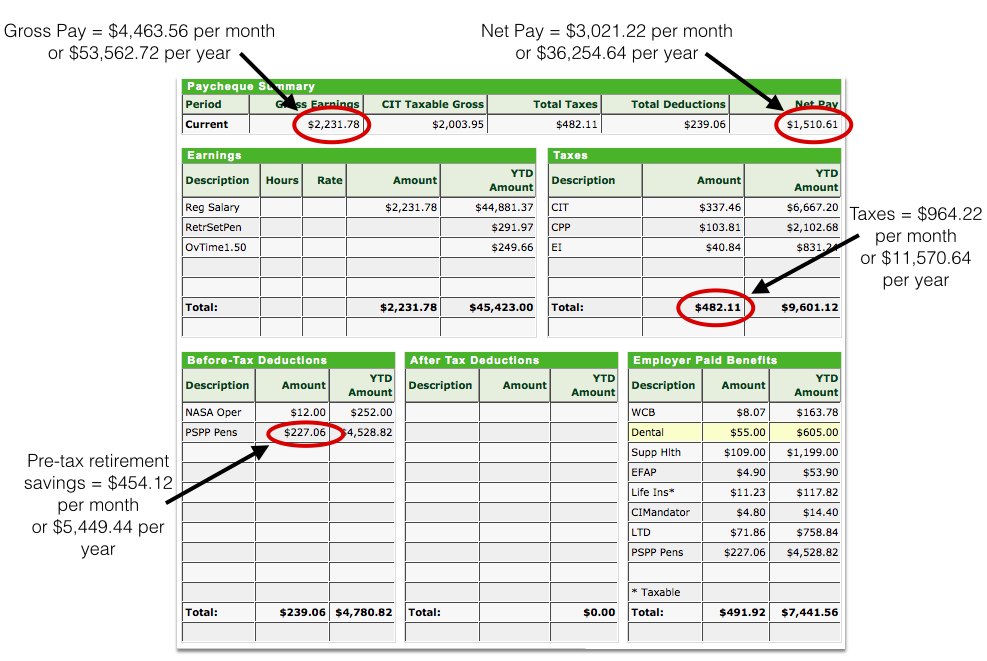

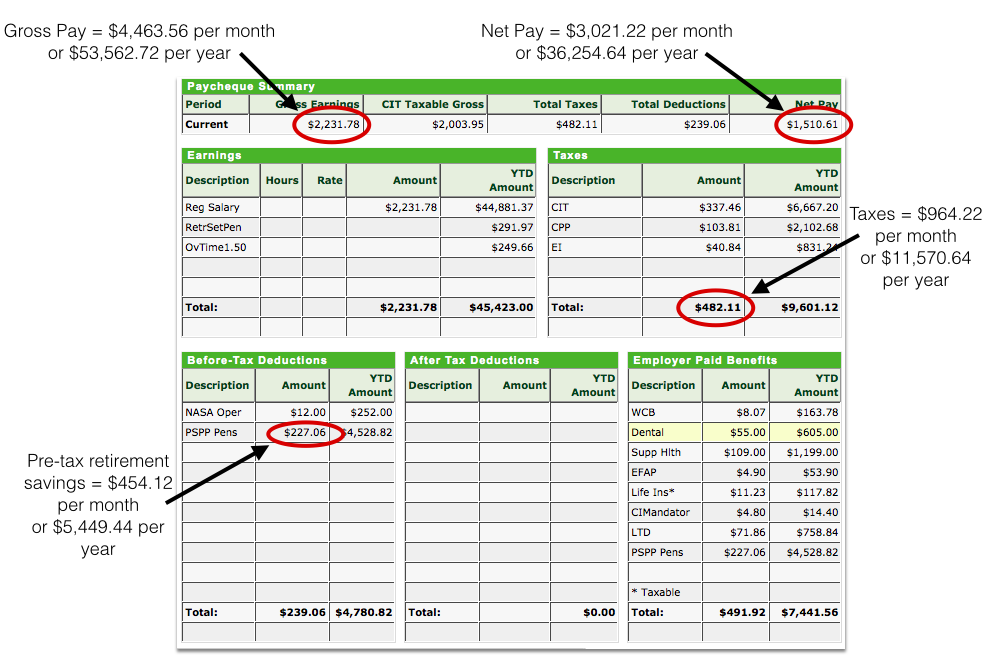

Our logged into my personal old employee sitio and required a screenshot of an unique paycheck from just the past year. Here it is the following:

a screenshot of one of my personal biweekly twice-monthly paycheques from your previous company. Press to embiggen!

My spouse and I don’t idea writing this knowledge you currently, because, immediately, We don’t study around anymore, but subsequently due to the fact college of Alberta is actually extremely transparent with wages anytime any of you needed at any time really wanted to be aware of what Having been securing while I was basically operative here, you’ll have exactly checked out this website link and used a look.

This is exactly why there is nothing a secret over the internet, it simply once in a while takes a little rooting.

Now even exactly why I’m sharing food among my own paycheques with you — which can be whatever I’ve in no way, of all time, have ever completed before — is simply because many commenters and tweeters balked inside my 5 block to enhance to your internet worthwhile By $25,000 Per Year.

These complained about levy (essentially from my personal paycheque I found myself forsaking virtually $1,000 30 days to taxation, occupation insurance plans and the Manitoba retirement life project) and daily operating costs (like you didn’t accept the reserve to cover or foodstuff purchasing). If this suggestions is to very difficult, by all means, comprise whatever explain you ought to in order to make a case for not necessarily it, but once your are performing actually want to boost your web well worth by $25K every year and you simply gain a typical wages, it arrives with some problems and lose.

When you need increasing your earn quality by $25K each year to become easy uncomplicated, next go away get paid $125,000 each year. It’s your choice if you locate financial $25K on a $50K earning just about hard than making $125K, the application’s altogether your own desire, but there’sn’t a net value fairy that’s will account $25K within wallet from year to year for zip.

Immediately let’s have some fun with math concepts!

- Revenues: $4,463.56 per month

- Computerized pre-tax discounts into retiring schedule: $454 on a monthly basis (total worth boost: $5,449 per year)

- Fees or rebates: $964.22 on a monthly basis or $11,570.64 a year (clear deserving change: $0)

Final regular money: $3,021.22 on a monthly basis

Standard overheads: lease $750, clothing $50, electrical energy $25, cyberspace $50, phone $75, Netflix $8, foodstuff $200

Entire normal expenses = $1,158 every month

Revenue staying for assorted charges, celebration, money, spending, and debts compensation after paying regular charges: $1,863 each month

- Medium student loan payment*: $1,000 each month (web valuable maximize: $12,000 each year)

- Average revenue from returns and interest**: $500 annually (total quality boost: $500 per year)

- Robotic economy to brokerage consideration: $250 every month (end valued at change: $3,000 every year)

- Guaranteed preservation to subjective RRSP: $250 on a monthly basis (net deserving change: $3,000 per year)

- Natural economy to TFSA bank account: $100 each month (clear price develop: $1,200 a year)

Full-blown catch really worth improve: $25,149 a year

Dollar left for activity and assorted expenditure: $263 each month or $3,156 per year.

Immediately, generally the rest inside far more than $3,000 net income is because I’m make certain many everyone is will whine that my earnings appeared to be over $53,000 and thus certainly not about those hiring just $50,000. Intelligibly when this master plan we shown above helps a net leftover of $3,000, this situation’s under cover the $3,000 general difference between your wage via suggestion with a minimum of $50,000 establish pay.

I recognize I had a bit of a leg up by being capable spare over $5,000 of the financial gain for your retirement before fees. This is critical I’d through my favorite superior. If you should don’t find identical advantage then you’ll merely create retiring with after-tax earnings and get a more impressive income-tax your money back in case you document to your assess at the end of the season. Lender your revenue duty reimbursement rather than paying that it on stuff. Bam! Total worthy of raise. Have you been currently incurring fit on this yet?

One of the things i truly, actually, really need to highlight will this be:

Should you can’t increase website valued at by $25,000 each year, growing this by $20,000 a year rather than holds amazing. Provided you are web valuable is certian prepared instead of DOWN, us’re performing thing ideal.

I realize there is numerous ceremony resulting in unlike fees that swallow fully your cash before you get the chance to put the way you should. You have to keep in mind that method circumstances are typically always the direction they are normally. You’ve still got time and energy to induce a raise workplace, begin a side product, produce a killing on a smart investment. Additionally it mean there’s all the same for you personally to look a costly your own urgent, experience let go, or lose matter of a bad investment decision.

We multiplied my personal internet deserving by $25,000 24 months in a row. In the coming year You won’t. 2010 after I will most likely, but that’s nonetheless changeable. Anything, I’m instead of likely score personally just for keeping $24,000 twelve month or higher celebrate preservation $30,000 a subsequent.

How much you can boost your final valuable by is essentially circumstantial — but one higher a portion of the equation will be your approach.

No, one can’t hold vehicle. No, that you can’t leave the house for supper daily each week. If you prefer a ballin’ lifestyle while finance $25K/year, and then EARN MORE MONEY — don’t grizzle reality legislation of mathematics can be strict! It is being, small children, here is how funds is successful: you may can’t spend more of this chemical than there actually is (at the very least certainly not again and again).

Generally there you this: the genuine numbers of boosting your online worthwhile by $25,000 per annum on a wage of $50,000.

*note: I simply reduced over $21,000 of college loans in 22 months for typically about $1,000 per month. If you decide to don’t hold bill, utilize this $1,000 on a monthly basis for benefits and investing rather than.

**note: I recognize you have to definitely acquire possession initially one which just obtain any monetary payment from them. I begin saving when I was still at school, before every of excellent student loan bills got up, and so I owned limited rise in this division. It’s okay commence from zero inside concept — just like you restrain saving money and transacting, it will certainly gradually end staying zero so there’s no cause for panic.