Practical part-time placed w with so many unforeseen minute of choice, that whenever I had been not using my time off to suffice yoga stretches or beverage on winter patios, used to do precisely what any good younger PF author should do: research fund.

I made the choice i wished to learn about the share and study nearly anything i really could happen. By the end of my own bust, don’t just required I devoured numerous instruction books and inspected unlimited sites and web sites about making an investment, our took to the instinctive send making beautifully complete spreadsheets of P/E ideals and EPS for 5 years for almost 30 agencies. I do think this looks extra-beautiful in my opinion because I simply didn’t know the thing these terms had been before, and now I look Yahoo! Pay with appreciative knowledge. I’ve happened to be checking out the stock market long. I want to getting in from the contest, but 1) My didn’t know how and 2) I didn’t have the funds to make it happen. I simply has gone ahead and reviewed both those problems together:

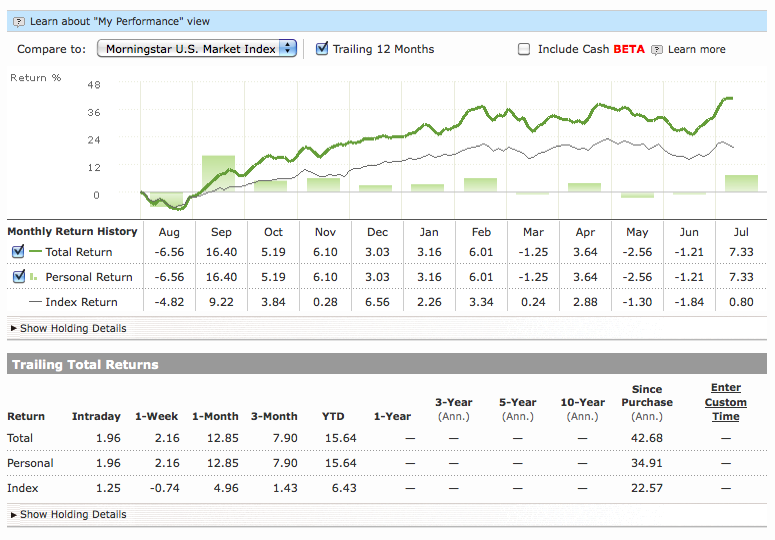

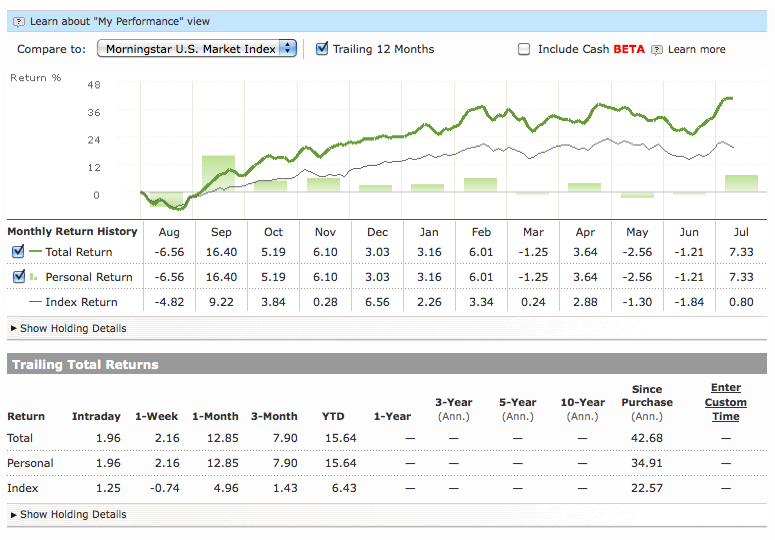

Foremost, our developed a free account on Morningstar.com just the previous year. We founded a mock profile, pretending to get inventory many firms. I simply select 7 different styles, ranging from businesses I suched as and realized, to info I’d never heard of proposed by store tech reviewers. Our fake-invested in Victoria’s hidden, fruit, and some substance technology companies Our don’t certainly much remember fondly the title of. I then see and await. For a complete period of time. It’s this that occurred:

To be ok with the regular selections? Yes. Brilliant I’m a little bit of pissed I didn’t invest a real income! My don’t believe my actual profile really approaching all sorts of things near this, spill 2010 had been just now actually good-time to get as. Nevertheless, our always mastered some effective courses and acquired working experience, though i used to be simply enjoying make believe. Potentially most people desirous to put money into store aren’t wanting to generate and screen a mock angebot for 12 months, but at least take for 6 as well as 3 before starting applying real cash in. I’m really contented i did so this because it has been really a “test drive” before committing my personal dollar.

Additionally, while i used to be observing and awaiting this mock cash flow and risks, you started savings. We helped in my favorite TFSA and mutual funds every month, whenever it actually was aching (i.e.. season 2010 as soon as I had been helping an impressive $1400/mo as a study college, and compensating 90p.c. of that to necessary charges and unsecured debt). Nonetheless, yearly later on pondered some liquid money in the TFSA.

You showed this report with Questrade. Achievements! Pondered a brokerage consideration! Not sure if those retains, but right before my spouse and I turn for Allemagne, I simply achieved with a representative from TD Ontario rely about creating a brokerage accounting together. Whilst the person would be remarkably handy, i used to be horrified by ones own expenses. $30/trade? Not even in my situation, thanks a lot. At Questrade is usually $5-$10 per industry, sufficient reason for modest leistungsspektrum like the I’m beginning with, maintaining the expense very low is really important making sure that they don’t take up my returns. Moreover, you popped a TFSA currency trading explanation, so my personal yield go un-taxed.

In the first place, personally i think very realistic about special financing finally. I’m in order delighted to include handle to our fund catalog. A lot more web log articles into the future one time I have the idea about this…