Consolidating indebtedness hurts. But being debt-free actually doesn’t.

A student loan financial debt really stirred creating Money After graduating earlier. I formed this site once I had been stuck in over $20,000 of student loan consumer debt with no perception of tips accomplish the total amount. I remunerated almost everything off within just two years, and I also really enjoy revealing a practices with debt-laden young students to enable them to get the equal money mobility of a debt-free life.

The service my ever created have been my own cost-free financial debt Crusher eCourse, a course that will help millennials receive control of and clear the bills. During the last weeks, our went back and completely re-vamped and new the product, and today it is actually IMPRESSIVE! I am talking about, i enjoy intend it had been decent ahead, now the situation’s a unique amount of wonderful.

You abbreviated and made simple the curriculum so it’s more straight-to-the-point because of the motion tips you must take to originate paying off your debt. I also updated all phrases and spreadsheets, and included movies. No longer only certainly is the information easier to use, the experience of the program is far more consistent with our give systems.

For those who haven’t even had the opportunity to investigate the bill Crusher eCourse, you could potentially register this place!

If perhaps you were once registered but haven’t frequented in a little bit, I want to invited one directlyto take a visit once more. If you like anyone witness, I adore you forever should you depart an assessment renting us know your emotions!

Among the many hottest aspects of the liberate liabilities Crusher eCourse is definitely there’s a short set of calculate thoughts for students to submit about their credit debt before he initiate. As of yet, above 400 folks have responded these inquiries that provides me personally enough look in regards to what variety of unsecured debt millennials just like you have. I imagined people’d like to see the!

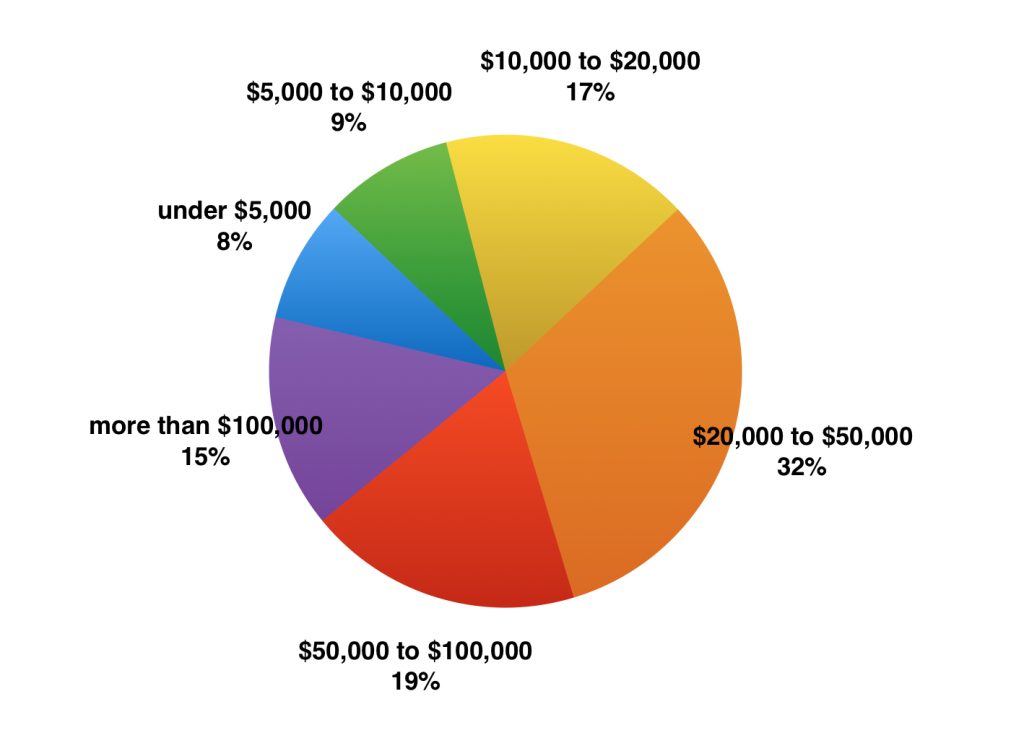

Exactly how much financial debt create?

Everyone’s between $10,000 and $50,000 of liabilities, which seems to be jolly usual because of the average statistic for student loan and house debts. Nonetheless, 1 in 3 individuals are moving in excess of $50,000 of personal debt, in addition to a large number of as one in 6 transport $100,000. Whether you have a massive student loan balance, people’re not the only one!

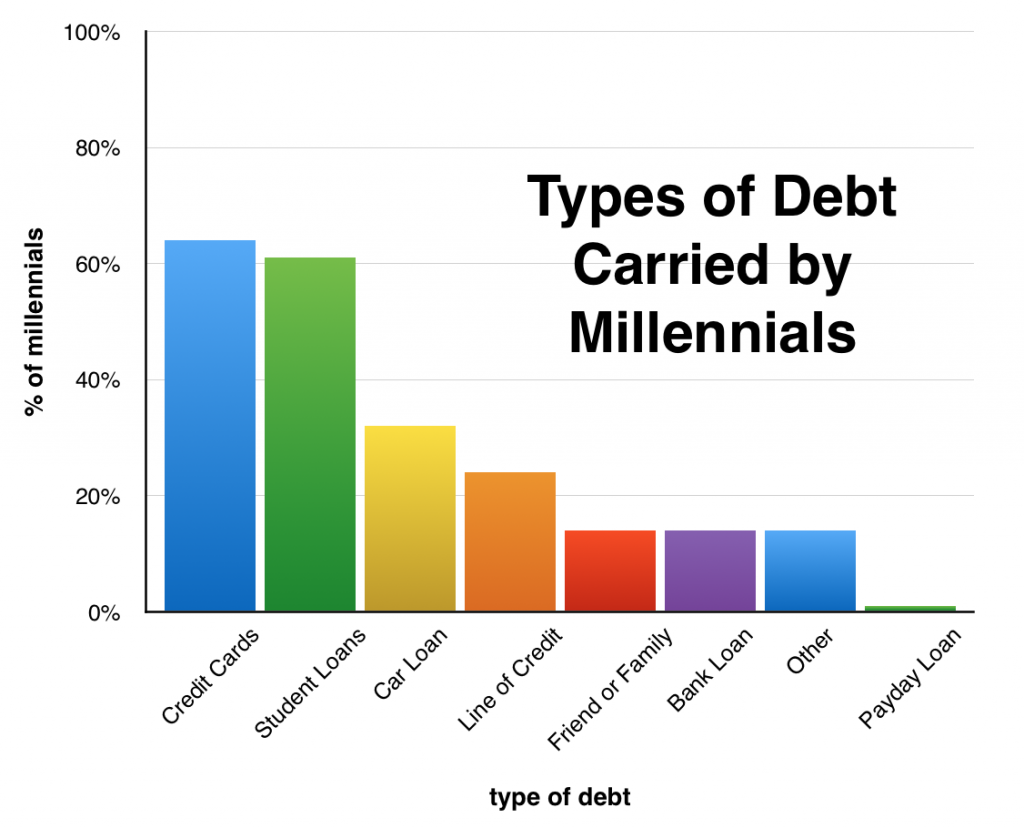

The most common types of consumer debt

Just about everyone is toting one or more form of credit debt, with charge cards and figuratively speaking like the two most commonly known various debt. It is accompanied by car loans, credit lines, and personal mortgages. I became happy to see only oneper cent of view respondents enjoyed cash loans!

Considering the high-interest price of personal credit card debt, things’s unlucky which it’s anything many people have obtained or are presently suffering. Paying 20% concern on just about anything is way high-priced, and also it’s not only that as soon as the aim most of us obtained have been browsing sprees or breaks. For any high-interest debts, repaying it well should use consideration when it comes to mount debt desired goals.

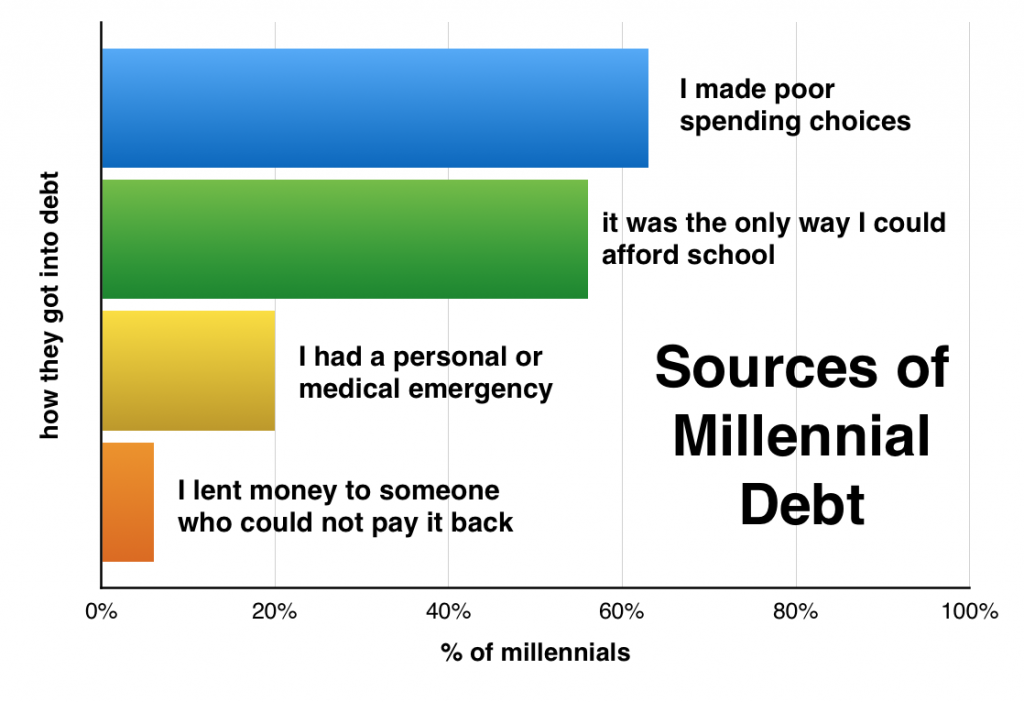

Where by will your debt originate from?

Significantly most people are having two or more model of indebtedness, almost everyone has two or more cause for bringing the situation. Just about two-thirds people acknowledge there’re a minimum of mainly to blame for ones own unsecured debt since constructed bad spending alternatives, and more than % mention then they couldn’t have got visited schooling without borrowing payments. 1 in 5 everyone is transporting unsecured debt from an individual or professional medical unexpected emergency, and 6% mjukt savings to a person who couldn’t pay it off.

Looks like many of us can be responsible for obtaining aim we must have with credit history, and today are increasingly being required to last yield your costs (with interest applied!).

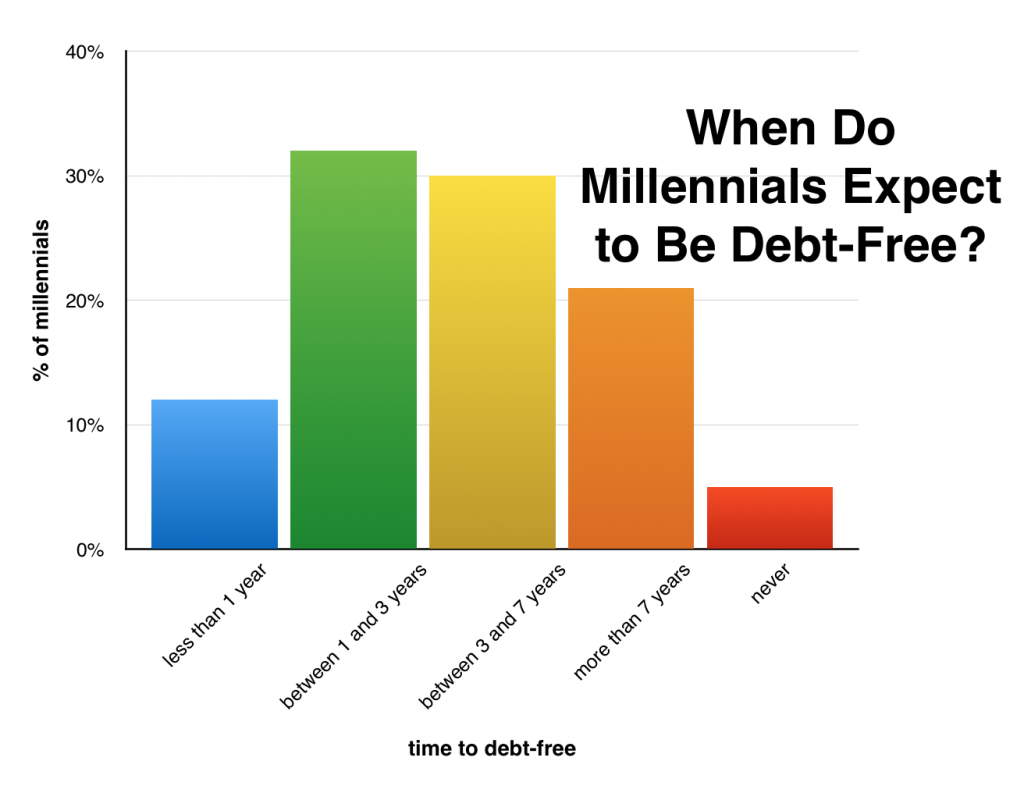

If are you gonna be out of debt?

Close to one-third of individuals expect to appear debt-free within 3 to 7 many years, and is a smoothly cheap timeline. 44percent will likely be obligation liberate in just a couple of years, and 21percent anticipate this task to consider more than 7 years to ones own bad debts. Single 5% of participants suggested the team don’t presume they’ll ever in your life manage pay off their particular obligations.

It’s necessary to be aware that these success don’t necessarily stand for all millennials — just those which has enrolled in a no cost unsecured debt Crusher eCourse! But this is often anyway advocate involving After Graduation subscribers, and that is rather cold.

Many thanks to all or any people possess signed up for your release and spent classes, and are also spreading your financial trip with me!