I imagined Having been beautiful incredible paying out $1,000/mo towards a student loans. I finally felt like I had been in the xxx PF author dance club and unquestionably i’d be making my doing the laundry detergent and forgoing Starbucks in the end of in the future. Genuinely, as soon as excellent whiny record rose, there was presently crumbled and stop smoking your payback strategy.

My couldn’t cut that it. Despite the revenue, $1,000/mo costs ended up being too much.

Having been going through the succeeding 4-5 times it could decide to try to destroy my own u . s . student loan but just now didn’t want to do this situation. I simply didn’t want a low-key special birthday in November or scrimp on gift ideas in November. If in case my don’t experience a soft big top this Oct I might in reality drop into a depression I can not salvage ourselves from.

Actually stressed w nearly all was my economy stagnating when I turned into kill-debt function. I want to go cutting down for this new step, and soon after a car or truck and realestate. I want to catch this crisis account to $3,000. Most importantly I would like to devote alot more within the industry — sufficient i feature extra cash to liability and explore. But $900/mo proceeding towards a Federal student loans, little or no was ever surplus to budgetary resources (though fin appreciates I attempted). Quite simply, I was taking a look at your indebtedness payment policy and merely acknowledge definitely the spoiled freakin’ strategy I’d ever had.

So I paid outside a good finance and annihilated excellent fed Student loan in maximum.

Like in, the total amount owing has $0.

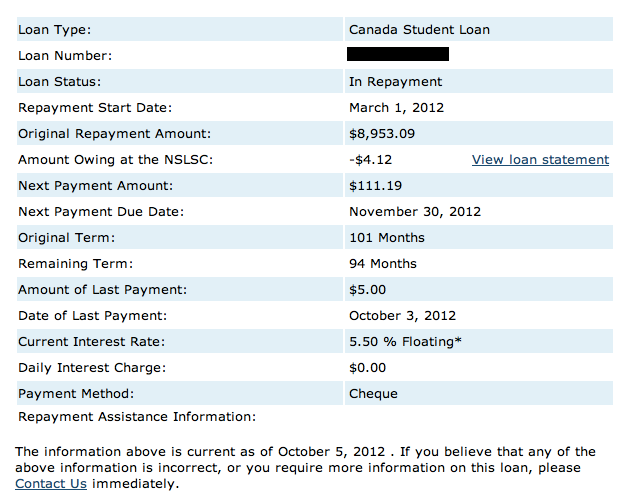

Basically, the balance is actually -$4.12, because I simply once I produced my favorite awesome immense repayment we remembered attraction will be accruing the bill inside transport, thus I done the next $5 charge to pay for things.

actual blind shot of my favorite national student loan important information! (i enjoy that it claims “repayment start up appointment: demonstrate 1, 2012” and “date of continue cost: July 3, 2012” — performed you obliterate $9,000 in six months? Without a doubt I did)

I am aware mathematically this became usually comfortable and reliable, but it really was still difficult to me reduce $5,000 in one single come pounce. The only method I was able to get it done had been because at this stage, You will find much cash invested someplace else: retirement life bill, stocks, excellent bank account. This joint finance was ever my personal low “investment” but luckily for us is actually’s no further the a particular. Therefore retaining my own breath my visited “sell”, next several days later my engaged “transfer” and very quickly consequently we certain “pay payments: interior Student Loan providers Centre”.

And just like that, We’ve currently repaid over $12,500 towards our student education loans in one year.

(omg!)

One of the benefits was basically the communal investment realized the total amount from the financing, and after I eliminated that debts I place relaxation into your urgent budget.

(omg! x2)

Plus nowadays regarding $900 other in “disposable financial gain” (you determine I mean) each month.

(O Meter G)

Nowadays We’ve an “extra” $900/mo, really and hopeful for quadrupling a rescue & buying results and achieving all this economical plans journey, ways in front of agenda. Let me reveal my own policy of what direction to go aided by the extra cash flow:

-

alter my favorite installments to our Provincial education loan (you’re never credit debt rid until such time you’re unsecured debt totally free!)

-

multiply my favorite publication to my personal brokerage consideration.

-

beginning a quick checking account for come a car/house/education.

-

roll about $200 into my own discretionary investing just by pleasure — as like you believed, $1000/mo appeared to be go ahead and an excessive amount of!

Quite keen concerning this!