I’ve got many an email these history weeks concerning how to build a realistic finances. Foremost i’m it important to show that I’m far from big on create. Excellent factoring process is made up of automating debts obligations and transactions to reductions, and waste, spend, invest whatever is definitely left until things’s absolutely all lost. Individuals always funding more cautiously, but I’ve establish easily let to in it, we start to feel restricted and definately will self-sabotage your initial prospect.

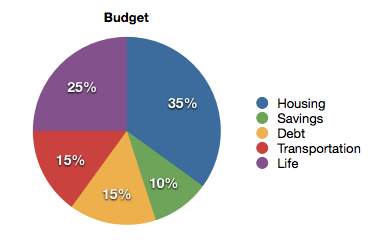

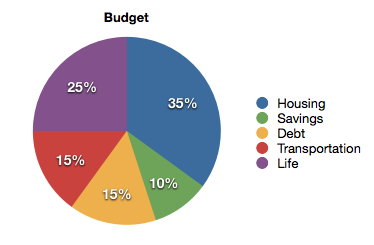

When I’m requested, “How much must I waste on…?” excellent answer is that, “whatever you feel is correct” — but you can find ideas. The loan idol, Gail Vaz Oxlade, propose a well balanced expenditure plan like this:

Awesome! I presume that really works for most of us.

That’s a net income, by the way. Don’t draw a budget with revenues. Members don’t arrive at pass ones coarse, you discover pay out ones profit.

Directly once I analyze that curry road, my own thinking were: 35procent is way a great deal to dedicate to houses, and 15% can a significant amount of spend on transfer. quarter-hour isn’t about adequate to arrange towards your liabilities, and 25procent on “Life” truly doesn’t solid excitement whatsoever.

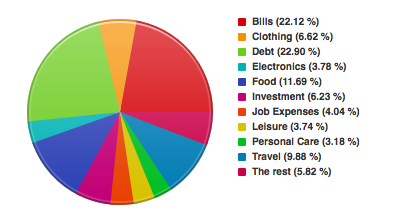

This could be an illustration portraying ALL our USING for 2012:

i personally use an application for my very own apple labeled INCOME 4 from Jumsoft to track all excellent expenses. Genuinely readily available transfer via Mac computer App shop for $39.99 — steep, but worthwhile!

Immediately, people some groups as compared to Gail journey because I like to live additionally thorough, but truly, I’m sure wherever excellent money is gonna (this data actually isn’t perfect body as it results aside all the Savings which are branded as “transfers” during money-tracking system thereby don’t register as “spending” — you will discover that used to do obtain many thousand funds of lumber though under “investments”! my save 20-30% of your financial gain virtually any monthly).

Should you’re pondering it seems like I’m purchasing lots of fun, you’re proper — but that’s because I’m failing to pay for a motor vehicle and surviving in a low priced residence, and so I don’t want Gail’s benevolent quarter-hour and 35procent for anyone sorts, respectively. Instead, I pay the thing I must following i use exactly what’s left to increase my personal consumer debt payment and now have a little bit more playfulness.

Longer facts shortest, your are performing what’s good for you!

Note that effectively for you doesn’t mean missing rescue or pulling your financial troubles out and about over 40 years. That’s not really what’s right in any way — that’s truly maybe the uncollectible potential matter! Besides, your capacity to pay shouldn’t involve maxing the actual implied different categories. Whenever you can afford a $1,200 residence based on the curry graph, don’t end seeking that when a $900 you are going to suffice.

Furthermore, don’t concern how many other people are trying. Our expend an obscene level on nutrition because I like to make meals and bake, and luxuriate in going out to feed 3-4 occasions per week. This can ben’t a bad thing, this is simply some thing my rate and was able to inserted a little more dollars against.

As a final point, notice that your financial allowance changes through the years. One time a personal debt is gone, I’m aspiring to film that total pie portion into a lot more financial savings and wealth. Besides, I purchased paying out around $4,000 on individual go in 2013, which should cut that everyday living classification drastically. Secondlybecause excellent salary boosts I’m wishing that my chosen lifestyle willn’t balloon at the same rate, in order for should change the harmony likewise.

Determine make a budget?