Various followers were inquisitive about where I’m controlling my incomebecause so much has evolved since I went from indebted undergrad to finance-savvy (even?) almost-MBA.

An easy summarize of a investing records

I bought your firstly communal money in ’09 and founded making contributions $50 on a monthly basis plus any extra income I’d. Diligent spending and market recovery guaranteed this investment funds progressed at a quick clipping. I’m completely uninformed of just how right my personal obtains happen to be because I’d no form of address. Inside opinion, committing ended up being allowed to be the simplest way to grow funds, in order this brief good budget seemed to be trying exactly what it had been likely to practice. (i might after riches this apart after line to create a $5,000 payment over at my college student financial debt, cutting out my federal government debt quite.)

Fast forward to 2011 and that I picked up your first widespread capital. Having been undoubtedly blogs and site-building through this time and find over-confident about wealth. Throughout 2012 and 2013, we benefit big on dependable selections like General energy and AT&T. This collection matured and expectorate normal profits, that I reinvested in more broth. Towards the end of 2013, the now that $20,000-in-debt-girl was basically now even $20,000-stock-portfolio-girl. Cover a turn-around! I wish to argue transacting savvy for those excellent portfolio progress, but it really appeared to be about slow & stable benefits, market place recuperation, reinvestment of returns, along with random lucky inject e.g., the amount of time i purchased provides Netflix under $220 and distributed at $350). My spouse and I even now keep my main sound broth, however complimentary 50 % of 2013, My spouse and I began pointing wealth outside of widespread lineage and into ETFs.

Will you match a case and its own functionality? low!

The gains of our selection vary roughly if holdings had been obtained as exactly what it got that bought. It’s a mixed chemical of personal leadership and market place performance — its for these reasons buying store is actually hazardous.

But that mayn’t intend anyone can’t form a solid, money-making stock portfolio of your.

When I founded wasting with Questrade, ETFs weren’t on the market how they at the moment are — if not i will happen across these people. Questrade continues to the most popular brokerage to all my own making an investment, extremely with ETFs.

At Questrade, getting ETFs just costs a number of money, that is a far cry from the $5 and even $30 dealing payments that array commonly determine. By maintaining my investment cost very low, my own cash is in a position to work harder for me and my personal prosperity may get without having to be kept in reply by top buying fees.

What exactly is an ETF?

“an ETF will be a great investment money that secures an accumulation of money, like store or bonds. This trades like a stock on a stock transfer.” – The Money Post

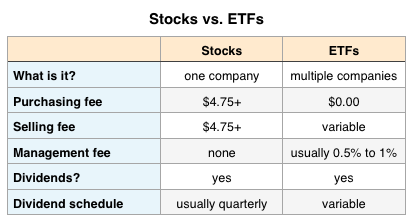

Fast review of handle vs. ETFs:

Reviewing that family table, two of our ideal things about ETFs can be 1) no expenses buying through Questrade and 2) finding a regular monthly dividend. A combination top a few things is one area magnificent: since get dividend rewards from ETFs and breed, you can easily reinvest it well in to the ETF, even when you can only just manage to purchase one product during a period. Generally, we don’t always use stocks unless i’ve at the very least $1,000, but in the case people $20 lie around with my brokerage accounts, I’m purchase another model in an ETF!

How to get started acquiring ETFs

Firstly, you will need to exposed a brokerage report. This can be accomplished through any heavy reserve or through a business like Questrade. May by and large necessitate $1,000 to $5,000 to open the accounts. Situation don’t feature $1,000 lie around, start keeping. Putt to the side a couple of hundred bill monthly brings time and energy to research the ETFs you’re pondering, which brings us to the other aim.

Strategy to pick an ETF

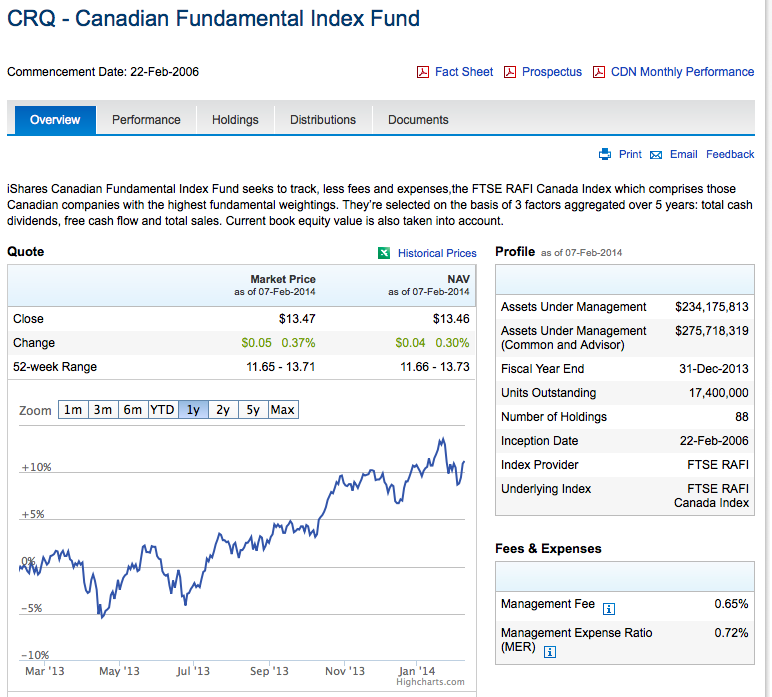

The most effective way to select your ETFs typically evaluate them on the web on a web site like iShares. We’ll watch something such as this:

this actually is truly a suggestion to get! I merely specified the best ETF regarding tilt!

This gives you the important overview of the account: if it was going to be begin, just how much her recently been carrying out, the worth of the belongings will be under leadership, buy holdings (thats may businesses and companies through the money), in addition to the cost. Understand with ETFs the relief fees are created in to the money — you won’t induce a bill for them or nearly anything! That is a fantastic review of the ETF, but the information is in the prospectus, you an receive as a PDF by for the maximum ideal monopoly indeed there.

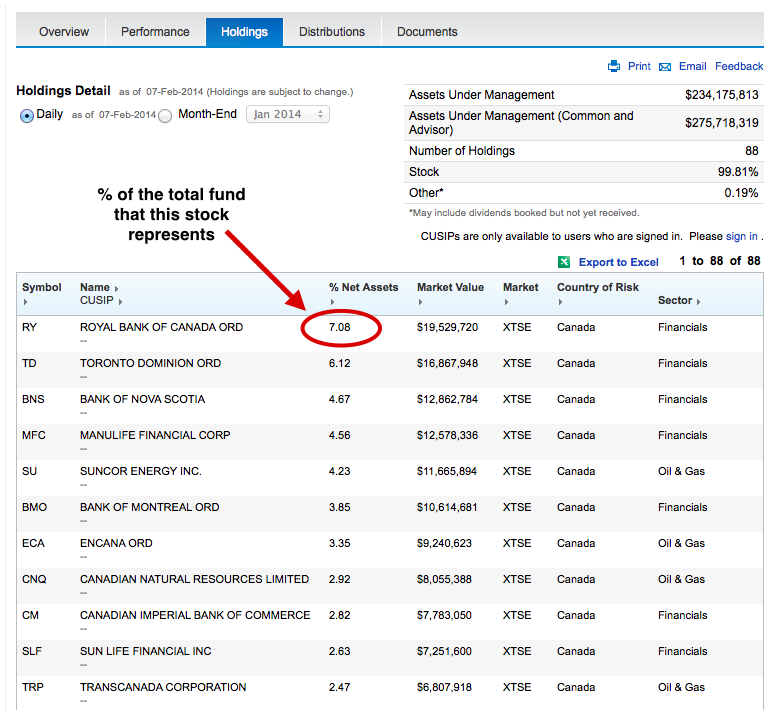

The next action you have to check is Holdings. This is exactly what repute take place during the fund and the way greatly each store comprises systems overall investment importance.

You are able to see roughly 7percent associated with the investment comprises of imperial reserve of Ontario standard

As we discussed, the ETF has numerous holdings — here, from completely different markets. It is one other reason ETFs are extremely big: create that mix up personal investing without you personally being forced to do distinctive lineage.

Glance at the holdings to find out if the ETF features employers and markets you ought to select. Observe that ETFs usually are “exchange industry income” meaning people’re sold to the capture — this suggests the amount of the grasping might and really does vary.

Collecting profits from an ETF

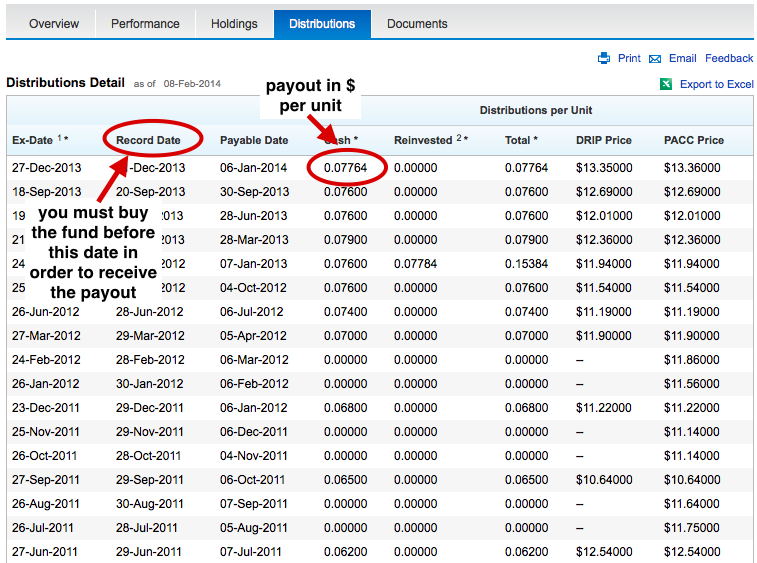

Situation push Distributions, you’ll receive an archive of dividend results the finance that appears such as this:

observe that this account spends aside quarterly, but there are plenty of that fork out month-to-month. Others pay out per year or semi-annually.

There’s some lingo inside article that you need to learn about:

- The Ex-date could go out after which, so long as you persuade a ETF having, you certainly will yet receive the pay out for your thirty days.

- The read evening will be the go out in which you should find the funding if you wish to get the payout for it that four weeks.

- The due date certainly is the trip you can expect to acquire our number payment.

- The SPLASH final price could be the number Re-Investment process costs – the price to purchase one watch inevitably with all the profits appearing paid for your needs. That way, option obtain wealth, may acquire more stocks for the ETF (this really organize during your brokerage and you’ll pick out the amount of you ought to SPLASH).

- The PACC price tag could be the Pre-Authorized income info amount – similar to the DRIBBLE costs, it is the run to purchase one whole mechanically, but this applies cash in your report instead payouts they spent you may.

Examine the dates to frequently the money will pay exterior. Countless ETFs will be regular, but others can be quarterly, semi-annually, or per year.

To assess the payment you will be given:

# stocks you own times dollars transaction introduced = profits

The pay out change on the basis of the holdings inside ETF. Some ETFs is often more steady than others and constantly yield identical, rest might can vary. One of the benefits?

You are able to support ETFs in tax-friendly data like RRSPs and TFSAs.

ETFs are the best way acquire lots of exposure to a variety of livestock, even when you have only a small amount find. Likewise, obtaining a payment the investing you’ll constantly reinvest great approach to build capital.

To read more about purchase ETFs, ron Carrick do an excellent television series on the topic regarding environment & email.