KOHO is the greatest cost management and protecting application offered. Gain cost-free cash on your own expenses, reach your economical desires more quickly, lastly stick to spending budget.

NOTICE: since i have certified my overview movie, Koho possesses new a supply you additional $$$. Enter the mode MONEYAFTERGRAD as soon as you registration to acquire 1% additional cash-back for 90 days!

KOHO Analyze Overview

In a big hurry? Here’s all you should be informed on KOHO:

- get no cost $$$ as 1% bonus cash-back for a few months any time you sign up with the procedure MONEYAFTERGRAD!

- that it’s a prepaid wireless credit scorecard, certainly not a charge card!

- derive 0.5per cent cashback and up to 2% cash-back with KOHO premiums

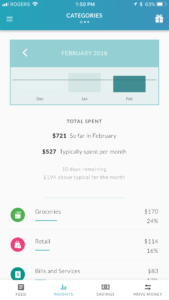

- KOHO keeps track of and categorizes personal spending you know precisely at which every dollars has gone

- the round-up aspect will let you round-up buys on the most adjacent $1, $5, or $10 and keep things

- put reductions goals basically create with an everyday, daily, or each month footing

A comprehensive KOHO Evaluation

This really is this entirely straightforward Koho overview! Koho is actually a Manitoba expenses and protecting software giving a person insights into ones expenses conduct while aiding you to meet debt finish.

This overview seriously is not a paid text, but I experience picture affiliate marketer policy with Koho. If you utilize the code MONEYAFTERGRAD if you sign-up and activate all of your tease, members’ll become a zero cost $20 (and I’ll will also get $20). Established a primary load from your paycheque for Koho cards, and now you’ll become additional $40. That’s $60 of complimentary payments! As soon as you’re subscribed, members’ll collect your personal value to request acquaintances & wife and kids with get the equal extras if they enroll.

A half-dozen reader mentioned about Koho, and that I worked the best way to establish an honest reply were give it a shot personally. At the beginning, I simply didn’t tumble. I view totally about a pre-paid credit linked with a typical create app. You didn’t observe how this could possibly come to be far better than from a cash-back mastercard in your scheduled cover chequing explanation. But at one time I simply started out making use of Koho, I appreciated the situation and from now on things’s one and only thing I prefer for dollar!

GET NEARLY $60 Right now

Precisely How KOHO Plant

Koho will be a “spaving” aid. That’s a text i take advantage of to describe a thing that can help you manage both all of your expenditure your reducing. Koho characteristics as both a spending monitor and a bank account. One weight revenue throughout your Koho cardboard by either direct purchasing the situation from your own paycheque, posting as an e-transfer, or transferring from a linked bank-account. As soon as your money is stuffed throughout your Koho greeting card, you may use that it anyplace charge cards are generally accepted.

Koho runs on endorse, but it is not likely a charge card. Things basically runs as a money card with amenities (and not one for the potential drawbacks!) of a credit card. Unlike a charge card, you will not spend some money you’ll don’t have got. You can exclusive spend cash you’ve even soaked on your KOHO menu. Quite simply are you expected to strategy and budget the expenditure, nonetheless also have to grapple aided by the real life which funds in time expires! If you enjoy the prizes and simplicity of credit cards but constantly arrive stuck in a consumer obligation pattern, essentially the terrific choice.

Personal Koho paper is linked within the app, which might observe and label our expenditure, as well as provide cash-back which helps one reach your reductions desired goals.

KOHO inspection: saving a expenses skills varying your activity

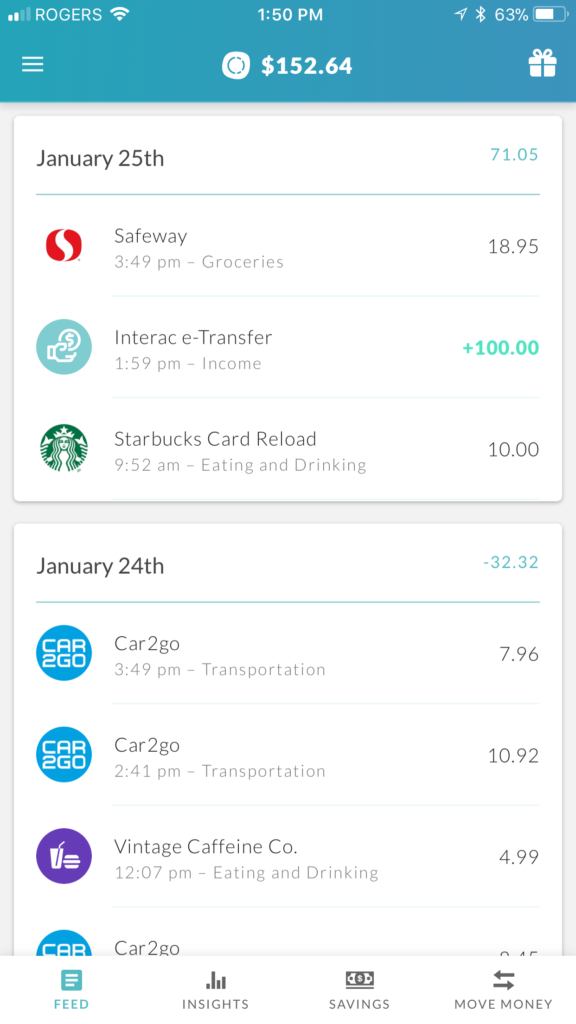

After you fill currency onto your Koho see, it can include the application while your “spendable”. This is the way far currency you have to devote. Any time you purchase with your Koho card, the software package will monitor and auto-categorizes the things you purchased. This occurs outright! You start to see the Koho alarm of how much money Our wasted exactly where there is immediately after My withdraw the charge card to fund an issue.

If Koho boasts suspected incorrectly in appointing a purchase order to different family, or perhaps you choose to put your get under a new family for your details, you can certainly do that quickly within the software. You personally’re too inside place any different types to raised reflect all of your spending habits as well as your your own fund. As an example, I put the kind “Baby” for almost any purchases I allow for my favorite kids.

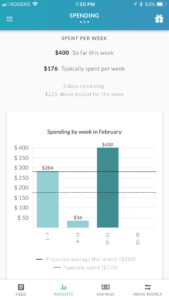

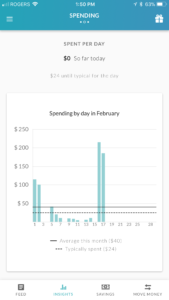

Extra buy Koho, the smarter them receives. It gives you statistics on the ordinary once a week and each day paying action. This gauges how much money you generally devote in a normal couple of days or daytime, immediately after which grants a projected typical. KOHO will let you know must’re above or substandard for any week or monthly. You could potentially align personal habits therefore!

Microsavings & cash-back ftw

Hands-down the best attribute of Koho, and just what influenced this Koho evaluation, is the micro-savings pursuits. Direct into the iphone app, you are able to set a savings objective then allot a tiny regular level towards the situation. This is often under a number of mere cents. Everyday it can be obtained from your own spendable and place towards your benefits finish. Any time you’re much like me, uncovering another $500 portion finances are very difficult but saving money $3 a day isn’t. Accept as numerous or as a few preservation finish as you would like, along with various levels for each. Koho will let you know exactly how long time it takes in order to save satisfy your objective, specialists fine-tune therefore.

I’m keeping for careless things like architect shorts, but Koho’s micro-savings element normally a great way saving further acceptable dreams. For example, if you should rescue a $1,000 the sudden investment this year, you can certainly do so that in Koho by putting away only if $2.74 a day!

APPROPRIATE: 4 approaches to improve your rescue by Spending Money

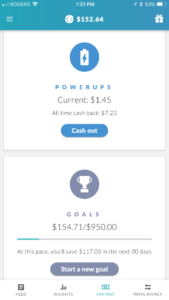

On top of Koho’s micro-saving, additionally, you will have 0.5p.c. cash-back on all your valuable expenditures. This collects inside the software package, and after that you can make to “power right up” to your spendable by cashing up.

Downsides and limit of KOHO

Koho possible won’t supercede your wallet and credit-based card, but it is a fantastic supplement to the things. Yet, it can do have cons (hey, used to do pronounce this is a brutally trustworthy Koho analysis!):

The strong strain (strong security) perform is a good way of getting funds on your current Koho correspondence. But determined by all of your interviewer this really isn’t simple total. If a manager can don’t grant revenue is lodged straight away to KOHO, members’ll need to use the straightforward transfer or e-transfer includes in iphone app. This can wait having your payments on top of the card. But my own exposure to the e-transfers is they will always accredited fast. Several arise within some hours of people making the ask. So that isn’t tremendously restricting however it does take some preparation.

KOHO is not credit cards

Koho has becomen’t good for stuff like getting standart hotel rooms or any other booking. Often these will inserted a pre-authorization individual correspondence for $400 because this will be subtract from spendable. This will certainly leave you on an excellent firm spending budget situation didn’t stored even within. Furthermore, because Koho can ben’t a bank card, it will don’t grow credit rating, so in case you remained hoping to construct or haunt injured credit score, them won’t provide you with that.

Learn how to get the most from Koho

Truly, one’ll like the benefits of Koho as soon as you use this, but you can find other “hacks” i take advantage of could make it work good. A Koho evaluation is certainly not utter minus the secrets to very succeed for you!

Have you thought to try…

- go for a certain number of “no dedicate years”, like one in a week or 10 monthly

- give personal power-up cashback like another micro-savings service. Don’t cash-out till you have adequate to obtain what it requires!

- earning your financial savings goals an item practical, like a lift towards disaster investment or your retirement reductions, and strive to lay aside around $1 morning. When you finally joining this purpose in Koho, cash-out the objective and channel the money to your proper history.

Overall Koho is that one of the finest create iphone app and fintech development ever. It’s right now a staple finance application for mine currency procedures approaches. We do hope you enjoyed this Koho inspection and just like the application as much as I cause!

*This Koho overview isn’t a backed send but contains affiliate connections. I simply see a compact payment when you enroll using this Koho suggestion policy, MONEYAFTERGRAD.

Great!

KOHO possesses expending trailing, reductions desired goals, and cash-back aio! Whether you have to predominate portion using or merely preserve beneficial a record of where every bucks has gone, this could be for every person. The shared balance offer lets you share costs with a romantic person or flatmate, and you could connect your current KOHO accounts to Wealthsimple to get started with obtaining the stock market.

REGISTER AVAILABLE and acquire about $60 in free hard cash! Merely join mode BRIDGET20 if obtain the application.

One’ll get $20 conveniently transferred when you download & make use of your KOHO scorecard the first time, subsequently yet another $40 must arrange point security from your very own paycheque towards charge card.

-

MAG’s popular opinion10