I’ve look a nearly crippling sense of emergency meet up with primary financial landmarks throughout my 20s. Whether I’m ordering in to the “adulthood will begin at 30” plan or simply just plain under table that now could be much better than future, my arrange high prospect for at which my finance must always be throughout my 20’s. And it’s only recently appeared in my opinion why insane that is definitely.

And even though I’ve happen to be cutting down for later on whatever garner this evening, I simply in no way actually believed about today can look like.

I’ve blogged before about how one skin a few of personal prominent expenditures the 20’s, and you have paying all of these with exactly what are apt current paycheck of life. This indicates backward about the schedule we must have dollar by far the most, we possess the lowest from it, but that’s truly the way it comes.

I’ve really been economizing for retirement plan for pretty much 4 many years, but We’ve under $40,000 conserved throughout my RRSPs. My just about maxed my very own TFSA out at one time, following almost all of the situation fast acquired liquidated to pay for excellent MBA. I don’t run home or a motorcar, imagine along with my own personal pc, the priciest objects I possess usually are hand bags. How’s that for asset?

I’m nearly 30 and my own networth continues to only some thousands of funds.

It’s a bit more demoralizing, to see the least. After many years of perseverance eliminating my education loan debts and savings & buying and selling, shouldn’t i many more to display for? Essentially, nobelium Even if pondered chosen not to ever go back to educate for the MBA, I’d only just be scrape the other unit of six-figures by 30. I’dn’t also be near $250K, aside from drawing near to millionaire level.

Thus if a great deal of time and energy definitely exclusively make distinction of a few thousand money, exactly what’s the purpose?

Time. The 40-ish operating long time ahead of you do your largest property inside twenties, not even to your paycheque. One purpose might plain one: the “magic” of compounding. I’ve revealed in past discussions that $1 rescued inside your twenties may be worth about $7 within favorable days. The things that position give out is actually the vast majority of results really happen in the past fifteen years of one’s 40 spring venture.

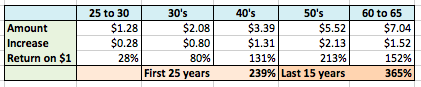

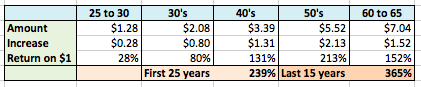

Return on a $1 venture constructed in a 20’s taking on an average 500 yearly return

Silly correctly? Your current $1 simply receives $0.28 in five years of your own 20s, but $1.52 in five years of 60’s (assuming your current reinvesting the interest accumulated during the dozens of years between to maximise the main benefit of compounding awareness). Imagine each $1 develops by 239per cent in the 1st 25 years… and 365procent in 20 years afterward! The results:

Your main the main abundance profit can happen at the end of our being employed generation.

Not only can personal first assets enjoy the biggest attention increases in newer many years, likely than definitely not your current 30 numerous years of activity feel is definitely dominating the very best compensation a person’ve ever received, supplying you with more funds to save.

I’ve we’re at all like me, you may possibly have foolishly thought of your financial growth as linear, with all your net really worth progress somewhat like across the period of time and tens of years of your life, during truth you personally’ll most likely see dramatic rapid rise in all of your cost savings and investments within the last few few years determine tire — and contingent simply you personally get, maybe even after.

Well the next occasion you obtain dejected regarding minor pack (or want thereof) of money sitting in your finances, know, the remainder is actually still ahead.

We’ll exist rich nevertheless… as we experience surpass each of our mid-twenties