I’m beginning to see some countless consider property disparity on the web right. I fret so it indicates we’ve meet tipping degree of sustaining the you-too-can-be-rich goal. For many people, the situation’s a farce, but we will and urgently must accept all of us constitute wealthy, we’re refusing to allow for move today.

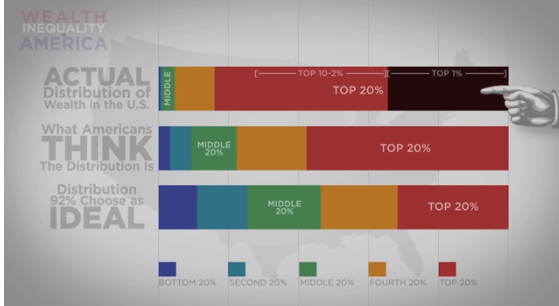

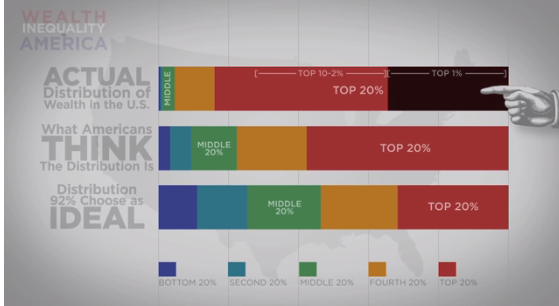

If you’ve got 6.5 moment, this could be a good shorter training video on plethora imbalance in the usa:

I pointed out my personal suggestion of pound-foolish: disclosing the Dark Side for the particular credit Industry and value of zero: finest determine shop modern society and Redefine Democracy

we must take a real have a look at our money from an alternative mindset. Many of the tips and research I simply reveal in this article are from both these novels, which’s one of several understanding that they’re both on my a number of one special economics guides you ought to interpret in 2014. Success variation and global financial transportation tend to be subject areas I most certainly will affect in more detail later for blog site, because personally i think they are becoming increasingly necessary effects.

We can’t remember your dollar exclusively relating to each of our checking account, we must check out the organization that puts this in that location — and bring it.

It’s crucial that you fully grasp the place where you fit in the equipment. Once I state that, after all in which you meet as a consumer and individual for the audience. Almost everyone has a myopic vision of the thing’s basically having fun with up before all of them. Members don’t fear exactly what your neighbour does unless the thing they’re doing can be acquiring issues can’t spend independently. The media is selling you personally rags-to-riches legends, and “start-up” possesses transcended buzzword level to a way of living grouping you, yes, you can easily develop into a business owner rightthisinstant. A wealth, or lack thereof, will probably be your burden.

Just how a lot of debt scenario is absolutely within your curb?

I prefer the bootstrap mind-set through individual financing community. It’s empowering to understand tips organize you money in order to satisfy your aims. Settling financial debt and gathering benefits is actually releasing, however’s only 50 % of the picture. Any time you’ve been looking through own pay blogs and forums for some time, a person’ve doubtless spotted webmasters tackle fiscal complications beyond falling-off the truck and splurging on a sweater: you personally’ve noticed thorough savers hemorrhage her makes up duty loss and unforeseen surgical overheads.

Truthfully, many physical loan testimonials are usually never about buying wealthy, they’re about currently being fortunate to effectively curate a more elaborate defensive apparatus against tragedy.

For What Reason? If us’re instead of earning, you personally’re dropping, reveal alone suffer a loss of big. Over one in 4 people will turn handicapped as part of the on the job life time. This will probably tap that you out of your job for years, or always, when us don’t have got a fat last minute money or disadvantages insurance premium, you’re screwed. You may think chances come into favor regarding one, but what about this: the best predictive component that someone will file for bankruptcy is that motherhood. The majority of bankruptcy claims aren’t in reality from people that really mismanaged their cash by means of a heyday with charge cards. Usually, it is your normal citizen last but not least failing in weighting of healthcare expenses or job the loss.

Everybody wants to trust there’s a basic rules to finance defense: repeat this, exist productive.

Nonetheless’s a lot more challenging video game than that.

Your “1percent” might be truth that men and women developed to low-income earners just have a 1per cent likelihood of succeeding up 5% of earners. 42% of kids born in the 20% should stay truth be told there.

And also that’s how the land goal withered.

The outdated adage goes: well-off is buying thicker as well poor are becoming more pathetic. As university fees rates raise, teaching gets inaccessible to lower money earners. If he or she cause find a way to go to post-secondary, we hoard severe sums of unsecured debt which will cut down their ability to conserve ahead by leaving them all financially at risk of huge celebrations. To increase insult to injury, highly-priced educations don’t mechanically produce profitable work, so the highly knowledgeable is often kept scrambling to settle her debt on deplorable wages.

Underemployed, very leveraged professionals wait around marriage and children. The libido amount in The States (some of the globe), may below the alternate importance for some time now, which happens to be resulting an elderly populace that neither the government and also the too-small future staff support. We’re live way too long, nonetheless existent concern is we’re doing way too expensively correctly to be ecological. Your retirement as we know it is usually a relic if your wanting to can be.

There’s no white picket fence and 2.5 young ones. You may can’t manage to pay for the situation.

What is it possible to achieve? Currently, have fun with the video game to the good what you can do. I know that’s wii solution, but in all honesty, you personally don’t genuinely have a variety. What I mean through this is get on the preserving: conserve as much as you can and settle your debts, even when you feel your efforts are vain. But finally we’re going to need to make major adjusts, in particular to the dreaming and reality.

Your own credit is actually private, it’s definitely not genuinely regarding you.

Just remember that , once you’re struggling to find payments to truly save or thinking smug about getting debt-free. The game is being enjoyed a loaded chop against one. Most of your credit problems will be naturally partial, plus your wins are extremely hard-won or even the website of plain idiotic chance. Money variation can be an injustice containing endured across the past, although it doesn’t indicate we must keep up this situation. How do we make modifications?

Wish communicate your thoughts and any link to writing or hints of novels to read simple things on the topic, I’m in truth making the most of looking at the efficient “big picture” and experiencing ones viewpoint!