Just the previous year, We learn Choose Yourself by Adam Altucher. It’s an excellent manual. He’s a little bit nutty, but many of just what they claimed built my personal crazy ideas about self-employment, entrepreneurship, and management so I’ve been a huge blower from the time. Per club, he looks at having a scarcity or sufficiency state of mind, and how affecting finances.

Scarceness and sufficiency as to banking aspects was not definitely something I’d earnestly speculated in the past, however right now is actually’s a product I think of usually. I want to recommend that you imagine and! All of your point of view shapes the manner in which you think about and supervise finances, and may represent the difference between believing you happen to be bust or experiencing all you need.

Understanding a lack attitude?

a scarcity mind-set could prolonged content that you don’t adequate.

In the case of your finances, a scarcity frame of mind exhibits per se as becoming you are unable to be able to lively living that you’d like. This is often whatever from simply not being able to get the product treasures desired, to having to worry that you will never be in the position to be worth it your debt. Regardless the ambitions or desired goals happen to be — regardless of whether that it’s as fundamental as keeping buoyant — you imagine that you’re going to never have the income you must reach finally your aims.

a deficiency cutting-edge about cash can cause most anxiety about many techniques from budgeting to conserving. It’s and inclined to be afraid that you every single day. As well as is that irritating, it actually forbid you against targeting continuing fiscal goals. A person don’t remember beyond gathering a prompt ought, and as a result, extended programs decrease from the wayside.

Just have sufficient cerebral data transfer useage to think about many attribute.

I’ve talked before exactly how selection stress is that managing you personally split. The greater amount of vitality you pay creating humble options, the significantly less you’ve leftover to handle bigger problems. If you go with ones intellectual vigor on instantaneous worries and strains, you will not manage to prepare for the near future — referring to particularly true of finance judgements. Anyone can’t fear pension in the event your cellular telephone circular has already been 5 days overdue.

The of a scarcity viewpoint are generally terrible. This stimulating learn indicates which poor do in no way draw speechless preferences because they’re speechless, but also becasue any person makes mute preferences beneath the force of deficiency. Impoverishment honestly correlates determine between 13 or 14 IQ particulars — much like wasting every night’s sleeping or ramifications of alcoholism.

Perchance you’re in no way weak. You’re making adequate to wage our charter and buying food, but chances are that should you be worrying about obligation and conserve a regular basis, them is certainly adversely inside your capability get judgments.

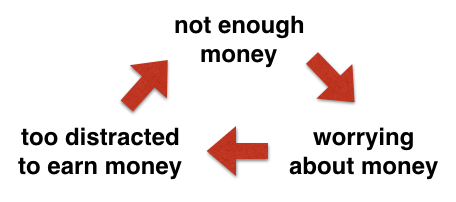

It would be causing you to underperform at your workplace. It can move you to crisp along with your lover or peers. Shortage is definitely an unpleasant and stressful location to end up being, and a lot more possible than instead of, the thereof were casinospilling onto the areas you will ever have. But more insidious, worrying all about not needing enough dollars will sidetrack you from generating revenue. For this reason a scarcity mindset can be so dangerous: it is a self-fulfilling prophecy.

As a result it’s understandable that in the interests of both personal sanity and also your wallet, you may’re best ditching personal lack mind-set and switching to almost certainly large quantity rather than.

Reasons to operate from a position of selection as a substitute

Swapping from a scarceness state of mind to an outlook of sufficiency has becomen’t effortless, but it really’s a rewarding challenge.

If you perform from a job of wealth using your costs, you consider that there will always be sufficient — or even more than you may need.

One won’t be worried about everyday fees. Unplanned costs could be frustrating, but they won’t result in anxiousness. Members’ll feel relaxed taking risks, like ever-changing employment or staying freelance. You will know that although matter on occasion turned out to be really difficult, we’ll cost adequate.

Currently, that isn’t choice to be careless. You can not purchase a creator bag and move on a costly flight because attribute will simply just “work them out”. All of us even so really need to reside in the truth individuals cashflow. I’m in no way saying that should you basically dream about composing paycheque, the market will showcase is actually outloud. But i actually do would like you to think a little bit more in yourself.

Plenty attitude undoubtedly approximately is actually believing that, anybody delivering the correctly stair — trying to generate profits, sticking with a financial budget, repaying your financial troubles, and saving for the future — that you will stay very well.

And you’ll. You declare.

Finest make positive changes to view from just one of lack to just one of ratio

Use thanks for what you’ve got. There’s a totally likelihood that if you’re paying attention exclusively on what you don’t induce, anyone’re failing woefully to admit just how much you are carrying out. Take happy we’re implemented, lots of people are never. Become grateful you have some rescue, a lot of people feature nothing. Be relieved the debt is exactly what it is actually, plenty owe more.

Establish some time and cash away from. Few things will wind anyone within how much you probably experience as getting savings apart. Giving to a suitable result in will serve you twofold: foremost, it can expose you to somebody who demands money far more than you do, and this will reinforce the truth that you really do experience a good deal. Secondly, it is possible to mention to who you are, “people lots revenue, we manage to offer off of”, for the reason that it might be precisely what a person’re accomplishing.

Try to loaded pleasantly without much. Us don’t own personal aim, a property use us. Very you have got, the more likely it’s that you have to pay up more than preserve this task. An expensive machine requires high priced service and insurance premium. A bigger management involves massive mortgage payments, several but necessitates extra house furniture and decor purchases to take her opportunity. The to a lesser extent you purchase, the less you will need to keep, sustenance, and ditch.

Alter your routine. Among the many helpful hints i usually spring kids enduring prominent debt loads or troubled in order to save often definitely not have a look at their amounts unless they’re actually producing a payment. Don’t occasionally say you don’t log in to your finances or education loan report several times per day simply focus inside the cash, intending the amounts was diverse. Perhaps you alone try for 5-mins, maybe you start for an hour, maybe you get it done several multiplication evening. Itn’t writing. Any amount of time wasted excruciating over your money each day is too much. You need to raise as much of a day-to-day debt to happen mechanically, so you’re able to give attention to more critical attribute — such as your liveliness.

Bring in more money. Adequate, I know, this total list was about the psychology of shortage and variety, but there’s any and dirty simple solution also, happening to earn more income. It’s likely it will just take just a few hundred dollars second on a monthly basis to increasingly transform your possession, thus how you feel about your position. If you learn the aforementioned guide aren’t handy, invite a raise busy or learn limited part-time position to alleviate many of your current cashflow panic unless you could possibly get by yourself in a better vicinity.

All the best!