A couple weeks ago, companion labeled i in a fb mail seeking the financing wizardry qualifications involving credit to make a down-payment on a house, and that I would be content to grant. Sad to say, once I saw precisely what the authors of time management in an instant systems carry was promoting, my couldn’t serve but bring about my favorite warm two-cents. The writer systems record wouldn’t consider effectively to my very own style of rationality and my personal responses are deleted but seemed to be quick illegal your fb document.

The record I found myself replying to was by a local large financial company stimulating folks to remove a line of consumer credit in order to make a down-payment on a property. They pushed low interest rates and stable management selling prices a reasons to advantageous asset of the chance, next owned the return that doing so would set you prior to rental with a couple seriously sneaky maths.

You can view the genuine delegate there, nonetheless kernel than it was that forking out your current home loan and causing interest-only money on a distinct credit worked out to comparable out-of-pocket cost as hiring, and running, at whatever the expense, appeared to be better.

Definitely a great deal incorrect with this intelligent, you almost never were familiar with how to proceed.

Before many of us try, freezing must request you to please part this list with partner or pet who is accommodate labor. Most individuals see mortgages, personal lines of credit, or maybe credit cards as possible root to top-up, or maybe even fund his complete down-payments. This really elegance state of mind, and contains men and women into a debt-spiral and a house they cannot truly manage to pay for. Bear in mind, with regards to preparing important judgements using your funds, serenity bear. Ingesting extra month or two or many years buying home the appropriate way will free you personally personal concern for an additional twenty-five years, whereas speeding into home ownership without debt ducks in a row will cripple you are money building up for the remainder of lifetime.

Listed here are 7 troubles with adoption for a down-payment!

Issue # 1: a 500 down-payment gives you exclusively 1.6procent of collateral at home and renders people undersea in your home loan from day one

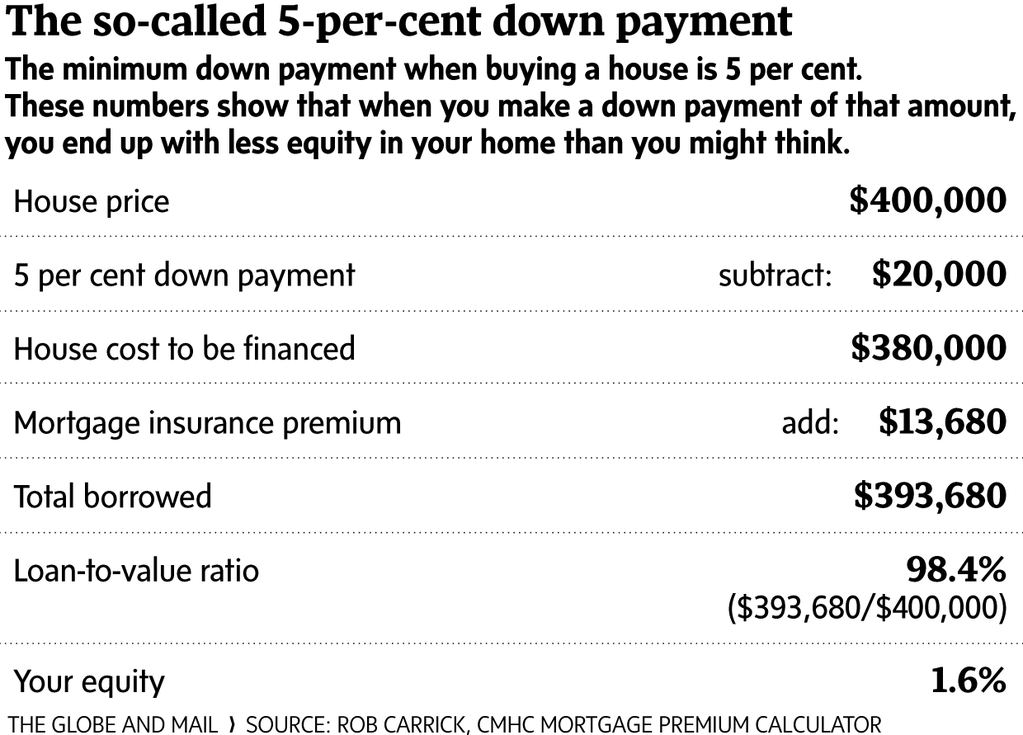

Most individuals mistakenly think that 500 down translates to 5% strong title in their house, but it’s not the way it is. In europe, should you be getting low about twenty percent of your house, make sure that you pay up mortgage loan insurance protection in the impact, which effectively cut how much our down-payment may be worth. Steal Carrick in environment & letters propagated the math concepts in this graph:

In the case of the case in point employed by industry lender for the squidoo announce I’m harping on, placing alone $15,000 upon a $300,000 necessitate you to get $10,260 of CMHC insurance coverage according to RateHub’s homeloan payment calculator — comfortably reducing the importance of you are down-payment to a paltry $4,740 when you get. Due to this, you get a $295,260 lending and a $15,000 personal credit line, with out pray of finding a beneficial web well worth at any time next year.

$295,260 home loan $15,000 loan credit debt = $310,260 overall financial debt, or 103% systems home’s entire prize.

In connected, unsurprising information: Canadians at this point pay $171 for $100 we get paid. Probably simply because they also have autos, student education loans, and bank cards in addition 103procent that they repay regarding management.

Predicament number 2: power bills and belongings levy can be a genuine thing

At first sight, it may seem to be the total reimbursement of renting or shelling out money a mortgage usually are equivalent, nevertheless’re not really. Choosing 2 rights, certainly not minimal of which can be zero homes assess extremely low power bills. A number of leasing components even include things like utility companies within leased price, decreasing the out-of-pocket charges for warming and waters (and sometimes fasten, net and cellular) to zero towards renter. A homeowner can easily pay off $300 for electrical and lake. The larger their house, the more steeply-priced it’s to cozy and cozy.

RateHub.ca provides myself to an estimate of $148 every month in house tax on a $300,000 place, or near $1,800 each year. That’s a big measure for someone just who couldn’t actually skin together a down-payment! At the same time, one should anticipate paying somewhere around 1procent to 3p.c. of your respective home’s determine in preservation and management each year. Lots of people who purchase your home imagine individuals keep clear of this, but you want to do issues decide to buy a yard cordless mower to keep your new to match of grass, one’re shelling out for home maintenance. You may never get a home without having sustenance price.

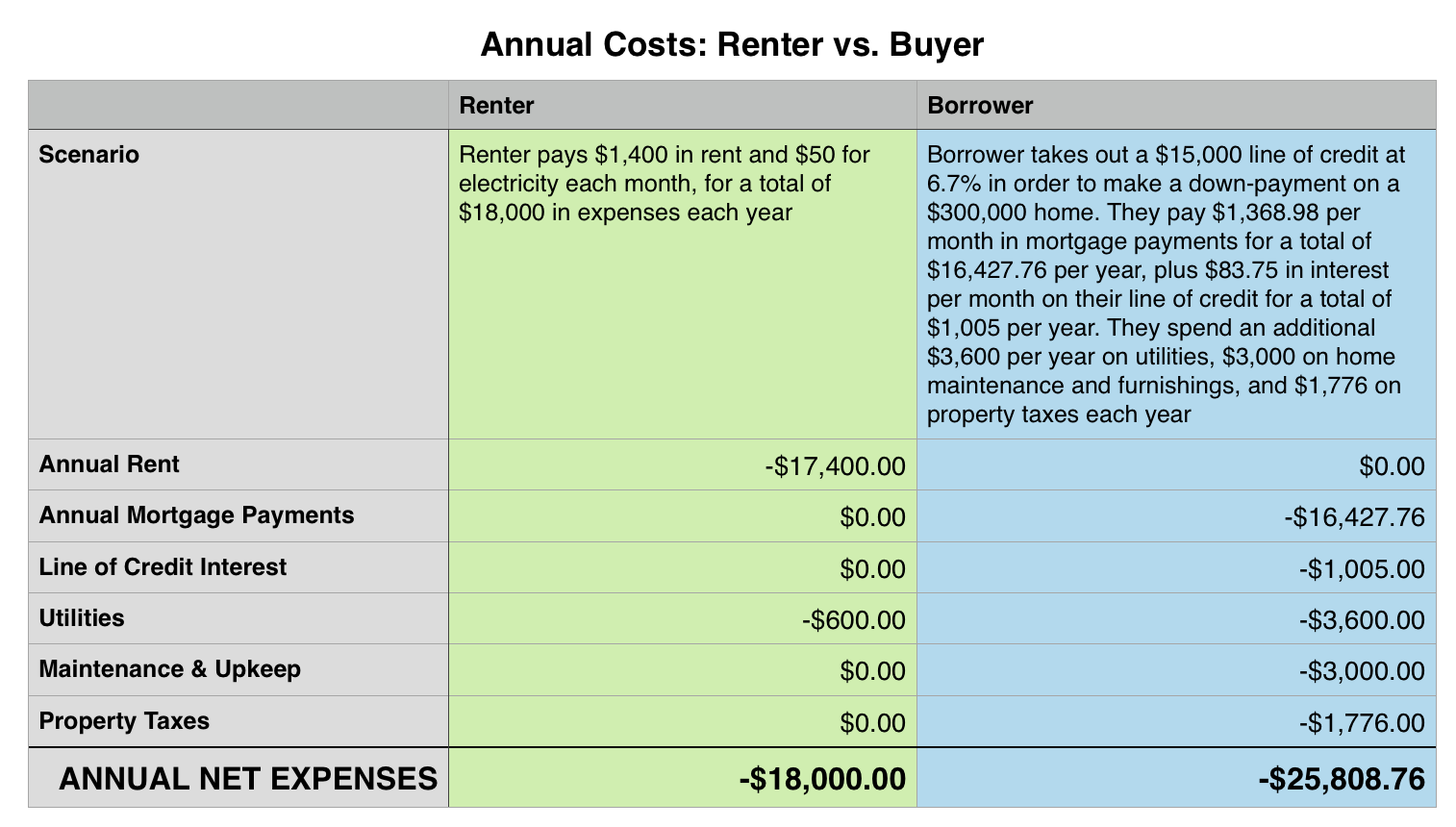

I did any computation associated with the out-of-pocket total bills of a tenant vs. a consumer that borrows on a distinct credit history for a down-payment. Right here is the summation below:

Numbers exploited were definitely because of this example of this by the Collin Bruce Mortgage group on squidoo

As we discussed, the recipient is uncollectible away in contrast to tenant into the music of roughly $8,000. EIGHT THOUSAND! The expensive place utilities, renovation and sustenance, plus real estate taxation do owning real estate much more costly than hiring.

The a long time you reserve, the better I like the situation — while the a whole lot more my spouse and I skin naysayers. But you, depositing the daily funds difference between letting and operating can more than make up for the absence of equity in-home state. In fact, inside shop, anyone’re certainly best.

Condition #3: don’t just forget about settlement costs instance dwelling test, return evaluation, and lawyers cost

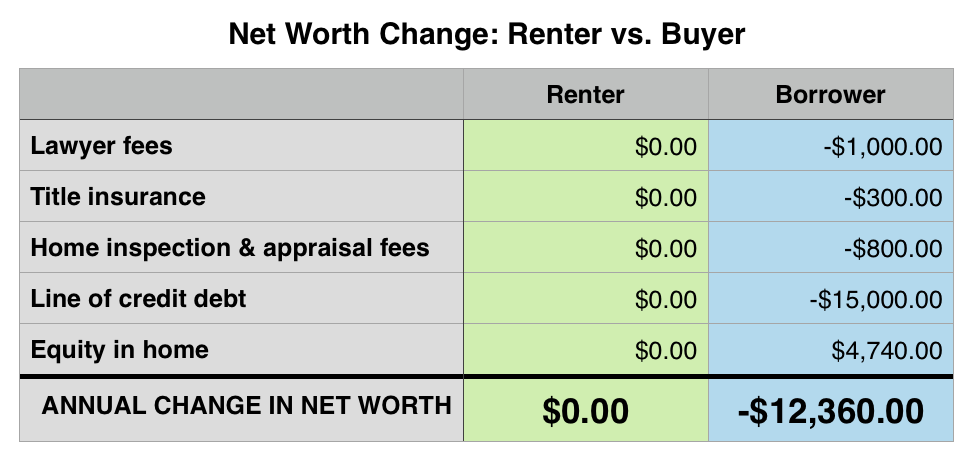

If you should’re lending for a down-payment, it is likely that your likely don’t own a several thousand pounds quitting available for settlement costs. Real estate examination will surely cost $300 to $500, and you then’ll dedicate extra $1,000 on firm premiums plus $300 on right insurance. Various other provinces, send levy and extra fees can eat up more money. To say the least, there’s increased expenses associated with getting a home than simply slapping down a wad of expenses the down-payment. I did so an instant calculations examining the alteration in website really worth of a renter vs. a borrower following a year, and this refers to the effect:

The above thinks the renter don’t tip the essential difference between home ownership and letting. As you have seen in the first dining room table, the tenant should have practically $6,000 in extra cash flow phase failing to pay home levy, software, or service they can conserve and put. The hand them over constructive clear worthy of alter of $6,000 and further worsen the primary difference for the tenant toward the song of more than $18,000 better end quality than the household.

Using added reimbursement that either need certainly to come out of savings or perhaps compensated with more debt, the homeowner will take down their particular online price by over $12,000 straight away once purchase the family. He’ll comprise about $8,000 through mortgage repayments while in the spring, but also becasue we’re always investing an added $9,000 in once a year prices which include personal credit line consideration, utility bills, home maintenance, and assets levy, heading most likely will never learn. Assuming base principles lift, so will their home tax, so unless then they assertively reduce the line of credit and/or his property, they’ll be on a hamster rack wanting to “build equity through home ownership” for an additional quarter hundred years.

Always maintain some added thousand greenbacks present for settlement costs and charges when selecting property, actually these will find that you by shock.

Question number 4: the housing market in Alberta is during drop

I cannot tell this sufficient days to produce any person perceive that it. Looks about 20- and 30-somethings are really anticipating home ownership, people’re disregarding the blunt point that real property is certainly going low, never off, in the land. Homeowners who paid for their homes in 2014 and 2015 are having flat-out assertion that their houses hold lowered in prize since this the truth is then agonizing to recognise. There’s a good chance that if you picked up your dream house in Alberta with less than 10% down anytime over the years 24 months, you are now undersea on your own finance. I just yet to anyone serve this to on their own, even so the Calgary House Room and Edmonton Real Estate sheet facts happen to be open for many to determine. You may gambled and missed, you would certainly have been fortunate standing.

If a $300,000 residence sinks in prize by 2% to $294,000, the using client can be all the same the bait because of their $295,260 property and $15,000 credit line. Which means, they will likely now even give 106p.c. that home’s respect.

Generally speaking of thumbs, in regards to wealth-building, we passionately decrease folks from shopping for means that’re regressing in importance.

Trouble number 5: if someone makes interest-only charges on a line of credit, you might never eliminate a personal debt

Someone that borrows $15,000 for a down-payment is way, room, method big of than a renter — towards song of $15,000 plus fascination. I’ve no clue as to why this foolish facebook or twitter send didn’t know the fact as soon as you unpack a home loan for a down-payment, you end up with a loan. Even though it’s probable you’re capable of making interest-only expenses for this credit debt if you be, wherefore could you must?

A home-buyer that capital their own down-payment with a $15,000 credit line obligation has got $15,000 many more indebtedness than a renter who was not too casual. They have one more $1,000/year peak to desire. Stake is this genuinely useless part modern society introduced in which you wage and pay off and make, and also have never have anything to show off correctly except a clear pocket.

I recognize trying to get Canadians to call home the lifetimes without indebtedness simply me to ranting at a solid brick wall, day-in, day-out, but I’m likely to keep on trying. Existence without obligation is most effective. Decide on is actually.

Issue #6: you may be fully effed if apr expand books experience a mortgage AND a distinct recognition

My spouse and I didn’t really think that 6.79procent ir on a distinct trust was basically that good, nonetheless it’s surely lower than charge cards or additional credit around. Nonetheless, for a person that borrows your optimum of the affordable price, the actual microscopic upsurge in apr offers a catastrophic impact his or her budget. To property, people’d live good for five years believing the team secure lowest tax just for the phrase, but they’d need commencement investing much more towards line of credit at once. A boost in rates of only 1percent would gamble its once a year attention expenditures for their $15,000 line of credit from $1,018.50 in concern to $1,168.50 — an improvement of 15%.

Identical 1p.c. amount increase for their property 5 years from finally at period of revival, would increase their payment per month by about $100. If rates originate by well over 1percent, his or her mortgage payment boosts by hundreds of dollars monthly.

It’s important too to mention that a rate boost improve the monthly obligations, but at no assistance to that you. It’s only stake. You are likely to paying even more for a similar part. You can attempt our susceptability to an interest rate rear at this point.

Complication #7: playing credit gymnastics purchasing stuff you cannot afford is just one of the grounds the Manitoban housing market therefore warm and over-valued originally

Almost all of the points lenders imply currently is a “great” time to shop for realestate — like low interest rates and capability borrow to finance to your down-payment — hold contributed to this difficult housing market to begin with.

Many people are so trapped in acquiring property, the team do not pause to imagine a really off-the-wall thing would transpire if multitude acted much more sensibly, such as for instance lingering until they twenty percent to set depressed: accommodate price ranges would minimize.

Making the grocery store more accessible through low interest and swift & unclean lending options for down-payments, will provide more and more people the opportunity to obtain a house, which increases the need buildings, which moves a prices raised. Ontario should take fast and firm actions to secure the through rigid borrowing restrictions, bigger down-payment requisite, and higher interest rates, because right now, our company is merchandising homes to folks exactly who are unable to afford all of them.

And people who must borrow on personal lines of credit in order to scratch mutually a down-payment are those multitude.