The first abstraction I did after your boy was developed ended up being take up rescuing to be with her post-secondary understanding. Prepare my very own baby’s student account ended up being one of the better aspects our was aware of to provide the woman with future economic certainty. Alot more perfectly, long-run financial privacy we never really had.

Precisely why I’m economy in my toddler’s student account

I am not saying certain that our baby will observe a post-secondary instruction. Everybody is evolving promptly, which’s impractical to anticipate what’s going to be the best work two decades from today, to make guesses as to what understanding and abilities those positions want. I really do see that gradually the significance of a post-secondary learning can be shrinking. But’s moreover true that individuals with higher educations typically get better revenue.

Regarding both a Bachelors academic degree and an MBA. Beat, we accomplished 7 numerous years of post-secondary (there’s 50 % of a Master of art in therealso, which happens to be how I were left with a strange figure). I simply were raised in a low-income every day, but my very own training includes allowed me to demand advanced incomes and ultimately remove myself personally off poverty. It’s transformation certifications We’ve that i’m can pull in the money I do. Getting skilled both economic lack and economic abundance, I am able to inform you easily that living with money is simpler. Similarly, really funds you really have, the easier property realize. Realize them’s defective configuration to talk in this manner during the personal money neighborhood, but i do think the individuals who think “money can’t decide to buy happiness” haven’t happen to be bad. Money buys guarantee, comfort and ease, option, and others statement make you happy.

One of the largest money battles in my everyday life was ever getting excellent teaching. This folks did not have wealth preserved, thus I paid the charges of your post-secondary absolutely with my very own pouch. Furthermore, I didn’t keep extravagance of support at your home through my personal diplomas either, which intended My spouse and I controlled all excellent cost of living too. Our won’t tally up the sum of in this since makes myself cry. Chances are i’d constitute $200,000 thicker if I had not essential spend college tuition and retain a roof over our chief during dojo.

Just how much will the girl college education costs?

To be able to reserve my very own minor the personal struggles I endured during 20s, it really is my own purpose to be charged for over $100,000 on her behalf post-secondary training, should this girl like to continue this task. It’s accomplishable the woman studies cost many more. Naturally, training & extra fees have got 18 a lot more days to increase before this lady starts up university.

In europe, post-secondary companies happen to be government-subsidized. Exactly why these individuals significantly less expensive than institutes of the identical competence in america. You realized the student diploma at a school that position through the peak five in Ontario, without paid greater than $5,000 every year in fee and rates. Think of joining an Ivy League for the worth! In the event payments multiple as soon as excellent son goes to faculty, him/her college tuition shall be $15,000/year or $60,000 for a 4-year amount.

With your assumptions, $100,000 is sufficient to pay money for an undergrad point in full. This’ll verify this woman doesnt increase any debilitating student loan unsecured debt or ache persistent pecuniary hardship caused by him/her coaching.

What’s the Certified Coaching Savings Plan?

The qualified certification Savings Plan or RESP is yet another awe-inspiring tax-advantaged financial savings auto offered to Canadians, much like the Tax-Free family savings (TFSA) or qualified retirement life nest egg (RRSP). The RESP is made to support and recommend mother and father to conserve for child’s post-secondary knowledge. You can read a little more about the RESP of the govt of Canada’s product in this article.

Rescuing for your child’s post-secondary coaching within the RESP is the sole method in order to receive any relative allows over govt. The quebec instruction Savings give (CESG) is perfectly up to $7,200 and europe investigating link (CLB) is really as much as $2,025. That’s over $9,000 in release dollar! They are both settled directly into an RESP, which means you desire a merchant account to be able to see them all! I-go into point as to what allows includes my favorite post, sole elder costs.

The way in which I’m saving $100,000 throughout my undertaking’s school investment

Our propose to gather atleast $80,000 throughout my princess’s certified schooling Savings Plan (RESP). The RESP offers a very long time share control of $50,000, indicating I’m expecting a baby allows and investment funds rewards to provide yet another $30,000. It will be possible the case will succeed sufficient to get my extensive $100,000 dream, employing circumstance itn’t, i am going to write the remainder of the hard cash someplace else or shell out of take as our girl attends school.

A Modern Baby’s University Or College Account Savings Plan:

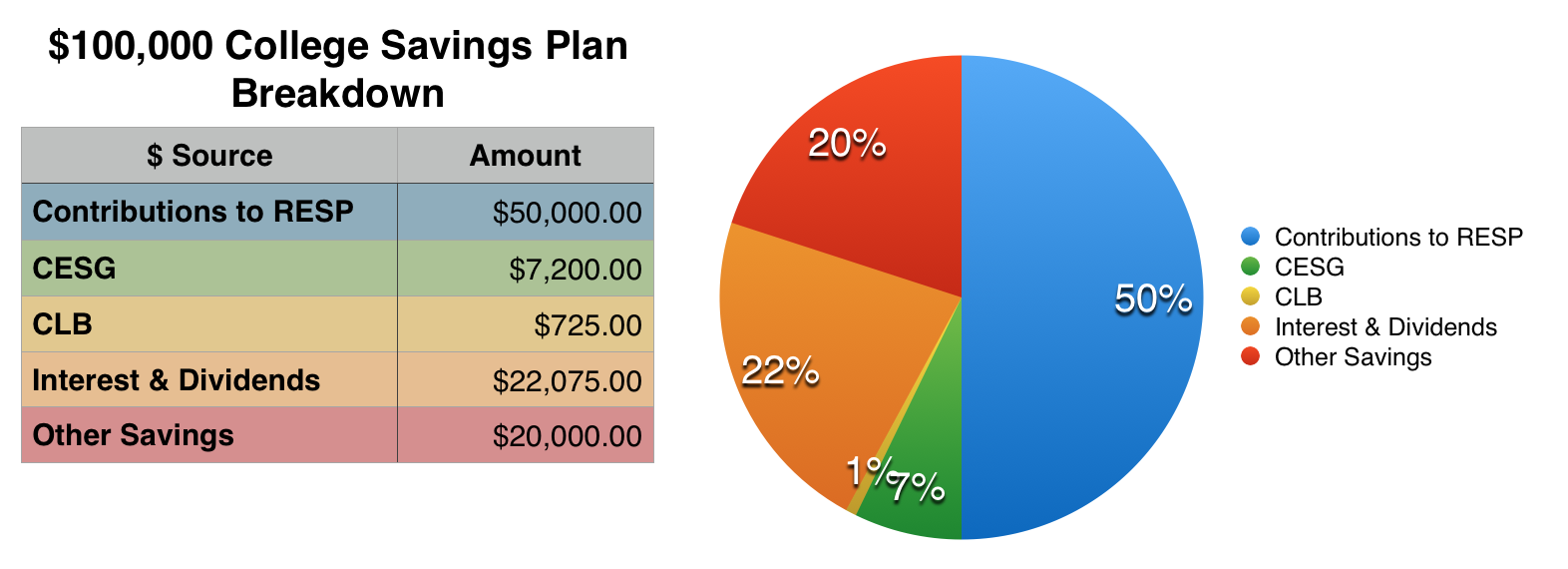

$50,000 in direct efforts to RESP $7,200 quebec certification Savings give (CESG) $725 Canada knowing relationship (CLB) $22,075 in awareness, off & investment capital gather $20,000 other discounts outside RESP = $100,000

The failure for your specific little one might look more other based on just what permits we secure and the way your own funds complete. I simply knowledgeable for all the CLB 2010 the daughter was developed while the seasons after, but won’t more, and that’s why Our only acquired $725 of a feasible $2,025.

Applying the faculty nest egg into work

Being yield an RESP, need a child’s elite insurance plans host. This will likely bring 2-3 weeks in order to get, specially when you’ve an infant on fingers. When you acquire your current child’s hell, you can easily open up an RESP. This could easily too take quite a long time to establish than a savings account. My very own newly born baby was born in May, but this lady RESP wasn’t running until October!

CONNECTED LIST: CDIC First Deposit Safeguards For Your Own Offspring’s RESP

You popped a qualified certification Savings Plan (RESP) with Questrade with a basic put of $1,000. Questrade can be an online discount rate business which allows you to oversee your individual buy selection. Meaning you’ll have to settle on and market the securities you wish to buy oneself. This really an amazing decision should you’re a qualified dealer and comfortable managing your own profile. If you require better buying, you have to pick out better hands-off choice method, like Wealthsimple to suit your child’s RESP. It is quite essential that you commit instead salvage in child’s RESP. Dealing brings an improved fall your revenue, consequently additional money to suit your child’s understanding.

TIED IN RECORD: Self-Directed Paying vs. Robo-Advisor

You at first establish a regular bank of $200/mo to excellent little’s college and university investment. You have to give about $2,500 a year to an RESP to receive the highest possible CESG. I got $2,400 on auto-pilot, therefore I discarded in an added $100 after cascade over the $2,500 the season.

It had been challenging to reduce maternity make. But one time my spouse and I alleviated into workplace and a salary increased, I could to improve excellent efforts. But there certainly is a little bit of a handling routine the place where you want to bring adequate to get your max CESG, without adding exceedingly you’ll smack the $50,000 info cap before you try! You intend to front-load personal child’s RESP fairly, but truly drag out at minimum $200/mo additions for 14.5 days to obtain the utmost federal offer cash.

As your RESP selection started initially to earn dividends, I reinvested them into a lot more dividend-generating trades. Them didn’t take very long the function to begin with providing over $100/year in money. This consistently maximize daily. Heading only be a couple of years prior to the second income make will outpace excellent funds there! By the point she’s in junior high school, I will strike the $50,000 bestowal limitation. Afterward, the list will grow by your profit it generates entirely.

Protecting to suit your undertaking so you!

Conserving for something will take discipline and schedule, and your the baby’s college finance is no exception to this rule. It’s crucial that you just remember that , every bit number. Even though you could only manage to remove $25 each month, things’s nonetheless better than $0. Also even modify gratis offer currency!

If unconditionally she or he is not fed their RESP for class, you can easily fail the RESP and channel payment (minus the scholarships) your particular professional termination nest egg (RRSP). Subsequently the RESP is one of the accessories for Canadians that can help tackle and give protection to their loved ones’s plethora.

Me trying to do everything I’m able to for your daughter. This really among the many practices possible facilitate my girlfriend in the foreseeable future. You can’t wait discover the thing that girl prefers achieve and be!