I am aware some how-to poles were boring for your PF gathering, but it sometimes’s important to share existing data in young approaches for audience who are only starting on their own process to property. A couple of my friends and pals induce described our blogging site boasts inspired these start up cutting down & making an investment, nevertheless don’t actually know where you might get go or exactly where they get.

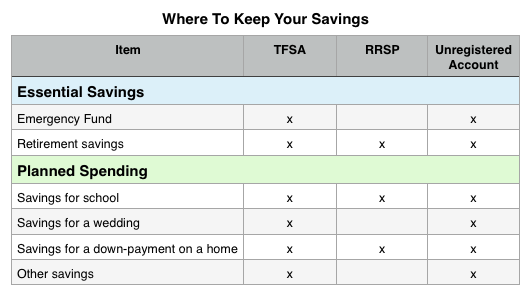

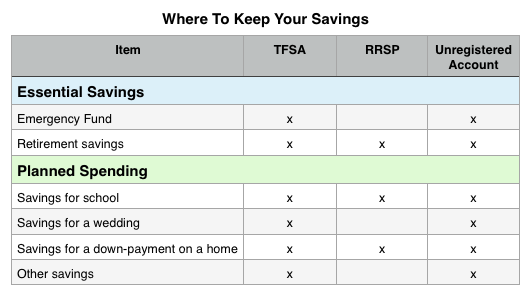

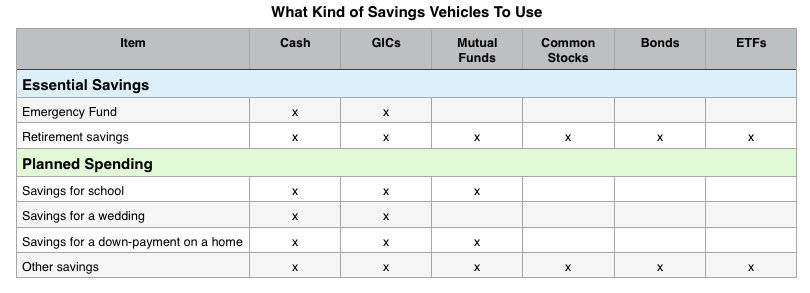

I’ve generated some uncomplicated dining tables to act as a “cheat tack” for what kind of rescue want and where to them, as well as the thing choice vehicles you really need to utilize.

What are the money you’ll need in what accounts

Answers:

Your disaster account should serve 3-6 times of most important overheads. Try to keep this in a TFSA or unqualified records since these provides no taxes effects if you should retreat the.

A retiring discounts might end up being keep in any specific accounting, but subject than definitely not the situation’s to your greatest benefit to utmost your TFSA, then you definitely maximum the RRSP, and then consumption a non registered make up retirement economy.

Preservation for boarding school or a down-payment on a house is often keep in any balance, but your TFSA is the better solution as well as a non registered bill. The lowest appealing decision but a choice all the same will probably be your RRSP, which allows one to disengage as much as $20,000 for class or $25,000 for a down-payment on your dream house.

Rescue for a marriage or other rescue like for a vacation: effectivement,, etc. should really be held in a TFSA or unlisted accounting avoiding any levy for those who cause a departure.

What forms of investing automobiles you must use a of your preservation ambitions

Facts:

Your own last minute investment requires to be melted and constantly convenient, so that should really remain as revenue is and ok as a GIC — although you surrender the interest rate was GIC must swallow dollars before maturity.

Retirement plan discounts needs to be mixed up across all kinds of assets, using develop wealth with considerably alot more chances (like repute) portion 20’s and progressively becoming more intensely weighted to a lot less chancy funds e.g., mutual funds, GICs and capital) whilst you near retirement plan.

Reductions for university or a down-payment on home must always be in wealth or GIC, but a mutual investment fund will also be acceptable situation’re not even going to return educate or order a home until a couple of years from immediately or longer.

Reductions for a wedding or anything you plan to purchase in two years or lower must kept in minimal rocky investing vans, like hard cash or GICs.

The things expense truck select for just about any different preservation is based on just what that benefits represents as well as its schedule! Money make sure you use in two years or little must be keep in revenue or GICs. Nest egg for just two to five years are a mutual investment fund, along with long term ventures for five years or even more, prevalent lumber, alliance, and ETFs are good choice.

Essentially that which you spare for and the way it’s depends on you, but that is a fairly easy explanation for your fresh owner or real estate investor!