This 30 economic objectives it is advisable to blockbuster By ageing 30 send in recent years went microorganism. It was satisfied with a tremendously beneficial responses, but there was numerous naysayers within the mix. Individuals seemed to gather around one-point of controversy: #5 – feature at minimum $25,000 stored for your retirement by age group 30.

Perhaps even the society & Mail’s steal Carrick recommended this might be “unrealistic”. He wasn’t lonely. Many individuals was adamant that if or not you can easily shoot this target hinges on your position: all you researched in institution, how much money liabilities that you have, whether you will need to assist all by yourself, once you set out saving money, and so forth. While all these things can highly hit your wages and cost savings energy, I presume most of us from time to time arrive at that commonly for explain to not ever salvage.

Whenever I thrust my favorite audience for heavy targets or flaunt a number of my economic muscles, I’m now and again welcomed with a few dissatisfied protests we needs acquired some very simple tease and therefore can’t sympathize making use of median rescuer. As a person that wore a distinct inadequate budgetary gains — from no adult advice about institution, to more than $20,000 of education loan bill, to letting and aiding myself personally since aging 18 — I recognize you can achieve way more along with your budget than you believe you’ll. Application and regularity go away very far when it comes to currency, nevertheless you have to put them into steps. Compassion for desperate situations is fantastic, but understanding mayn’t produce money, and I’m supposing a person’re below as you desire income, instead of hugs.

Really, you truly want to have very similar to a year’s salary saved for retreat by years 30. But this is tough, specifically if you save money than 4 decades in school or have an high-earning vocation. Purpose $25,000 is certainly excellent line to target to begin with, and then nearly anything apart from is usually a nice shock!

Suggestions Rescue $25,000 For Retiring By Property 30

Step one: Break Thinking Anyone Can’t. Really, prevent. Like with my discussions about how to lay aside six-figures in seven year or increase your website value by $25,000 annually, I most certainly will certainly not engage the explanations we can’t (aka. don’t need to) save $25,000 by develop 30. Really the only explanation you might not manage save $25,000 by age 30 is that you are aged 31. Not one other explanations took!

Step two: perform the business. You are going to make between $300,000 and $400,000 (or higher!) through your 20’s — while’re revealing to I do people can’t store around ten percent of the? Boo! So long as you start at develop 20, although you may make a compact compensation you simply have to help save 6% of your respective source of income to tip $25,000 for retirement by age group 30.

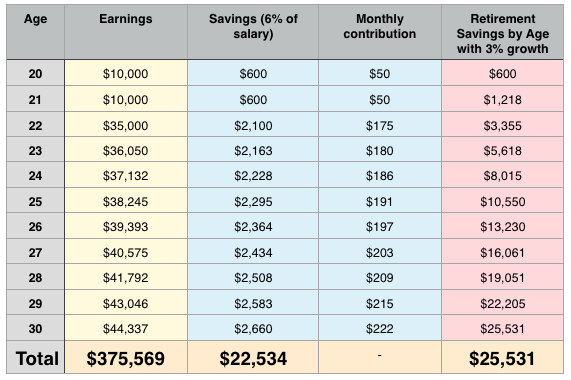

Within the dining room table below, You describe how a twenty-something with a normal pay might write $25,000 for retirement by age group 30 by conserving 6procent of these money:

chart supposes kid looks on the job intermittent at months 20 & 21 so offers a lower cash flow! Salary growth by 3percent per annum believing typical, smaller stir.

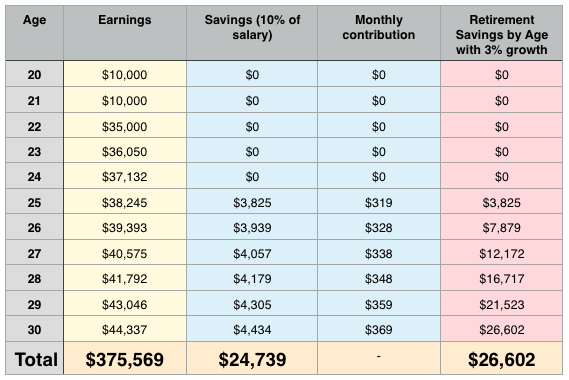

Should you don’t take up savings at 20 then you’ve saving far more as soon as you manage begin, but all person just lost. In the event you’re a deceased flower much like me and don’t act protecting until ageing 25, you’ve in order to save ten percent of the financial gain to reach $25,000.

Into the stand below, I simply outline so how a twenty-something with an average wages might write $25,000 for pension by change 30 newbie at the age of 25 by rescue 10% that money:

a former flower saver can don’t assign everything aside until age 25, after which then they begin preserving 10% of the cash flow. Earning and wage goes up are similar since preceding case study.

Any time you earn much more, you save a smaller sized proportion of your own gains nevertheless meet the same exact aim!

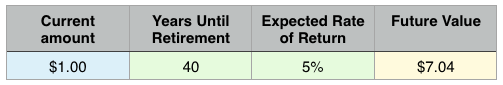

Action 3. Start CURRENTLY,! However this is an urgent, please-begin-yesterday make a difference. The Reason? Because hoping you can get to an annual yield with a minimum of 5%, every bill you place away now’s valued at $7 at your retirement 4 decades from currently.

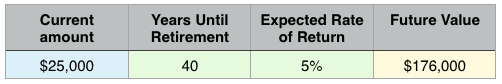

And so when one’re griping which part-time duty become compensating we $10/hr, emphasize to your self that that will be basically $70/hr for ones 65-year-old yourself. Are you presently observing how come this is so imperative at present? Must do work the total $25,000 by get older 30, that you’ve even protected $176,000 for your retirement:

Wow! really worth the battle easily at any time determine this task.

Step four. Manage you are property. Among easiest ways to your prolonged cost savings desired goals normally put your money effectively. In instances above, I often tried an interest rate of come back of 3procent to 5%. When you can set maybe 1percent advanced, that finishing total at retreat will skyrocket above a quarter of a million dollars. The most significant components of monitoring a property have been:

- putting for all the future (this indicates no strange day-trading or chasing “hot” stocks),

- diversifying our rescue. Attempt maintaining many the retirement life in safe parts like cash and alliance, some in average possibility purchases like a mutual investment fund and dividend livestock, along with ease in progress repute and ETFs and

- DON’T RETREATING MONEY.

In europe, members’re permitted to need inside RRSP for problems a down-payment on property as well as to return school. That is an way to undo your time and effort! Don’t eviscerate you are RRSP to property or give tuition fee.

Supply 5. trimmed yourself some cord if you decide to don’t survive. $25,000 is a major host, where might an unforeseen occasion that stops from fulfilling that dream. But that shouldn’t require you mustn’t attempt. Even if you save exclusively part, we’re yet arranging by yourself upward for an awesome money forthcoming. Bear in mind, any money you place off of portion 20’s is definitely worth $7 in retirement life, therefore it’s beneficial provide although you may just have the capacity to catch multiple during the tip.

Where are you able to receive the revenue to play a role in personal termination data in order to really achieve the weekly and once a year efforts essential extend to $25,000 by change 30?

- do work added numerous hours or at a part-time duty

- gather a collect

- make the most of boss your retirement blueprints or any other positive aspects if usable

- leverage an interest or skills into an item repaid, like self-employed writing or tutoring

- persuade dress, books, or gadgets that you simply not demand

- miss elevate the phone/computer annually and hang on to to your aged technology for 3, 4, or 5 year

- block a sinful outlay that’s injuring system plus your cash (i.e.. cigs or liquor)

- economize as a substitute to spend cash windfalls like a heritage, completion reward dollar, or tax reimbursements

- neglect a yearly family trip

- confuse an essential choose like your vehicle, downpayment on property, or a marriage for one more yr (or two!)

- accept 1-2 beers on Friday/Saturday nights rather than 3-4

- move to an inferior, less expensive studio or get a friend

- maximise payoff steps tools you may spend less of your own funds on items need

There’s countless methods! And that’s why i am aware THIS CAN BE DONE! do so for your $176,000! Do so you don’t have to feed guy foods or live in a box as soon as you’re familiar. Us’re likely to be of this successful inside your seniority, there’s sumptuousness luxury cruises and playing in Vegas available, therefore originate stashing dollars for that activity!

Excited saving money!