A reader recently mentioned:

What might own big payback, adding $5,000 each year into a bank account or deploying it towards your loan?

It’s a smart problem, plus one We haven’t view greatly approximately because I simply don’t get a mortgage, but I found myself in a business mood this weekend therefore I chose to work it.

Assumptions:

- You get a $500,000 location (regular cost in Canada) with ten percent down

- You have got a $5,000 unwanted useful to either submit economy or make to your finance

- Personal checking account evolves tax free (TFSA)

- You earn a standard rate of transport of 500 your money as you invest in shares but aren’t that great in internet marketing

- You personally fasten home financing interest of 2.39percent to very first five years of lending and 2.99% for all the 5 years next

- Home increases at 3% per year, but that is unimportant manuals’re a property owner in total three problems

- One don’t repair home or affect

- You won’t ever make withdrawals inside TFSA

All of that mentioned, there are certainly several unbeknownst specifics over two-and-a-half decades very these formulas were for activities use just instead of to be taken as skilled personal suggestions. Regular my spouse and I stop hoping assume mortgage prices at spring 10 and lazily leftover things at 2.99procent.

Though, let’s enjoy.

Product: It’s safer to lower your expenses than to do second installments against your current lending

First you didn’t many essentially accept this, and so I maintained engaging in the data over and over repeatedly, lest you finish visibly destroyed on the web for this horrendous cost (that will probably materialize either way). But it doesn’t matter how many different ways used to do this situation, saving however came out ahead of paying off your lending:

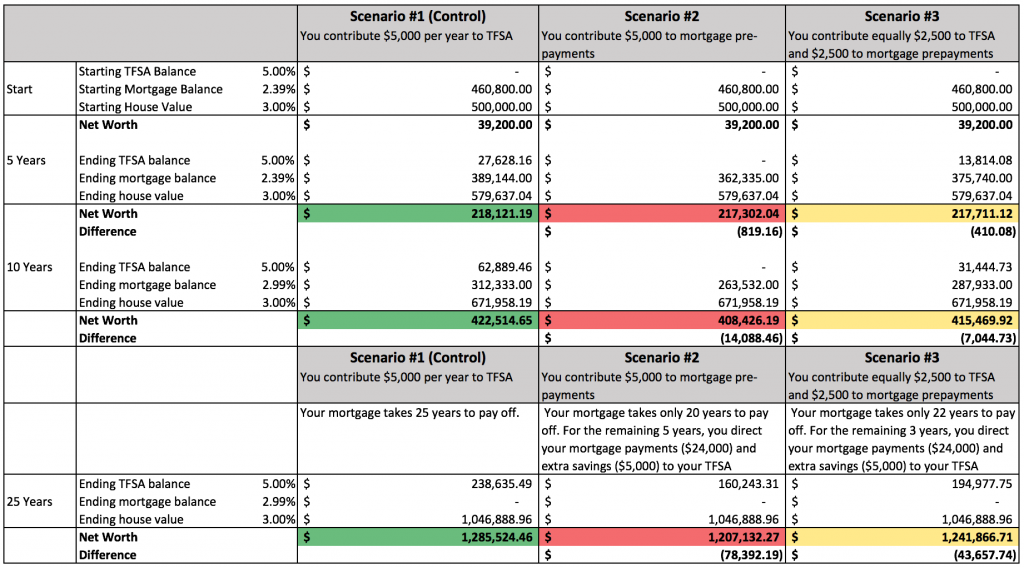

Comparison of utilizing surplus $5,000 to rescue, special charges in the direction of the financial, or share between both. Tick to enlarge.

I often tried RateHub and home loan Cleverness for all the property computing, and your spread sheet can be acquired for obtain correctly the following since you may want drink which includes for the size oneself.

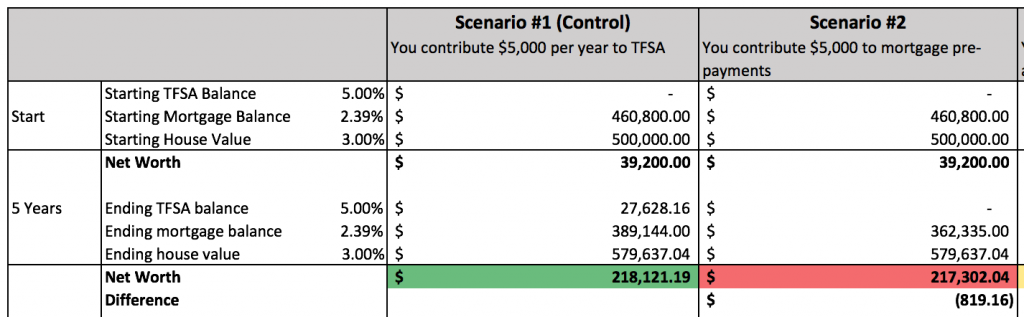

It creates minimal difference the way you function $5,000 in the 1st 5 years of owning a home

As you have seen via postpone, the difference between applying $5,000 element family savings compared to on the mortgage for your beginning five years of home ownership will be an impressive $800. Us’re still beforehand with preservation, but scarcely therefore.

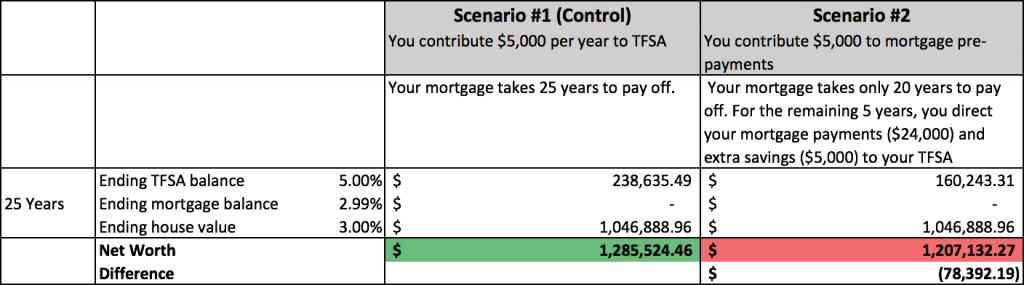

After 25 years, anyone exactly who chosen to place $5,000 other into a his or her TFSA besides towards a home loan, escape $80,000 euros richer in comparison to individual thought it worthy to set the bucks towards their loan only to turned out to be debt-free five years a lot quicker:

Even though the competitive mortgage rétribuer chosen to reroute their particular home loan repayments and additional currency to a tax free family savings going back five years, individuals couldn’t get up to date within the purchaser that has recently been attentively putt a smaller amount out for just two ages.

So if you had any incentive to help save, that would be this situation. But why are the final results well impressive?

Income will be material and builds earnings

Money in the lender (as well as the share) delivers two the main incentives that early mortgage repayments don’t: liquid and profits phase.

Liquidity is the biggest benefit to funding reductions over a paid-off dwelling. You could tire $1,000 from a family savings or betray a standard to cover an unforeseen investment decision, you can’t bring a number of house windows off house to pay payments. Despite the fact that two total quality numbers used to be exactly the same, I’d experience a predicament with a savings bill and a few consumer debt over zero-savings and zero-debt. You intend to can decide with your dollar, specialists no more than accomplish that if you decide to have payments at your disposal for.

That is where all people will chime because you’ll protected a property money line of credit should you goal reducing personal home loan. This will certainly supply you with the capacity to spend money similar to cash truly does. But unlike money, a HELOC is located at mortgage loan that works against your own total value rather than sell, and while you might get back the flexibleness of preservation, you won’t keep minute most beneficial section of wealth ventures: profit.

Profit releases salary by means of stake, benefits, or working capital benefits. Still at 1p.c., monetize the lender is kinds online valuable than home loan pre-payments due to the fact bucks earn a compounding motion and finance pre-payments won’t. Giving our home loan early will take you debt free sooner and save you involvement, but even when you yield your property 5 years prior to timetable, this situation’s too little a chance to get up to date toward the person who’s been making her funds grow for 20 years. This holds true even when the lending curiosity exceeds what you might gain within your family savings, if in case you want to know wherefore, try this base: reasons why You may Shouldn’t Haste To Repay Your Own Lending.

You’ve happen to be instructed this before, but it really’s accurate: account curiosity in fact is probably compelling push in market.

As a general rule of browse, I’m often more interested in revenue than credit card debt, and passive income has become preferred action of most. Making an investment money provide you with an appealing passive income supply, reducing a home loan won’t.

Nevertheless, maybe or maybe not on what us worth

Absolute and total debt-freedom will be an objective most people should have, just how rapidly find truth be told there depends on simply how much this situation concerns for your requirements. You may and ought to consider whatever is certainly important outloud when considering reach debt targets and styling your lifestyle, so this has cost savings and owning a home.

However, don’t pay extra individual finance and conserve the cash in place of.