The newest part of Manitoba fintech is definitely KOHO joint accounts, allowing than before to say fees and money ambitions with someone else. In case you have a roommate or a co-parent or other people you want to rip payments or keep for something with, KOHO would be the spanking new solution to sharing food revenue.

Please be aware truth subsequent is not at all a financed base, but I do catch $20 by using my favorite affiliate value MONEYAFTERGRAD to open a free account with KOHO and make the first purchase. However, in addition, you catch 1per cent bonus cashback for three months when using that coupon code! If you’d like to unsealed an account with KOHO but don’t want either folks to discover a free of charge wealth, plainly meeting koho.ca to sign-up!

Really KOHO?

KOHO is an innovative Canadian fintech institution that will let you monitor personal investing, lower your costs, and garner cash-back on the expenses. The application performs pretty much like a prepaid sanction cardboard that offers cashback. You will get all other simplicity of credit cards without any of this risks of commencing debts. However advances! The credit card is actually tied to a slick outlay trailing iphone app that also will let you determine nest egg desires, round-up your purchases, and speed up your money.

Always unconvinced? Check out excellent extensive KOHO Overview in this case!

He’ve been the most popular cost management software package for over twelve months, with helped me to help save literally thousands of euros towards the money desires while reigning in my investing. I am not a frugal man or woman and I hate to a outlay restrained in anyway. KOHO makes it easy personally to enjoy happening without started overboard. It is the main fintech aid that’s previously basically shifted my personal actions. This is exactly why my spouse and I can’t quit singing their own praises!

What exactly are KOHO hallux joint debts?

KOHO joints records enable you to arrive every one of the incentives and conveniences KOHO, except amplified by writing with someone else. Take advantage of the capability of a prepaid plastic card, make any paying, conserve for plans, and get paid cash-back.

The best part? We don’t have to use KOHO join history with a romantic mate. You can easily open a KOHO fit history with those you ought to partake overheads with: a roomy, a co-parent, someone! You-know-who you may write about monthly bills and objectives with, therefore you access make a decision the person you wanna write about a KOHO joint explanation with.

This can be most likely the most important and many distinct advantages associated with KOHO join explanation. For the majority of standard separate savings account, normally ought to be establish with an intimate person. However, chances are prone than not really that in the course of your lifetime you’ll live posting money with people a person’re instead of romantically using. KOHO causes so simple.

Of course, you’ll continue to use KOHO in your core press and so the fit bill is definitely a great strategy to ease husbands and wifes financial situation!

The way you use KOHO joint balances

To employ KOHO separate information, both persons prefer a KOHO paper. Any time you’re not yet part of KOHO, join up from my very own value MONEYAFTERGRAD you’ll become 1procent bonus offer cashback for 3 months enhanced your money in case you design your number 1 buy aided by the cards.

Must’re previously enrolled nevertheless man or woman you desire a KOHO fit consideration with is certainly not, you are able to let them have my favorite program code (thank you!) you can also deliver all of them to your affiliate codes and’ll acquire more bonus offer cash back once sign up!

After you’re both subscribed to KOHO, probably you only will have to add a separate balance during the software package and ask each other. After this you deposit the accounts, and yes it study much your individual KOHO bill except currently their common. Us’ll receive cashback, can raise a round-up for leverage, and develop propagated cost savings desires.

Anyone’ll manage to fasten between your physical KOHO report and the KOHO fit explanation exclusively inside app. While all combined account hobby will be visually noticeable to one another story container, your personal KOHO bill will remain non-public.

KOHO combined bill are the most useful method for embraced bill and discussed budgetary pursuits. Whether you shared expenditures to handle like foods and utility companies or else you’re saving up for holiday with each other, KOHO joint profiles take-all the clumsy between right out the equation. Imagine by no means being required to ask your friend if he or she compensated the electricity bill ever again, or irritate a significant other due to their use for the grocery store dollars. Addionally, envisage buying time period improvements the moment they suffice pay up a bill or learn food items! KOHO needs a person discussed.

How I specifically utilize KOHO

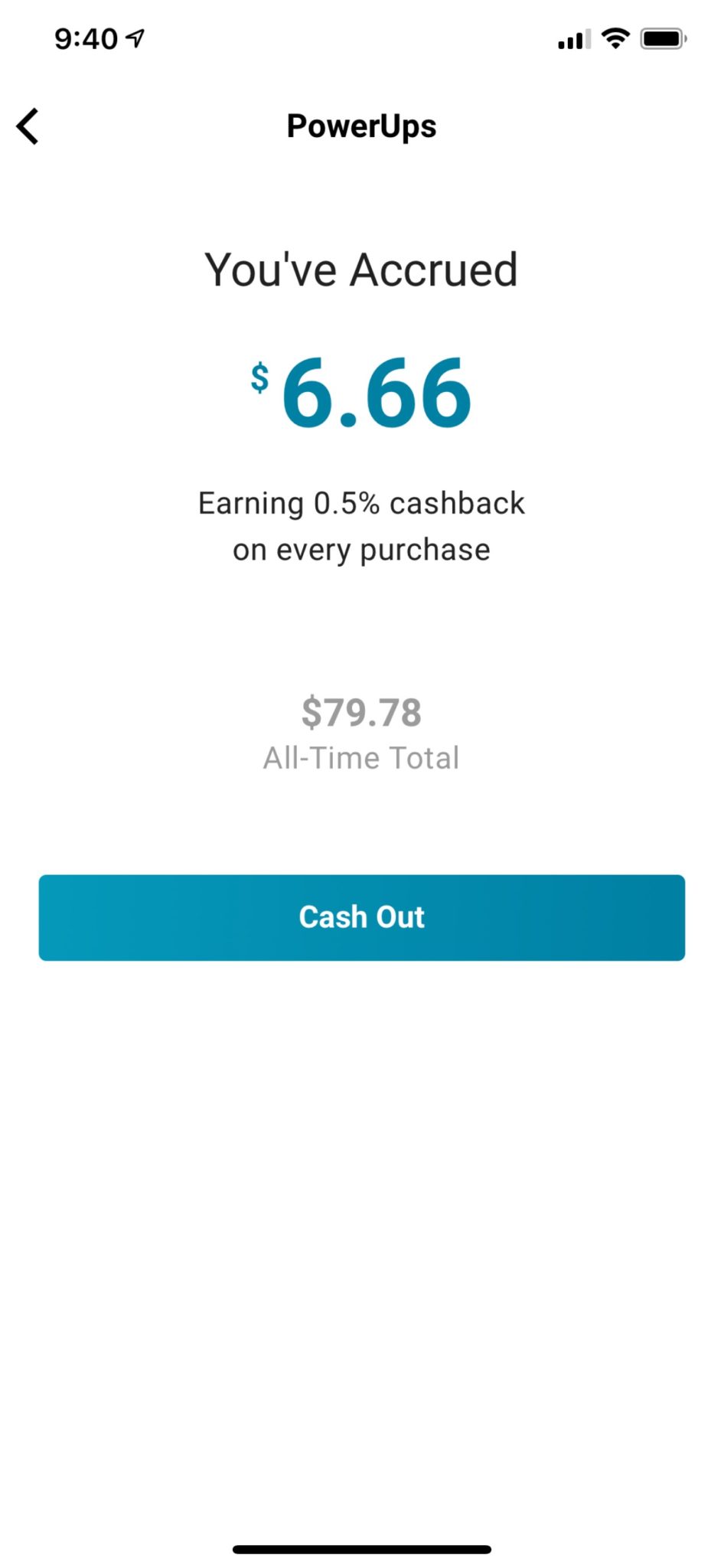

I’ve privately used KOHO for over a year, and I’m yet even as haunted as I had been on the beginning. In the past year, I’ve received $79.78 in cash-back, which means that I’ve wasted basically $16,000 applying our KOHO tease. If this looks like most, the situation’s because My connected my very own Starbucks see. Ha!

Precisely joking, I really practice KOHO for all of it i could apply KOHO for. This is why I buy store buys, air, newly born baby outfit, cover Netflix… just all. I simply set up my very own KOHO tease being laden with my own extra cash every payday, so aspect of your paycheque is also one on one collected correct on top of the cardboard. I favor this approach because I know exactly how much I have to commit on a monthly basis. Whenever my favorite KOHO poster looks cleaned out, I have to quit searching until then emergency occurs!

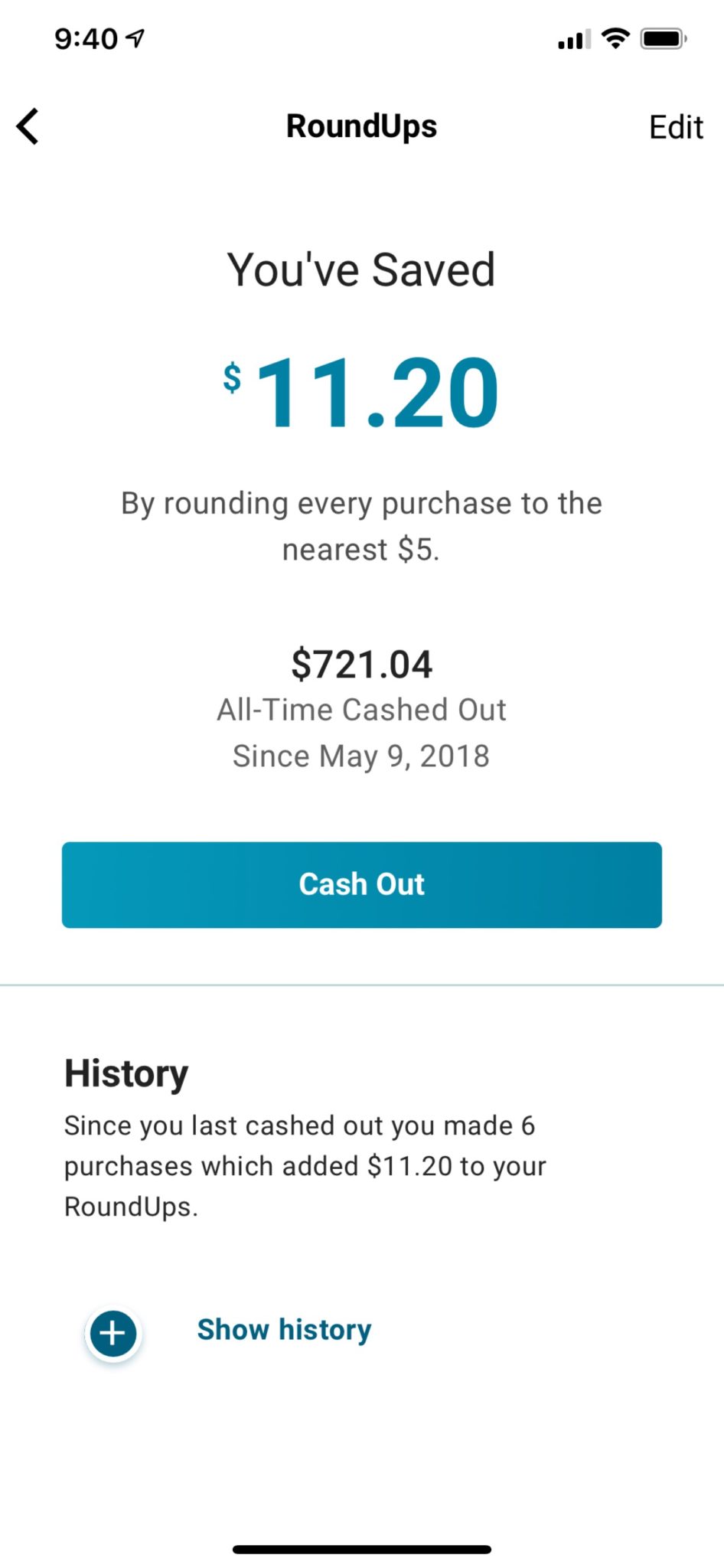

Our opt to round up every purchase into the dear $5, and this also provides let me spend less than another $700 ago one year. Really, as soon as a round-up entire outreaches $25, we transmit them to a savings objective. On a monthly basis, i usually feature two regular goals: a supplementary vehicle payment ($250) and somewhat advance to our TFSA discounts ($100). Because of round-ups, it’s my job to attain these goals choice prior to the period ceases.

Furthermore, I not too long ago interconnected my Wealthsimple story to KOHO. We install an automated change from our KOHO poster to excellent Wealthsimple history so we could restrain reducing and transacting for future years.

RELATED BASE: guidelines for KOHO and Wealthsimple to Spend, prevent, and place!

Automating this transfer to Wealthsimple mean it occurs without us being concerned regarding this, and furthermore, as my very own KOHO balance is staying buoyed up by round-ups and cash-back, it will make this weekly funding find completely smooth.

Final thoughts

Sharing food money with other people has become occasionally an easy mount. It doesn’t matter how free you may be about principles, border, and anticipation, one thing’s bound to go wrong. And since that’s anything as mentally priced as revenue, could lift freaky reactions of frustration, treason, and defeat. KOHO synovial balances cause shared costs easier to travel. Possible promote a or as low as you will need, dependant upon your position.

KOHO joint information are great for husbands and wifes, roommates, or anyone else that has to rip bills and part preservation with someone else.