The Tax-Free checking account (TFSA) is the foremost extended savings vehicle suitable Canadians, but to a lesser extent than 40p.c. of eligible savers are making utilization of things. In the event you don’t get one, them’s the perfect time to open up a TFSA.

Starting a TFSA this pretty easy. All you need to do is settle on a financial company with to your online insurance plan Number (crime) convenient. Before you may enroll, below’s a crash study course in what the TFSA and the ways to be successful for yourself.

Its TFSA acts

The Tax-Free Savings Account (TFSA) is a qualified report unveiled last year by your governance of Canada to help you Canadians lower your expenses. Sadly, everyone don’t realize it really works. Whenever TFSA was first presented, Having been so scared through the acronym, I simply didn’t clear one. It has beenn’t until a few months afterward as soon as I perfected how it trained i at last set up my own very first TFSA. Our think about many individuals can tell the exact same information!

Yet, the TFSA is definitely astonishing. If assign dollars into a TFSA, any financial gain them receives through fascination, profits, or working capital gains is usually tax-free. Yes, you only pay NO TAXES on this source of income!

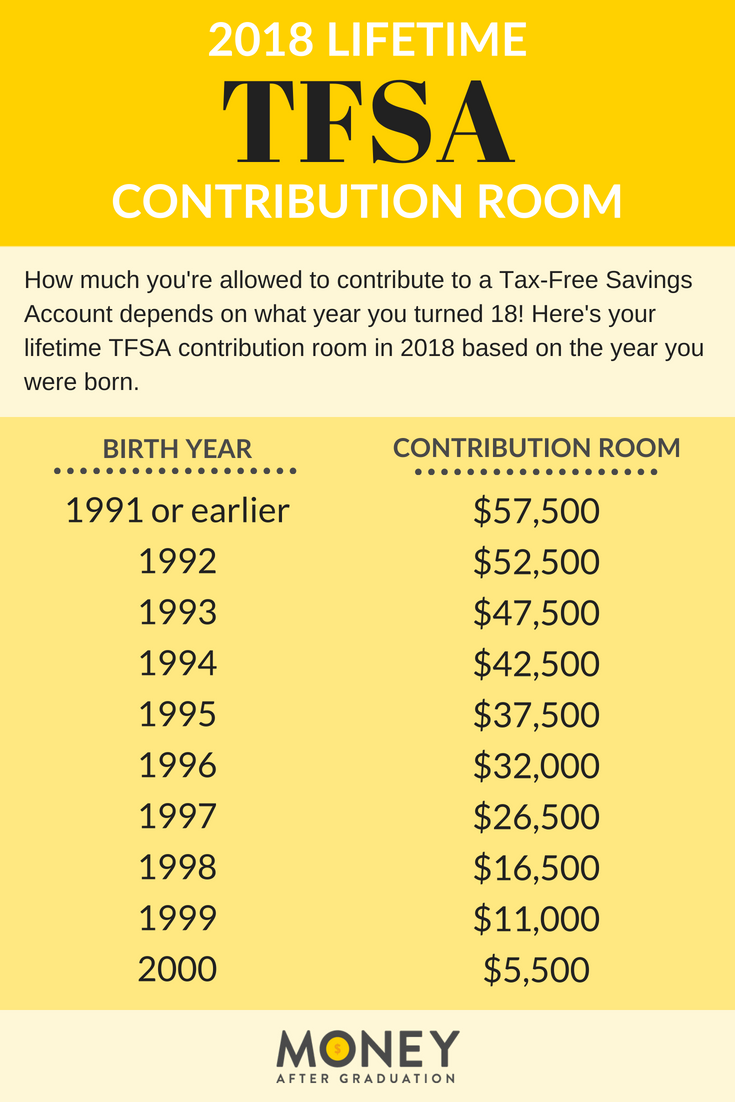

Any Manitoba older than 18 can loose a TFSA. The gross annual part place currently is $5,500 every year, but you are permitted every part living space for last days that you are currently 18 or elder, too. Consequently even if it is the initial year you open a TFSA, you are able to bid “catch up” on period of time you did never chip in.

Here’s a quick mesa explaining what amount of giving gathering you have in your TFSA based on how old you are:

Smashing fiction towards TFSA

There are two things you need to learn before you decide to open a TFSA:

The expression “Tax-Free Savings Account” is also amiss

Tax-Free checking account is usually a mistaken brand given that it shows that this needs to be a checking account. Itn’t. You will have a TFSA reciprocal money, GIC, or maybe even business accounts in which you spend money on lumber, securities, and ETFs. Exactly what TFSA you decide on hinges on your finance know-how, qualifications, and pursuits!

You can get several TFSA’s as you would like

You must stay on within your period TFSA sum limitation, nevertheless, you don’t demand a particular TFSA. The TFSA is without a doubt a versatile bill, you may need several in order to satisfy distinct aims. It’s fine to one hard cash TFSA kinds urgent account, and one TFSA used the market for your retirement. It’s your cash, guarantee that’s working out for you!

Guidelines for the TFSA

The great thing to start a TFSA for is to economize for retirement plan, but you don’t have got to. In fact, you are able to exposed a TFSA to help save for anything you want.

Plenty utilize her TFSA just to save right up for prominent buying, like a down-payment on your house. People put it to use as somewhere to maintain their last minute budget or perhaps even economize for a secondary. Unlike the Registered pension nest egg (RRSP) or qualified understanding Savings Plan (RESP), there are no principles about or after you withdraw cash from your TFSA. This will make it very easy to operate and use in any manner fulfils you well.

However, it merits saying that the simplest way to make the most of your TFSA typically earn quite possibly the most tax-exempt money, and also that comprises far from paying out the money with this explanation. In the end, finances cannot make consideration, benefits, or cash profit if you decide to devote this task! Which is why the Tax-Free Savings Account is unquestionably a strong your retirement discounts software. Unlike the RRSP, there are no levy to consider if you lend or if you form a withdrawal in your retirement.

Make your TFSA a lasting discounts van that can help you personally grow your internet value over your health, not a place the place where you stash cash before your future packing flight.

Why you ought to spend money on a TFSA

Saving cash is incredible, but trading money is good. It’s merely through dealing that you can really take advantage of the TFSA’s genuine strength. Naturally, you prefer many tax-exempt money attainable, along with highest fall is within the stock exchange.

Because, you must design your Tax-Free checking account a financial investment story. Decide on a thing a lot better than a savings consideration, firstly self-directed or robo-advisor consideration. As a substitute to only money-making 1procent (or significantly less!) in curiosity about a savings history, members’ll can garner dividends and assets reach individual buys. All of this earnings component TFSA has become tax-exempt.

If paying causes you to as well restless despite the prospect of bigger earnings, around choose a mutual finance or GIC. Although choices usually offering substantial return than a savings balance. Consider, us’re aiming to obtain the most dollar potential as this investing source of income can be competely tax-exempt.

Excellent spot to open a TFSA

Mostly any ridge will allow you to arise a TFSA, however options are far better than many. To obtain the bang for your buck, just shop around when you agree. The following are some of the best TFSA solutions in Ontario:

Wealthsimple

Wealthsimple is made for men and women that know the stock is a good destination to spend his TFSA, but don’t touch certain picking and selecting store yourself. In case you have learned to pay, it is advisable to stored some “lazy currency” in this case, consequently it can improve without fret. I just now subscribed to Wealthsimple, and after this can be found the initial $10,000 controlled complimentary (so extremely the TFSA!) by ticking there.

Tangerine

Choose to avoid the market for now? You may purchase a TFSA common budget, savings account, or GIC with Tangerine. I’ve wore a TFSA with Tangerine for pretty much a, so I sexual love a high-interest fees on savings. I’m too hot for its no-fee chequing, in order for may be valuable investigating if you decide to’re fed up with investing work prices. You can earn around $150 in rewards by visiting this link, which is an excellent figure to use to start up the TFSA!

Questrade

So long as you’re previously investing-savvy and just need to eventually improve your TFSA’s power, a self-directed selection at a discount brokerage is your best choice. I have been a customer of Questrade since I have begin investment, and I fancy the low-fee building for trading stocks and ETFs. Questrade now offers hands-off portfolios, so in case you wanna control a couple of your hard earned cash your own self and leave the remainder of large to somebody, can be done both all-in-one property.

Financial acronyms are perplexing, and TFSA is not any exception. So now you understand those letter mean, the ins and outs, and exactly how much donation space you may have for your own personal preservation. The TFSA can simply manage their meet your needs for people with one! So in case you experiencen’t done so but, exposed a TFSA and helping tax-free progress to your monetary dreams.