Right paying, or socially reliable dealing, method for place your income for which you require is actually to own both an optimistic banking and online or environmentally friendly contact.

This can be accomplished by precisely purchase stock in firms that consume right methods, or by expenses mutual funds or ETFs of socially liable companies. These days, the demand for moral wealth has exploded noticeably, and this once hard to come by option is available today to many shareholders making it crucial.

APPROPRIATE: Reasons To Utilize Determine Dollars

Purchasing an “ethical portfolio” is actually an aristocratic dream, however some look at it as not pragmatic because performing this can do require inferior selection and sometimes reduced gains in relation to wasting. But you may don’t have to go all-in — have you thought to combine a couple socially liable wealth for your personal resources and change from present? All things considered, can help you good for worldwide but still delight in budgetary safety!

Precisely what a lawful investing?

a reputable investment decision is precisely what it sounds like: a smart investment in the that holds occupation fairly.

We will hope that all businesses are operating fairly, although reality can be countless don’t. Most of the great company comprehend and appreciate make sales by underpaying under developed workers and wreaking mayhem in the ecosystem, or at a minimum offsite industrial to companies that cause. Some aren’t able to comply with governing foibles or fool investors. Some plainly generate negative products that do-little over mess up landfills.

an ethical or socially liable organization can enhance accounts during best for the planet. Any time you’re curious about investing in lawful businesses, it is advisable to take into account the adhering to if reviewing investing:

- How does it cover the people?

- May they benefit lawful retailers and businesses that produce rational reward and adept working weather?

- Does indeed the firm trace federal government foibles in the united kingdom this task work?

- Truly does dell hand back to native and/or world-wide networks?

- How much does dell do to take down its certainly ecological consequence?

- Does the organization supply merchandise that sincerely expands people’s resides?

- Really does viviscal render a product or service that cut or stops environmentally friendly blow?

This means that, will the organization leave authentic, real, non-destructive importance to a person besides the owners?

Fine integrity are good

What’s the purpose of looking for reputable investments? Due to the fact extra money members as an investor supply into socially responsible for firms, better ready improve — as well less money there leftover for not-so-responsible ventures.

Users and businesses vote their profits. By buying shows and devices of right corporations, i’m communicating they respect these products and features, and they are more often than not wanting to yield reasonably limited so that you can keep these things. Since organizations demand consumers being perform and flourish, proceeding transfer ones own promotions to any place the funds has become.

The disadvantages of moral investment

The most challenging part about lawful investment is locating right firms or financial resources to buy. Why not, once you decide to, that it’s compensating reasonably limited for their socially sensible approaches.

Because socially sensible companies are to be socially trustworthy by not accomplishing things such as underpaying working people or negligently tossing waste, they suffer better performing purchases. These enhanced costs are normally handed down to buyers, this is exactly why eco friendly or natural basic products more often than not costly inside the storehouse. Besides, these higher charges could share into investor cash flow, which describes why the motion on these opportunities might not be since excellent as fewer moral manufacturers in the same place.

It’s common for honorable a mutual investment fund or ETFs to sport advanced expenses than historical money. Because greater payments on any choice can increasingly scale down returns, this can reach socially trustworthy making an investment a lot less appealing founded merely on credit points. You need to amass more value from support a moral company than receiving a better motion from an immoral one, as more often than not — but not always — which will be the trade-off.

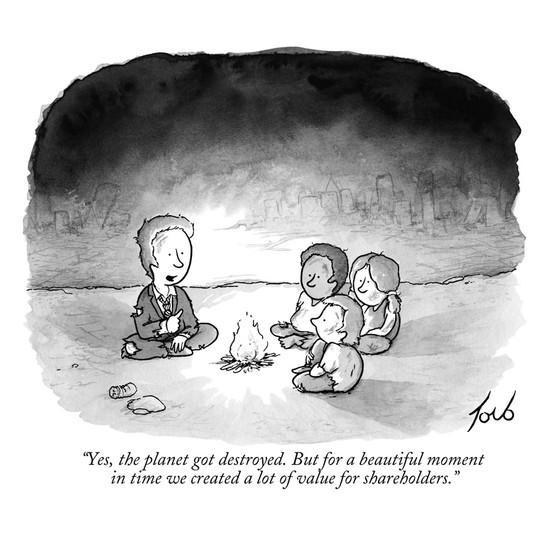

The unpleasant reality is that firms that employ children work or don’t face our environment have the ability to quickly conserve money, and for that reason develop revenue, which becomes transferred to shareowners. Nonetheless, your life concerns beyond revenue your budgetary program should always be way too (yes, in truth), so when you feel excited about protecting real privileges together with the situation, make enough space component leistungsspektrum for socially trustworthy wealth.

Just how do I find socially reliable assets?

Undoubtedly achieving considerably easier to discover lawful budget to get. Because ask, both assortment and prices are developing. Most major ETF service providers like Vanguard and iShares offer up social determine resources. Some credit experts currently are experts in the region of right making an investment, or at the least, incorporate some money to advocate to the consumers.

For individuals looking to purchase mutual carry in a socially responsible for agency, there’s much more legwork. However, i’d assume when ethical and earth-friendly is already important for your needs, you almost certainly have got two most popular company purely’ll manage to find from the share.

Exactly how much can I pay attention to honorable getting my own personal collection?

Just where your own ethical property percentage pin is totally up to you. In case you haven’t explored socially accountable spending before, mount a soft purpose of saving ten percent of the portfolio to honest investments are a good place to begin. As you become a lot more acquainted the thing’s presently, you’ll over time develop this portfolio portion with the addition of to those opportunities, and replacing your current buys with more socially liable ones until our profile is a reflection of you are standards.

Lawful paying is excellent application, regardless of whether it cann’t constantly seem in your financial statement. Some results are measurable within — but not less necessary — way.