upon your targets and buyer belief. The lower comfortable that you are making use of the currency markets, the you really need to depend upon a robo-advisor.

Precisely what is repair it on your own or self-directed investment?

Dealing your own personal investment funds angebot is commonly consult to as self-directed or “DIY” buying and selling. Within this position, you’re purely to blame for locating and monitoring the possessions that you select. You should do the analysis, make decisions, and undertake the actual transactions. You will need to supervise expense experience, eliminate levy, and a lot more.

PERTAINING: building a Six-Figure Stock Portfolio from rub

To get started with a self-directed venture portfolio, one should open a business account. This is often distinct from a bank account, though countless significant bank provide brokerage reports. A brokerage story will let you “broker” (aka. sell) securities like lumber and ETFs.

a business consideration might end up being a tax-advantaged story like an RRSP, TFSA, or RESP (quebec) or a 401K or RothIRA (American). It’s as common as selecting the accounts at the time you register.

When you take self-directed buying

A self-directed choice profile is good for a lot more seasoned investors could manufactured a smart investment for the understanding of how markets study. They’ve been familiar select funds and execution sells. The team discover how to minimise expenses and fees, so that they can have price modest.

The key benefits of self-directed committing tend to be more control over you are investing, which means both low rates together with the potential for greater yield.

In the event you’re uneasy about forming all of your accounts, one cheat you are able to is always to reproduce a robo-advisor selection. Many robo-advisors usually are clear about how and where these people invest their clients’ dollars. They even arrive specified in just what actually ETFs they will go with! You may replicate a actual list allocations discussed on their online websites without having to pay their own charges. The sole crochet is that you simply have got to satisfy improvements and minimize taxation.

Self-Directed Spending vs. Robo-Advisor Relation

Extra a side-by-side compare of Do-it-yourself investments and robo-advisors to give you a sense of the deviationand the advantages and pitfalls of the:

It is essential is opting for whichever would be ideal one!

Truly the only mistakes you can easily certainly gain seriously is not putting anyway

Local plumber start in the currency markets is actually 8 in the past, nevertheless the second best determine is true nowadays. The earlier obtain initiated transacting, more time period you have to find out how shares work and also the more lengthy your hard earned money would cultivate.

In regards to picking self-directed investments vs. robo-advisor, remember, this task’s all right to modify your heed. Members’re permitted to use one, whenever as it happens to not ever become right in shape, change your money to the other! Every so often the only way to find out what kind of individual you will be often turn an investor. Break putting things off debt reliability, and obtain began putting now!