One of the greatest complications encountering millennials at this time is definitely taking pleasure in any illusion of a cushty way of living while underemployed (or unemployed) and stuck with student loan obligation.

For those garbage Boomers conditions phase that personal young people, millennials act really have this more complicated than a moms and dads managed to do. Just about everything is more pricey, however the a few things that’ve become the costliest remain the measuring sticks of prosperity: post-secondary teaching and owning a home.

For a number of, home ownership looksn’t much on the scanner since’re wanting have the funds for leasing in an unrealistic locale.

How much money if you are paying for house?

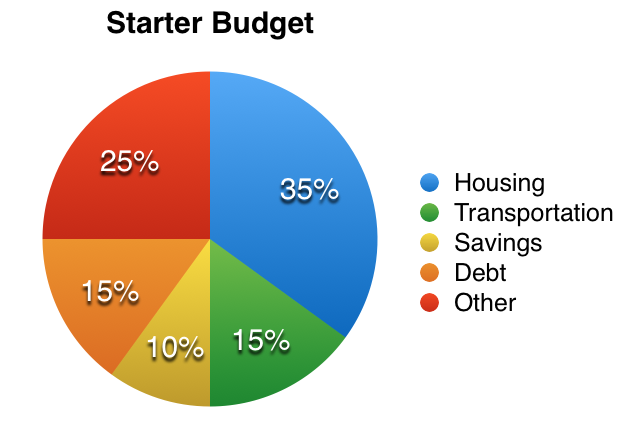

An over-all guideline normally waste about 35procent of one’s net gain on every home cost. This consists of rent/mortgage plus tools, coverage, fix & upkeep, home owners expenses, an such like. You will find this from a suggested (benefits essential) spending plan release that looks along these lines:

For those located in costly cities like Toronto, Vancouver, san francisco bay area, New York, or many, 35procent of the net gain may not even binding personal standard rental, not to say your own some other shelter bills. If you reside in an unaffordable destination, genuinely permissible and necessary to spend more than 35procent of the net income to help keep a roof over the head.

In the event you forget about automobile use, you’ll well hold spending up to half of your respective net income on lodging fees.

Due to the fact as we discussed from my favorite indicated finances over, 15% of the net gain is a good suggestion to invest on shipping. If however you can easily eliminate or greatly lower your transportation expenditures by choosing to stay near job and party all night atmosphere, then you can be ok with allocating these discounts to enhanced house cost.

Focus on cutting your large price: accomodation

In case your pleased locate is the kernel of a tangible marketplace, i’m a person. I’ve at all times cherished to call home smack-dab in the centre of an urban area, in particular within a 3 collection r of a grocery stock, my favorite restaurant, and might work. I’m favorable I’ve seldom referred to town or Toronto family commonly this will use bigger personal gymnastics and inspiration to accomplish. However, I have lived-in various inferior appealing places simply to remain on budget but still inhabit the communities I’ve preferred. Roommates, walk-ups, existing properties, balconies that gone through maneuver batch, no balconies in any respect, closet-sized spaces, and screeching water system water lines have previously been a section of the “sacrifices” I’ve produced to lively where by I want to and within resources.

The trick to residing the city you need (as well as the local you prefer) has become picking out the most affordable option where placement. There are a few different methods to attempt:

- Share space by getting roommate(s)

- Be happy with smaller expanse, like a bachelor or a dojo

- Go for an adult producing

- Discontinue “must-haves” like a dish washer or ensuite clothes

- Appearance 10 to 25 a few minutes outside each of our correct local (that’s not wrong open passage drive or Uber tease)

For picking out the environment you have always wanted, every now and then you must choose between whether that makes up that “home” you dream about, so when this indicates the life-style or town you have always wanted. One can’t forever pay for both.

Be worthwhile the debt to take back to your disposable income

There are the apartments rentals I experienced as a debt-laden scholar, there are contain condominiums there was normally. I’ll reveal: this situation’s choice more straightforward to survive in which you desire with’s one peak you need to pay. Every $100 you personally’re paying for education loans is that $100 which might be likely to a swankier dwelling — so when considering accomodation, $100 says a long way.

Many individuals recognize student loan costs as a required evil, even so they don’t are. You are able to (and really should) pay off your debt eventually, if for far from another good reason that it removes the premiums through spending plan. The main difference of becoming debts cost-free in a couple of years as a substitute to 10 is over just saving cash on curiosity bills, things’s as well with regards to the business cost of possessing ability inside your calculate 7 ages far sooner.

In case the debts will be stopping you from proceeding from capability dwell for which you must, why not pay it off.

Or at a minimum wage part of it well. Minimizing your unsecured debt and/or one or two student education loans can indicate the simple difference between residing in ones mom’s basement and absolute in the city. Start to see the debt as a pretty tangible mechanism keeping us from the home you desire — because it is. Reduce it and dwell whenever you will want.

Generate profits with a surface hustle

Hands down the easiest way to afford nearly anything spare within funds are to dedicate a particular income supply cover the application. Chances are that it probably would consider as few as $200 or $300 more monthly to be able to be able to be the spot where you may want, so now this grows into an issue of exactly where will you line up this extra cash to be charged for a exaggerated book.

Single half-day type at a coffee shop would quickly add an additional $50 every week. Now practical question becomes:

Are you willing to cause lattes for 4 hour on Monday afternoons so that our flat?

If the response is number, members don’t essentially need be indeed there.

For all the passion for the almighty, MOVE

This can be an undesirable view, nonetheless it’s worthwhile considering. I am certain noone that stays in Toronto area desires to impart Toronto, however if surviving in an unmanageable locale has become cleanup your finances and decreasing your personal future budgetary safety measures, zero about in the kernel associated with the planet is really worth this task.

You’ll retirement life economy beyond be approximately your favorite coffeeshop.

Be personal debt zero-cost more than make sure you call the zipcode place.

Can help you your task elsewhere.

Regina, Saskatchewan is reallyn’t that lousy.

Simple fact systems make a difference is also, it will don’t writing exactly how impressive the ambiance in Toronto/Vancouver/New York/San Francisco is actually if we can’t afford to get involved in the application. Quite often simple fact associated with topic looks, you probably can’t be able to inside an unaffordable location, and you also’d much better off departing.

Conscious this situation’s blasphemy to say this, many multitude in no way come round to plan, you could hold very lovely liveliness including rewarding study, excitement club, and well establishments outside the large and most steeply-priced towns in united states. Indeed, you personally’ll perhaps determine support where cheap relieve you against stress and anxiety that was getting a serious plate on savor life in big-city.

And let’s picture for a second exactly what your lifestyle is like if you are capable pay out simply 35p.c. of your respective profits on lodging, and clear that excess quarter-hour for travel. Cool, appropriate?