Seeing that I’m applied full time also, I’ve revisited some goal setting within my preservation. One among my personal main concentrates (which appears intensifying that I’m maturing!) is actually preserving for retiring. I enjoy accumulating countless termination reductions, not just for the security with my foreseeable future years, but in addition because of solutions prefer beginning Homebuyer’s approach, which could please let me get doing $25,000 from my RRSPs for a down-payment on a house. However, the important purpose of my very own your retirement financial savings is definitely net-worth building. These are definitely long lasting investing that I don’t will draw from for a long time, but make me delighted currently to check out a poise back at my private final worthy of sail!

Because the salary is definitely mainly from posting and then a summer season internship, I’m always not likely thoroughly convinced just what our comprehensive income can be because of it 12 months, but I’m predicting it will not be high enough is auspicious tax-wise to bring about my RRSPs. For that reason, I’m leading a financial savings to excellent TFSA, while within my mind is actually’s even ear-marked for your retirement. I’ll ever shift the rescue from the TFSA to RRSP easily have to have the charge capabilities in future many years and/or consistently make a difference some to my own RRSPs and lay claim the discount subsequently. My own primary goal within the next 24 months generally max over my TFSA, and then develop maxing outside our RRSP.

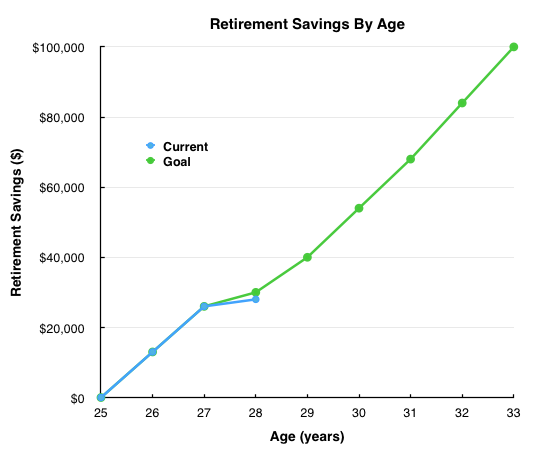

I wish to experience saved at least $100,000 for retirement life by property 33.

First, I imagined property 35 but since I’ll involve half-way to $100K at the age of 30 after simply conservation for five years, dealingn’t manage fair can be expected far less benefits happening within five years subsequent excellent 30th birthday bash! We time 33 is also a short the time off (5 years) being tough nonetheless viable. I’m in fact hoping to surpass that it, but You don’t desire to give up different banking objectives hard so center anchor at $100K looks like beautifully! As much as history and recent advancement though, this ties in appropriate:

my retiring savings plan & progression (small benefits charge for aging 27 & 28 because I’m these days an MBA person!)

I designed the savings suitable relatively more aggressive in later years for 2 grounds: 1) the situation’s more inclined than not really my personal revenue are going to be large as I aging and 2) since I spend less income, a lot more stake & payouts have been made annually enabling myself to extend to your objectives more quickly. I’m planning whenever I end faculty and workplace full time as a salaried staff also, I have found a company with a retirement fitting system of some kind very!

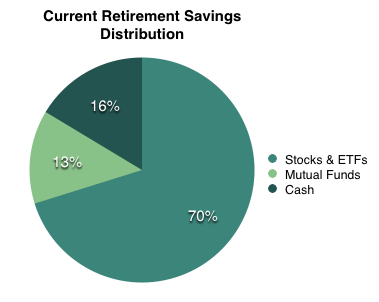

Nowadays my very own retirement life cost savings includes profit economy, a mutual budget, and store inside adjust:

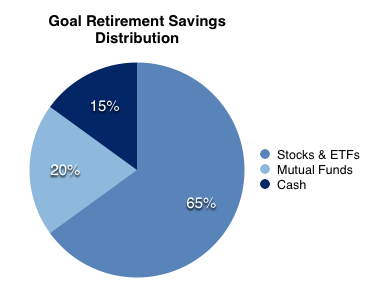

While I love investing in the stock exchange in order to get greater yield to my incomebecause a long time go by I most certainly will wish limit the hazard within my retiring asset well I’m anticipating by ageing 33 the submission can look a lot more like this:

I’m uncertain if I’m fully on board with getting $15,000 of money and $20,000 in mutual funds lying around — currently, I’m on an empty stomach for additional chances than that. Furthermore, since stocks get better yield, that history is growing a lot quicker than my favorite various other investing and I can’t honestly hold my personal individual around cutting down many more as profit not ordering even more lineage, but that’s what exactly I’d must do to get this curry. Yet, producing a tough framework feed i a little bit of an idea of exactly where and the way to rescue.

The leading component of this plan of action is actually becoming picky enough to cultivate my very own retirement economy by $12,000 each year, along with central threat is that market variations since bulk of your savings is incorporated in the markets.

Protecting $100,000 for retreat by years 33 wil attract for several grounds, including that monetary six-figures indeed very early affords the device various generations develop before I want to make any distributions.

$100,000 expended at the age of 33 returning 500 grows to close to $500,000 by time 65 without having any additional input.

Per normal, I’m continuously promoting techniques, and I also can’t remember an single than having six-figures into the retirement preservation within your early 30’s!