Number buying and selling is probably the how to form a totally second income pour. With bonus inventory, that you put after and garner always!

Passive income, desires profits only pull in whilst dormant, is an activity wanted by many. It can be used to either make your capital by reinvesting, or avail protect ones average once a month operating costs. Benefits do fit the bill due to the fact finest residual income reference, since the revenue looks alternative, arise much quicker than rising cost of living, calls for little to no support, and may essentially prove tax-advantaged. It may take a chance to catch a sizeable number bonus profit, but luckily some time is found on the side!

The industry of Bonus Dealing

Rewards, like many economic articles, are quite obvious with the open but challenging on the bottom. During the exterior, payouts have been settled to dispense the’s profits to their stockholder. Currently being a shareholder of a dividend-paying team entitles that you a share was net! A great dividend quote is helpful to the shareowner and association, but we’ll explain many that later on.

You will discover numerous those who want to spend money on solid, number giving organizations as being the central of the portfolio. This tactic is frequently named dividend expansion dealing. The object within identify means growth and development of bonus charges eventually. The average total dividend change for S&P 500 corporations is usually 6p.c. (a relationship on 1990). Isn’t unheard-of for particular providers personal the average annual number raise of ten percent or more!

Once will be the remaining schedule you’ve got a 10% rise?

Dividend Investments 101

If you decide to’re much less confident in regards to what off usually are, your region is designed for people! When I mentioned sooner, payouts can be a means for businesses to generally share its very own achiever along with its shareholders. These are generally a part of the wages that’re spent outloud, the shareowner. You can actually obtain profits available funds or as more reveals, but we’ll find out more into that after.

Exactly what are each one of these bonus weeks?

A company will say a bonus of a certain capital. The go out they so is referred to as resolution present, nonetheless, that supply is absolutely not that imperative. Locate nonetheless two vital goes when viewing the bonus:

- Ex-Dividend appointment – you need to use the supply before this present if you wish to be given the bonus!

- Settlement escort – the time dollars actually is spent to shareholders.

You may find out the enter Date when looking at stock. That is formally the day you’ve got to be a shareholder “on read” to be permitted the number. Selecting two working days after the ex-dividend appointment; it is because positions much consider that many years to stay. This escort offers decreased importance to a trader in comparison to ex-dividend escort, it’s advisable that you discover around just what the read point is also. You should wage many more attention to the ex-dividend go steady on the other hand!

How to review repute for bonus dealing?

There are numerous distinctive performance metrics previously consider off and figure out how just these include. Luckily for us, each of them need elementary business!

The dividend get is also a portion exhibiting simply how much the gross annual bonus will be when compared to portion price tag. Excessive is way better; this implies you get more than passive income out of your funding. Simply to supply a thought, the medium bonus stretch of the TSX blend got 3.45p.c. in 2018. That suggests us earned $3.45 in dividend profits for every $100 wasted.

One minute significant statistic will be the bonus payout proportion the settled profits at odds through the full-blown pay . Quite simply: will sony cause adequately income to the profits these guaranteed a person?

Firms with minimal payment proportion (read half or a lesser amount of) are usually more conventional using dividend. They provide over twice as much dollars essential wage the dividend they secure! Providers with massive payment proportions will be taking up alot more peril, but consequently, propose larger payouts and higher makes. It your choice to ascertain the standard of peril that is right for yourself.

Now, you should think about the dividend rate of growth. Providers prefer make ones own profits in time, this statistic actions the interest rate through which they do quite! The more all of your bonus repayment develops, the better your own residual income gets. Should recall whatever said previously, a standard total bonus increase features 6percent for its popular S&P 500 carry service.

Think back, you will be creating a six-figure stock portfolio, that might be full of a range of budget or specific stocks. Don’t only if look at the dividend! It is merely a compact a portion of the big picture this place, and exploring the lumber and also the corporation generally.

To reinvest, or maybe not to reinvest?

Keep in mind while I noted there have been two opportunities when it comes to ingesting the payment? You now have to bear in mind that. Luckily obtainable, it is very an easy alternative supplied guess what happens you are purchase goal were.

The simple goal is also use the dividend in bucks manner. You’ve got cold income you can do anything you want with. If you need second income to remove through buying account and enjoy, essentially the approach to take. But specified your actual age, this could never be the best option! You’ll wish make power of compounding.

Reinvesting to your profits allows a securities to supplement into alot more companies. Businesses and companies and brokerages actually make it truly easily done this, taking something termed a DRIP. The Dividend Re-Investment Plan (DRIBBLE in short) inevitably convince your own bonus fee into securities without battery charging compensation; plus a person occasionally receive a deep discount of 2-3%.

You are able to register for the DRIP system by inquiring your stockbroker. Just so you’re aware, never assume all regular possesses A GENERATE sadly; it really is a determination the company’s administration must induce.

Dividend Increase Wasting: A Case Review

Let’s go over a paved state of affairs showing you the way powerful bonus increase making an investment is often.

The Dividend Growing Individual

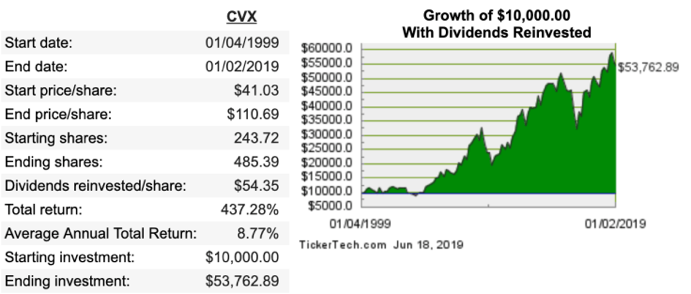

Let’s pretend that you got $10,000 worthwhile of Chevron companies on the ny supply Exchange* at the outset of 1999. Here’s what you will consume at the moment:

- 243 offers of Chevron price $41.03 each

- $296.46 in second income across the next 12 months ($1.22 per contribution annualized)

- 2.96p.c. dividend stretch ($296.46 / $10,000)

*Note, the case in point needed to be in the USA capture since these magnificent budgetary pocket calculators home based only help U.S. tickers!

Containing Number Channel’s DRIBBLE Homecoming App

Fast forward 2 decades. Your own $10,000 buy merits $53,762.49. Here is what you’ve exactly:

- 485 part of Chevron valuable $110.69 each

- $2,308.60 in passive income by future 12 months ($4.76 per contribution annualized and rip regulated)

- 4.29per cent number get ($2308.60 / $53,762.49)

- 23.1procent pay on purchase ($2,308.60 once a year come back the classic $10,000 venture)

Let’s use this in. After two decades, you have made beyond 5x your 1st investment usually caused by investment progress. But, ones residual income stream developed especially, spreading it self by over 7x initial profits level! This second income growth was since a couple of things: dividend make elevates and dividend reinvestments.

Steps to start Running Number Cash Flow

Isn’t it time begin? Here’s the three actions to put your increased awareness into activity.

1) pluck a type of bill

You first need to the profit note. Benefits are generally taxed in quebec meaning you may utilize attempting to keep these people in authorized bill e.g., a TFSA or RRSP). Opting the best place to place your buys may be difficult, that is definitely that this base on list constructing often helps. Here’s a small blurb from this content specifically best:

For people who don’t need meditate a lot, that is an partition of asset:

- TFSA: Canadian handle & ETFs (inside unfamiliar withholding income tax)

- RRSP: Canadian, American, and external stock & ETFs (since you compensate much less unfamiliar withholding levy and most likely have much more publication room)

- Unqualified Accounts: Canadian, United states, and abroad store & ETFs, and any space transacting activities (to short levy on benefits and tackle hazardous buys to state great deficits if a great investment applies improperly)

Most of the time, the duty charge on profits is lower than “regular” source of income. There are several anomalies and laws, particularly related to U.S. stocks. It’s hard to generate a one-size-fits-all alternative, plus it’s far better to consult a pro certainly as your profile gets big.

2) Select a stockbroker

So the dealer will have to offer the model of account you wished from step 1. In addition you undoubtedly demand a brokerage that provides a DRIP where choosing rewards. Questrade does have a person protected in this connection! Actually excellent less-expensive representative for self-directed dealers, and they have robo experts and. Moreover keep documented information like TFSAs and RRSPs.

3) want between lumber and ETFs (or take both!)

Traditional bonus growing spending calls for deciding on particular lineage using some or every one of the measurements most of us outlined past. However, it can don’t should just lumber more after ETFs have left mainstream. Consider How to expend with ETFs.

There are index-tracking ETFs that focus on number revenue and also have quite lower charges. When I create this, there are certainly 18 ETFs in quebec that focus on number source of income and then have control obligations under 1.0per cent.

As ETFs serve charge that articles into earnings, certainly a decreased upkeep idea. You do not have to consider personal businesses, their pay out rates, and stuff like that. Point you should think about with ETFs could syndication you get and the fruit it gives you personally.

4) keep donating and spending

Procedure actually doesn’t block as soon as you create your preliminary sign up and get your first stock. The way it is people seen above concentrated a one-time investment funds and followed this situation over twenty years. The simple truth is, you’re (maybe) earning steady money, over time picking right up alot more bonus repute and ETFs! To your residual income flow develops at an even greater gait rarely.

Summing every thing Up

Ideally, so now you comprehend actual force of dividend growing committing: a chance to design a blast of passive income that multiplies per se. Preferably, you’ll use a DRIP if possible for all of your own job to increase evolution. Later in life, you can actually consequently do the cash to add as well as completely substitute your revenue. This won’t happen during the night, but thank goodness set is included in ones area!