Likely the identify about this send happy you personallybecause charge cards are sometimes villified inside the personal economics people. However, if that you’re debt free and you could make do credit without spending beyond your means, a bank card contains even more extras than downsides.

People two main plastic: gold bullion dweller state cards, which expenditures $150 a year, and no-fee MBNA cash-back benefits card.

I often tried to truly have the Platinum land state cards, but downgraded to fantastic cards after I went back to school. I truly, in truth lack excellent platinum tease as well as the airport seating areas and your free hire car advancements and my own gifts notes to Coach… cry. Possibly the following year i could tumble in return.

Anytime you can, I simply charge all transactions to my favorite usa reveal amber paper.

At sites that do not settle for European show, I spend with my Mastercard.

We’ve a 3rd no-fee, no-useful-rewards sanction cardboard that I’ve acquired since I have was basically 18 we don’t employ however continue installed in a cabinet because You consistently get back and to fruition about cancelling is actually. Similarly, there are the tall track record (almost 11 period of time!) but on the other half, them by no means becomes utilized and could be the application’s credit history doesn’t thing. I simply remains away from combining getting to inactive to call off combined with a feeling of crisis readiness that, if my own pocket have been acquire stolen for a second time, we manage to find money while expecting renewal credit history and charge poster in the future in.

Exactly How The Bank Card Improves Everybody Funding

1. This credit card argument details excellent outlay, on to every penny. As far as I like cash, yet I’ve found that it wearisome to write down the place this almost penny flows. My personal visa or mastercard affirmation is a great enter of that your cash adjusted. (know: them’s feasible for personal credit to feature blunders and wrong prices, which is why that it’s crucial that you charge that against your reception. Because my spouse and I control excellent transaction yourself in factoring program I use — dollars 4 by Jumsoft — I simply examine my own card document online 1-2 meter a week to make sure it harmonizes with personal records)

2. All our frequent living expenses happen to be supercharged to this credit card, lowering the quantity deadlines i must recollect from a half-dozen just to one. You don’t discover or attention once my favorite credit, Netflix, or cellular monthly dues change — they are all on auto-pilot recharged to our charge card and I also realise the moment the bank card circular can come right!

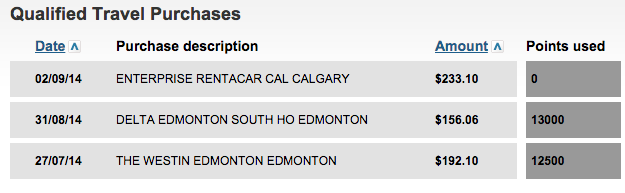

3. We score the benefits information like hell! generating hard work to place all my own spending on solid, Our waste over $1,000 over at my charge cards launched. To the usa Express this will likely read to 1,000 Amex specifics, and the same in principle as $10 (a-1per cent go back). Undoubtedly soon I’ve used Amex points to acquire over $250 of lodging stay once I stopped town to attend wedding events. I like the way in which Amex let’s you select amount specifics you want to cover the past few fly acquisitions:

*Note: flush imagined the dweller carry has become “my” tease, I prefer what for synovial taking with my husband, such as these motel is. Both marriages we will joined was for relatives of my own, thus I felt like because I simply pulled the man right to Edmonton for my children happenings, minimal We possibly could create would be relax the of your motel decree. It’s merely another way we all communicate dollars after our very own join chequing and mutual financial savings bill.

The motive my very own charge card works well for me to as a create software is because of our by no means run an equilibrium.

I get installments against excellent debit card equilibrium 2-3 instances every month. I have to — it offers use panic whatever time You find it crawl over $700! I’ve eventually built that magical subjective financial sixth understand whereby i only sense any time a proportion is becoming too high and I just pay this downward. This is the best process because my do not ever settle concern on any kind of my favorite expenses.

Should you have an equilibrium in your plastic, DON’T USE THE SCORECARD MERELY TO acquire INCENTIVES. The incentives don’t negate people give in attraction, this means you’re all the same operating puzzled. Place the menu by, crush indebtedness, when anyone’re down to zero stall one calendar month, and you then start taking menu once again.

A credit card bills induce dealing with my budget better, but I am certain that it’s instead of for every individual. Other people induce excellent gains card or additional plastic card that assists these budget?