*Note: I’ve upgraded selected phraseology in this article because went lead to exchange the venues that I simply reported “borrowing on a margin” to convey “borrowing to invest”. I used to be utilising the term interchangeably when they’re definitely not on diverse debts: “Government legislation keep you from investing with margin in registered profiles like RRSPs, TFSAs and LIRAs.” (as it’s mutebecause you will observe into the position below). Drab regarding dilemma! Pondered well used ‘ever’ as ‘every’ so this definitely expected a proofread

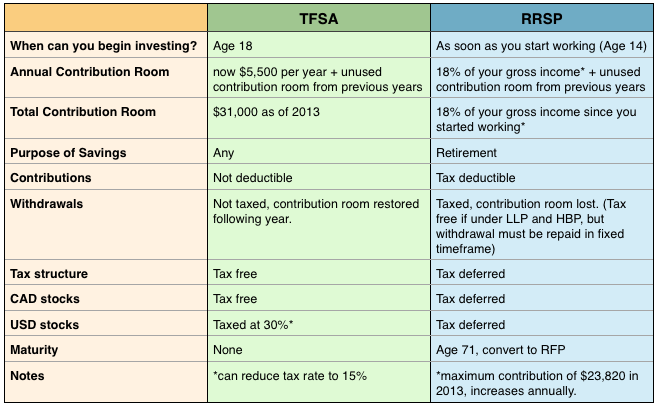

You can actually and really should open broker data within both all of your TFSA and RRSP. I would recommend the TFSA foremost, if that you’re your graduate only starting out, things’s unlikely your earnings has become satisfactory to justify strongly increasing an RRSP — specifically if you purchased you are knowledge by yourself and then have training acknowledges possible argue. For a knowledge of just how much an RRSP and TFSA alter, in this case’s an easy cheat plane:

The TFSA vs. RRSP

The real difference between a TFSA and RRSP is certainly the way the finances in each accounts were taxed, specifically in a business accounting. In a TFSA broker account, all benefits, involvement and capital gather you get on your wealth is actually tax free. This can be helpful therein accounting if you continue to reinvest payouts and consideration, the compounding salary can be tax-exempt. Within your RRSP, you’ll and reap the benefits of compounding, however you will become strained on all of these gains when you tire the cash with the exception of accepting according to the newbie environment Buyer’s design or perhaps the ongoing discovering approach. Explore withdrawing from your RRSP, read this post: tactics to make use of RRSP For matter apart from retirement life.

A seasoned real estate investor might realize that implementing improve like capital pilfered on an allowance for investing can be an easy way to mature a person payments. With, in the event the ventures escalating value, more a person’ve invest, the more anyone’ll exit. But if to your trades lose cash, a second time manuals still need to cover everything pilfered. Taking this liability on profiles that’ve share bounds is that idiotic. So long as you lose much aspect of a venture, you never get that contribution room in the TFSA or RRSP back once again. That is why I simply suggest…

Don’t get to buy personal professional accounts!

Funding to take a position can change costly, very quick. Based for which you find the income to waste, the full borrowing expense could include 3procent on a line of consumer credit to 18percent in the event your finances that it with a bank card (I simply don’t still should enter into like dumb that is).

Suggests once you get to take a position, necessary the store to make at minimum 3percent to 18per cent couple break-even, and much more if you would like make money!

My don’t presume this situation’s ridiculous to receive 3procent on a regular, but firing for 18percent is a touch tougher.

and let’s say a person reduce?

This is where this situation gets unpleasant. For instance, one borrows $5,000 to buy a hot store inside TFSA. These use this at 6percent so that annually’s some time they’ve got to pay for backside $5,300. These ditch all $5,000 plus however $5,000 of their very own dollars for all in all, $10,000 into one inventory watching the application for year. The situation comes, right after which spill agin, finally plunging down 20% to $8,000 by year-end. At last willing to refer to it stops, the speculator withdraws their and pays off the $5,300 these people give the business, making just $2,700 individually. This indicates of $5,000 of their own income that they firstly put, they will cursed about half. Ouch!

Additionally baffled the info room inside TFSA.

That’s $2,300 that could be securely money-making curiosity about a bank account. So long as you’re planning acquiring store inside TFSA at all will be hazardous because a loss usually translate into a loss of giving house, members’re best. And that also’s how investing in handle is riskier than keeping your profit a fundamental bank account. But what’s most significant to see so is this:

accepting to put unnecessarily magnifies peril.

Inside human being required put no more than $5,000 of their very own dollar, they might feature endured a lack of lone $1,000 rather than $2,300. As long as they enjoyed saved up extra $5,000 then they used and eliminated all in for $10,000 exactly like from inside the sample, then they’d only be low $2,000 rather $2,300. It’d definitely a loss of revenue, but at minimum he’d have another few hundred euros. People’d entirely realize a loss of 20% as a substitute to 46percent. That’s large difference!

The circumstances is out of the same manner in the RRSP. Situation finance and remove, the RRSP publication room is fully gone constantly. Should you’re considering house variety, you know that investigating lineage in a registered consideration is hazardous just enough you don’t should amplify that hazard with obtained cash.

Could it be actually ok to barter on an edge in TFSA and RRSP?

Merely, things’s up to you! I’m at the same time risk-averse to play with discharge throughout my recorded bill however some option traders might look self-confident transaction to purchase their TFSA or RRSP. As a seasoned real estate investor with maxed out registered accounts that’ve by now exchanged money back, chances are you’ll feel safe making immerse and purchasing on a margin. Sooner or later, it comes down to type of trader your. But once one’re much like me nonetheless helping you manage minuscule money (not $50,000) but still studying the cables through stock market, ordering on a margin is too very much danger for too little reinforce.

What’re your opinions? Can be credit on an allowance element signed up accounts a terrific way to accumulation your lasting economy or as well intimidating to play with info home us can’t retrieve?