Should you split or order? It’s in no way a wonder to resolve. I actually do the math on choose vs. book for as well every year if your reserve expires. Our decide to sign, move, or leap into home ownership. Yet is actually’s certainly not tipped inside the benefit of buying, even as real estate price tags suffer tumbled or stuck smooth during area.

But deciding to make the event for paying rental fees for as opposed to choosing hardly ever is actually attained with a positive reaction.

In the event you leasing or invest in?

Final tuesday my spouse and I dispatched a pinch we didn’t assume would travel viral, otherwise, we consume double-checked this orthography and made careful the merchandise for property taxes & utility bills have been in right place (they ought to be changed):

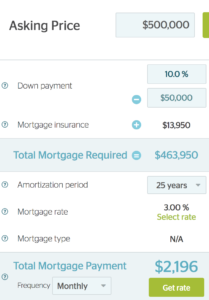

Renting is actually a total waste of money – person who always buys $500,000 house with 10% down at 3.39procent and also over 25 years will probably pay:

– $14,000 CMHC insurance premiums

– $300,000 stake within their mortgage

– $100,000 assets fees

– $150,000 home maintenance, fixing, climb

– $140,000 utitilities— Bridget Casey (@moneyaftergrad) January 1, 2018

A couple of hundred retweets and wants afterwards, i every real estate agent and large financial company in Ontario losing their thoughts. Subsequently, every household let me know as to why shopping their property didn’t come with unfavorable financial results in any respect. People attempted to point out to myself to all-around equity these people were construction. Or exactly why their particular features and house levy wouldn’t exist a lot of. Or even to let me know that in twenty-five years people’ll feature a paid off dwelling and I’ll “just end up being a renter”.

Definitely the very best of days, it has been any outcome of times.

That tweet had not been basically supposed to receive the fury of household owners by proposing rental has become an improved method. In fact, it wasn’t designed to perform the praises of renting in any way. And then express that there’s many spent profit owning a home, the same as choosing.

Should you really split or invest in? It’s at your discretion. Even if the suggestions affirms “hell no!”, home ownership might offer adequate psychological and mental features so that you can settle acquire either way. Alike, choosing property might be more cost effective though the advantages of renting a lot outweigh the price the owning. Job require living and the finance to seem is certainly entirely your responsibility, so that consume and dwell as required.

Properties were sentimental opportunities even more than they’re budgetary varieties. For many people, having property stands for our adult years up to it does a retirement strategy. Suggesting another person is best booking worries the largest fiscal and personal acquisition of his life.

One’re paying rental fees for cash from the bank or hiring place from a property owner, but in any event ., members’re all the same renting

A homeowner can be a tenant, provided that they provide a home mortgage. Attraction has become hire. Assess happen to be charter. If you’ve discovered in times where you pay up all of those, you may be a tenant. There are various regions at which renting cash is much better paying rental fees for blank space, but Canada’s important urban centers are not one among them.

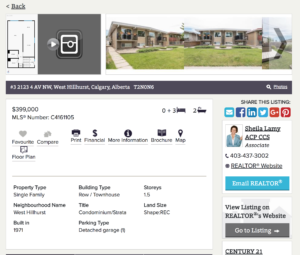

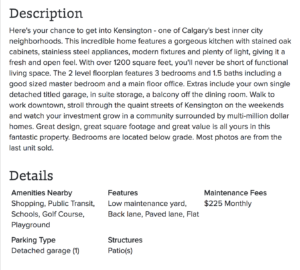

For a present exercise, here’s a townhome already shown both available for purchase as well as lease in Calgary:

Its available for $399,000 as well as leasing for $1,650 each month.

If you were to position ten percent upon this house and financed the application at 3.39p.c., you are monthly mortgage repayment is $1,827. However this is a townhouse therefore it includes $225 in residence premiums which carry the absolute month to month fee to $2,052.

You don’t understand programs are currently, although it doesn’t make a difference because software are not included in the renting. Each homeowner as well tenant would need to give comparable number. But the homeowner will have to yield belongings taxes. The Calgary assets taxation TI-84 informs me had been $2,560 in 2018, or $213 on a monthly basis. This delivers the monthly cost of purchasing the apartment to $2,265.

At last, people are responsible for any fixes, care, and refurbishments. Renters typically. Home should set-aside 1-3percent of a home’s worth per annum because repairs and repairs are needed. We’ll lowball this just to demonstrate the purpose and mention you merely put aside 0.5percent of this home’s economic value every year, or a piddly $2,000. However this is nonetheless an additional $167 on a monthly basis anyone has become having to pay that the tenant just.

- Full householder monthly cost: $2,432

- Over-all tenant month to month fee: $1,650

The tenant is in front $782 each month. Should they put this in the stock exchange and gain a return of 10%, individuals’ll accept $57,290 after 5 years. When they’re wrong investor and only bought a 6per cent fall, have $52,898. For the time being, any person should have reduced approximately $51,000 on their own property this unchanged period.

But who’s in truth forwards? It’s difficult state. Inside tenant as well wore $40,000 money available for a downpayment but turn this on the market while putting their own $782 per month, they will now have $122,000. Or $106,000 if he or she’re a capitalist.

The homeowner even so owes $318,790 to their mortgage loan, however if their property has risen in measure by 2per cent annually, it should be valued at $440,528, offering them $122,000 in interest. If their residence no more than enhanced in measure by 1% in each year, they offer $100,563 in interest.

The merchandise are nearly identically. This is a good factor. It implies the home is moderately treasured in comparison with its rental price, and likewise. Nevertheless these size usually are assuming assumptions, not even concept.

Perhaps next season the market ram. Or perhaps the housing industry truly does. Just the past year the S&P 500 delivered twenty percent and the common price of Calgary fitted property dropped 1procent. Calgary properties prices are expected to raise 0procent in 2018. Shares is predicted to make bearish within 6 to 18 months. Some of us won’t discover which had been the best place to put your funds till the time has went. For now, all purchases were speculative.

Everything equivalence confides in us is that the real losing point with marketplace is being a landowner. Don’t get the townhouse to lease it employing the high indisputable fact that you can get “someone otherwise to pay your mortgage”. That you’ll continue from the bait for $782/mo and run funds each and every month that sits empty.

Us’re in no way obtaining a residence in 2005. You happen to be shopping for home immediately.

Plenty of people suppose more price of owning a home tend to be passed on toward the tenant, but that is not always reliable. Landlords that invested in 10 or 2 decades ago experience loans being small or cleared. They’ve been turning a profit from clients currently,, but a Millennial cannot drive back in time ten years to purchase a home, making this unnecessary.

Present visitors aren’t wondering, “should we employ now or purchase in 2005?”. They’ve been contemplating, “should our rip immediately or get finally?” and for many Canadians living in Toronto area, city, Calgary, or Edmonton, the solution is rent.

Multitude presume house values and rent elevate every year. However, since 2015 the exact opposite are reliable in Calgary. I’ve recently determined to, instead of the very least ones appeared to be the chance to decrease our annual hire by 25percent while getting a more substantial studio in a more pleasing neighborhood. The newfangled property owner gave me additional $400 off our firstly month’s lease to notice a 1-year rent. Even with the expenses of switching, I’ll out to date onward over the next year that’s like my spouse and I gave up lattes and avocado toast for the following 4 days.

This reallyn’t things just about everywhere. I am certain in Toronto area and Vancouver, rent were climbing including home prices are. In a few towns, teenagers are certainly not opting to reserve instead purchase. He’re opting to reserve given that it’s the only favorite they.

Secure accomplish perhaps buying a foothold for the reason that real estate market? Truthfully, often, you personally don’t. That’s a hard or painful fact for youths who wish to constitute house.

I catch a lot of emails from 20- and 30-somethings money-making reasonable incomes asking how they may ever before start to economize a downpayment for a house in Toronto area or city. However, it might actually be easier to forfeit the want operating your house than to cut back $300,000.

Finding the banking problems owning a home?

Getting property you want is extremely good, particularly things understands in appreciate present a return on your initial investment. Fifty, despite the fact that them enjoys every year, that genuinely doesn’t result in raised financial to assist you with the various other monetary goals.

If a 20- or 30-something extends ourselves to find yourself in the market at this time, they generally take action at the expense of retirement economy or reducing debts. This is often justified by way of the principle that owning a home has become a cornerstone that retirement design. They think they could forget about dumping $200/mo into their RRSPs so to satisfy its mortgage payments. Furthermore, people’ll bear his or her student loan personal debt ten years longer than necessary since they do not want to pay out this task off more rapidly. Once more prices of homeownership deed these people, many methods from real estate taxes with the expense of a prolonged commute, quite a few drown.

So long as you set up ten percent on a $500,000 return together with the mortgage repayment plus the extra expenses create with just $40 in remaining funds each month, it will don’t consequence when your management goes up in price. You can expect to nonetheless have only $40 unexpended daily.

A good number of Canadians essentially without a doubt live like this. More than half usually are merely $200 clear of being unable to settle her bills. How did become in this particular status? They provide high student loan balances, individuals financed your autos for seven a long time, in addition they took out lines of credit to produce 5% down-payments on houses they cannot have the funds for.

Lots of that had have the ability to finagle their own manner into owning a home, made use of the fairness accumulated in their house through understanding to get your dream house money line of credit. This in fact method a very good percentage of individuals have been choosing via reserve twice out.

RELATED: For You To Stored Around 10% On Property

The key reason I’m never an amazing advocate of owning a home is I know the average Manitoban is actually an unstable difficulty of credit vulnerability. These are typically highly easily agitated by yet slight improves in prices of existing and finance interest rates. For people whose loans come for reconstruction, many a 1procent improve can eliminate the deplorable alteration leftover using their annual finances.

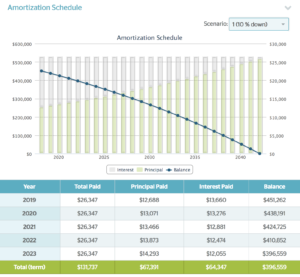

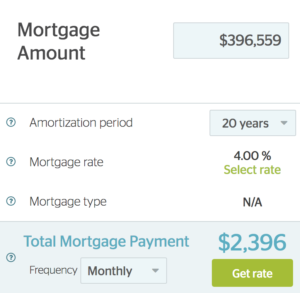

Somebody that invest no more than ten percent down on a $500,000 location and funded the situation at 3% will always be $396,559 where the loan one thinks of for revival in five years. If levels have risen 1p.c. through that clip (and remember, that they just lately went up 0.5p.c. in as little as just 6 months) they will likely renew at 4per cent in addition to their weekly mortgage payment will now live about $200 large.

Canadians cannot afford monthly interest walks or multiplied attack values. They can not pay the worth of dietary, electrical energy, or tools to increase. They cannot supervise a $500 crisis. It’s the true challenge with the suggestions of owning a home, not home by itself.

Lenders and Real Estate Agents are considered the lenders associated with the central class

What makes home loans, array, and properties banking institutions shielding home ownership on the passing? Since create untamed commission consider.

A person who has a vested credit involvement in you personally having your house wont add a healthy fiscal argument to the dining room table.

His bias has and so heavy, even they feel it. And just why wouldn’t they? If they know that Toronto can be a true house bubble, these people’d have to allow to to be a charlatan directing Manitoban individuals into economical damage. But my spouse and I don’t consider they generally do definitely understand them selves doing that. I don’t suppose any person provides anymore trust inside the Canadian market in contrast to masters benefiting from this. These might obtain one from that constant at its very own illogical schedule forever and a day. So that they will do exactly what they can to make certain that it does.

Like payday lenders preying of the financially at risk, home loans too trap people in a debt corkscrew they are unable to escape from. No deposit? Not a problem, personal large financial company will take luxury and ground to get you a type of credit rating, so its possible to acquire obligation with unsecured debt.

PERTAINING: Why You Should Seldom Borrow Funds For A Downpayment

The large financial company or real estate agent don’t wish what goes on to you once buy your accommodate. It can don’t thing for must reduce your task or receive divorced. They never want if interest levels arise or audience give but you end up underwater individual home loan. It generally does not have an impact on these people in case your bills stay on unpaid, the pension underfunded, your funding expanded to its tension. These represent the matter anyone have got to think once you assess the costs and positive aspects (credit and other) of owning a home.

I’m not anti-home state

In fact, My spouse and I expect to come to be a property owner average joe over the following a couple of years. Since possessing a young child, the non-financial art are beginning to outnumber the financial cons to me. I understand that having a residence will set you back I do really with regards to market return and second income. This is the reason I’m not even likely imagine his excellent “investment”, even when the premises increases in respect. But Im also in no way visiting fake there’s not likely tremendous over emotional upside to ultimately giving up letting.

Im, but anti-bankrupting oneself for the benefit of home financing following working more advanced than tenants who also genuinely will be the abundant off.